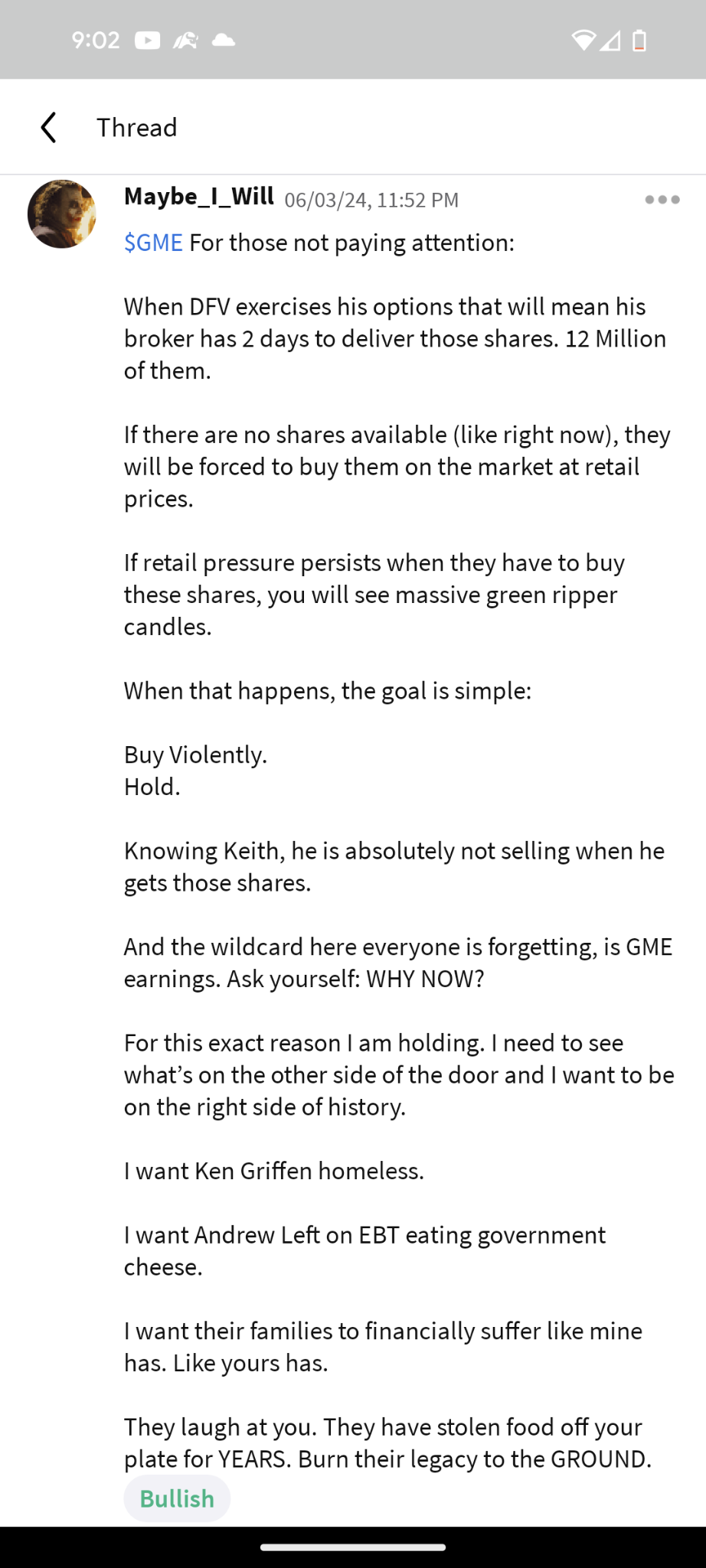

GameStop saga 2.0

Borrowed from someone else. It's not from me. Just sharing. Do with it what you will.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

愿赌服输 : Every retailer thinks this way. Market will go opposite.

Birdistheword OP 愿赌服输 : Whatever his reasoning is, I don't think it's just about money. This is all speculation of course. But my perspective is that he does things for something that he believes in. I am not sure what will happen with the price or when more news will come. I am very interested.

愿赌服输 Birdistheword OP : Absolutely agree. This is once in a life experience. Let’s join the rally and see

101748546 Birdistheword OP : Now delivery of securities has change to 1 day. Do you think the hedge will be stupid enough to realize the trade in 1 day? Nope they learn from 3 years ago. They even hire keyboard warrior to study WSB to know the strategy of us dumb money movement. Whenever a certain % hit in that shares mention in WSB then they will start their counter measure but shorting way down to screw dumb user out before it can Ballon like GME...

OneLastChance 愿赌服输 : U got the point

愿赌服输 OneLastChance : However, there are still institutions longing this counter. There will be a violent fight when the date is close

Ken Griffin Charity2 : More nonsense from apes who haven’t got the foggiest understanding of options. This is not how it works… like at all.

His broker doesn’t have to deliver anything. The writers of the options are the ones who have to meet the exercise obligation. Basically, there is going to be zero impact on the stock price, just like there wasn’t when DFV exercised his calls back in 2021.

Ken Griffin Charity2 : And imagine gambling on meme stocks, losing, and then accusing Ken Griffin and Andrew Left for stealing from you. People with zero accountability for their actions constantly looking to scapegoat others for their stupidity. Absolutely priceless.

Meme stocks introducing financial Darwinism is the greatest thing to happen to the market.

jddddd : Hedge A shorts GME, Hedge B supports crypto ETFs. Hedge B supports GME to rock the pillars of the traditional financial system. Are we going to see the battle of Hedge Funds? This is more than just a battle of the stock. More than just a battle of idealism. It is a battle of the current financial system. 3 years in the making.

R30R : The foundation of trading is based on longevity of solid companies. Hedging on a meme stock to perform every single time, that too based on one person as a trigger, is just not right.

As it is you have 100s of mini meme stocks around but one must be very naive to think the institutions don’t know how to deal with this the second time around.

I really wish there was a win-win but the brutal truth is that this is a meme stock and the institutions are now well prepared. I might also argue the institutions have the common man’s hard earned money this meme stock is trying to rob. So this self righteous rant as a victim isn’t quite cutting it.

View more comments...