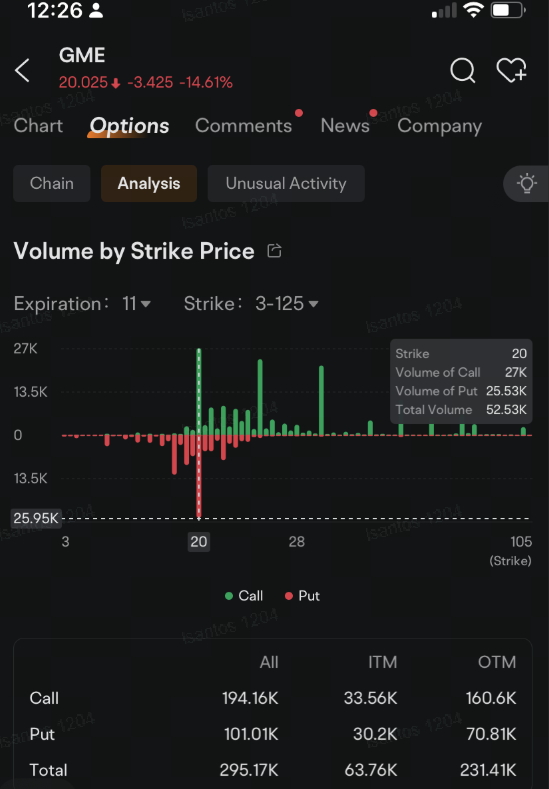

Amid that sell off, technical indicators tracked by moomoo are showing positive signals. Seven of the 15 gauges are showing that the stock could now be oversold, and the trend may turn bearish. The stock price has breached the lower line of the Bollinger Band, which could be seen as a sign by some who study charts that it could revert and rebound from today's low. Still, it's crucial to use the band along with other technical indicators and review the fundamentals when looking at the trend.

LittleSoldier : Game stop is a joke!!

Stop peddling

Nathaniel cyr : How can I deposit funds to invest and trade

White_Shadow : keep the momentum going and it could stabilize over $20

72078329 : i was sick and had the 3 opperation if i can do i can stulill do ill learn it . starting ge5t on my feet

Laine Ford : no comment

Cypher : “That missed the average estimate of $895.7 billion…” did you mean $895.7 million* instead?

@Luzi Ann Santos

Cypher : “15 gauges are showing that the stock could now be oversold, and the trend may turn bearish.” Maybe you meant to say bullish* here?

@Luzi Ann Santos