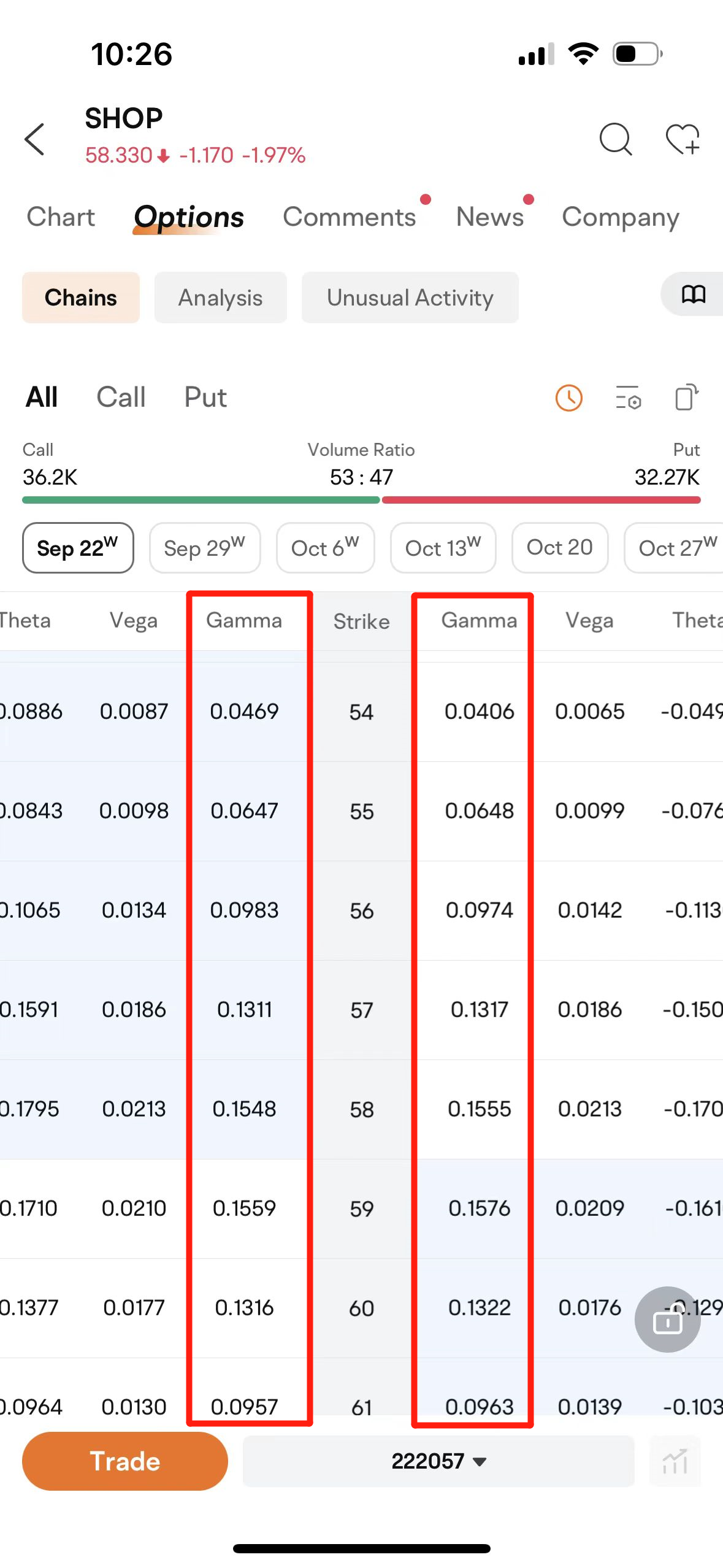

Gamma measures the changes in Delta with changes in stock price. As the expiration date approaches, at-the-money options' Gamma tends to be all its highest because the option price becomes more sensitive to changes in the underlying asset price. In contrast, the Gamma values of in-the-money and out-of-the-money options tend to increase slightly and then decrease as the expiration date approaches. This is because when the expiration date is far away, the primary factor affecting an option's price is its intrinsic value rather than time value. However, as the expiration date approaches, the primary factor affecting an option's price becomes time value, making the option more sensitive to changes in stock price.

In addition, for at-the-money options, the distance between the strike price and the current stock price approximately equals zero. Therefore, at expiration, there is a 50% chance that the option will end up in the money and a 50% chance that it will end up out-of-the-money. At-the-money options are considered to be the balance point between in-the-money and out-of-the-money options, and they are the most sensitive to changes in stock prices. As a result, at-the-money options have the highest Gamma among all options, This means that the option premium of at-the-money options will change more quickly with changes in stock price compared to other options, all other factors being equal.