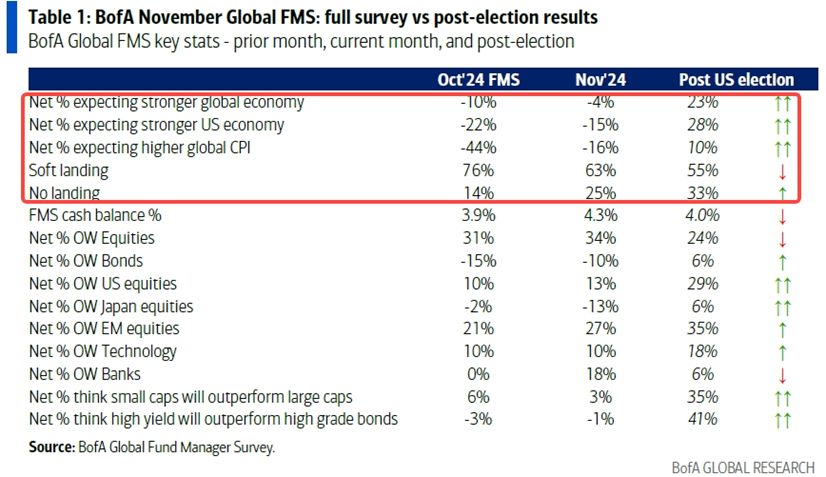

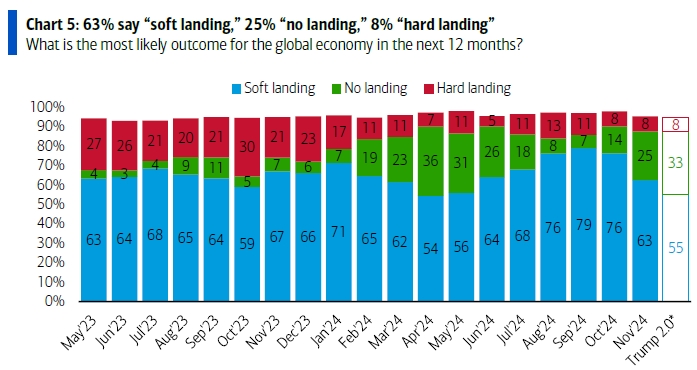

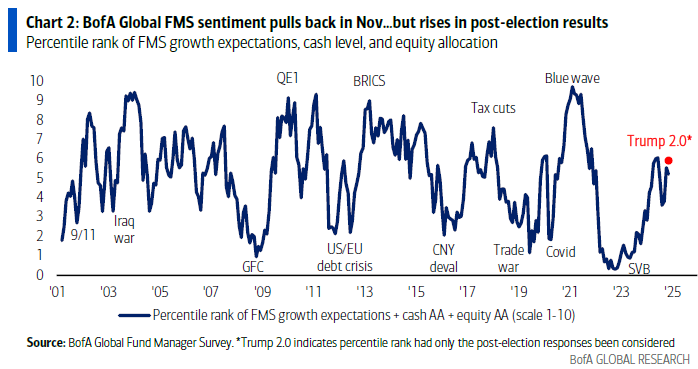

The latest Global Fund Manager Survey from BofA, released on November 12, shows that global fund managers anticipate an increased probability of the U.S. not landing, but also an increase of inflation risks. Additionally, fund managers have developed a stronger preference for high-yield bonds and U.S. stocks, especially small-cap stocks. The Bull & Bear Indicator has risen but has not reached a state of extreme optimism.