Going beyond tech: Uncover potential opportunities in US stocks

Hello, I'm “to the moo”, sharing a potential investment opportunity every day to help mooers get a head start on investing!![]()

Recently there has been a hot topic on Wall Street, which is the "reindustrialization" of the United States.

Wilson, a Morgan Stanley strategist who has long been bearish on US stocks, admitted in a previous report that he had misjudged the extent of the bull market in US stocks. He believes that the reason for his misjudgment was the US government's "fiscal stimulus", such as Biden administration's investment in infrastructure, environment, and manufacturing industries worth trillions of dollars.

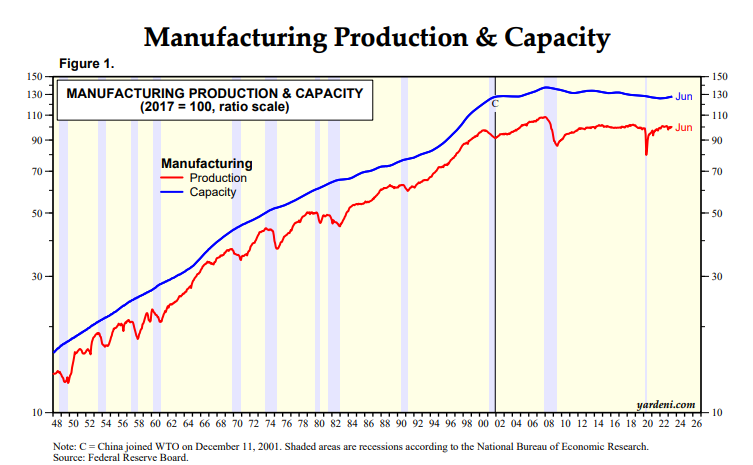

Since globalization, US manufacturing has not grown for 20 years. However, facing the new anti-globalization situation, "reindustrialization" of the United States seems to be the trend, and it is also the core of "Bidenomics": driven by industry and fiscal policies, promoting the return of manufacturing to the United States, consolidating the United States' leadership position in key areas, and dealing with "powerful strategic competitors".

As can be seen from the figure below, US manufacturing construction expenditures have started to rise significantly under the drive of direct subsidies, easy financing, and tax incentives from Biden's "three major bills"-the "Infrastructure and Employment Bill" signed in October 2021, as well as the "Inflation Reduction Act" and the "Chip and Science Bill" signed in August 2022.

But the first obstacle to this path is the sustainability of the fiscal drive: raising interest rates while issuing debt. It is no wonder that Fitch has downgraded the debt rating of the U.S.

Wilson also believes that there are signs that the high level of fiscal spending that has supported U.S. economic growth this year is unsustainable, and may be a wake-up call for U.S. stocks.![]()

In the short term, if the Federal Reserve later finds that fiscal easing has not led to economic prosperity and interest rates must be cut, there may be a double US fiscal and monetary easing, bringing about inflation and a rise in gold.

However, in the long run, taking into account the anti-globalization and the certainty of the re-industrialization of the United States, the United States manufacturing enterprises in the next 10 years may be a potential investment target.

7 Stocks That Benefit From U.S. Reindustrialization

In 1999, before China joined the World Trade Organization, U.S. manufacturing accounted for 27% of the world's production; now it's down to 16%. UBS expects this to rise back to 20% by 2040, implying a 5% annual growth rate in manufacturing, more than double the average of the last 20 years.

However, U.S. companies are unlikely to suddenly shutter their factories across Asia and move to Tennessee; they are more likely to seek out incremental growth in the manufacturing sector, taking into account low labor intensity, healthy domestic demand for goods in the U.S., and substantial policy support. Chips, automobiles and pharmaceuticals all fit these criteria, and ETFs in all of these sectors could be a good place to start looking long term.

On top of that, Barron's has selected seven stocks that it believes would benefit from a U.S. manufacturing renaissance. These include $Rockwell Automation (ROK.US)$ and $Emerson Electric (EMR.US)$, which are dedicated to industrial automation. $Eaton (ETN.US)$, a manufacturer of electrical systems; $Trane Technologies (TT.US)$, a manufacturer of air conditioning systems; $Amphenol (APH.US)$, a producer of electronic and fiber optic connectors, cables and interconnect systems; $Keysight Technologies (KEYS.US)$, a software and services company; and $W.W. Grainger (GWW.US)$.

We have also summarized the fundamental data of the above companies for the reference of the mooers.![]()

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

101772986 :

102740297 : Good

102178130 :

蒸蒸日上 : Ok

im hot :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) ok

ok