Goldman Sachs: 15 Out of the Last 17 Days Witnessed Sales of the Magnificent Seven

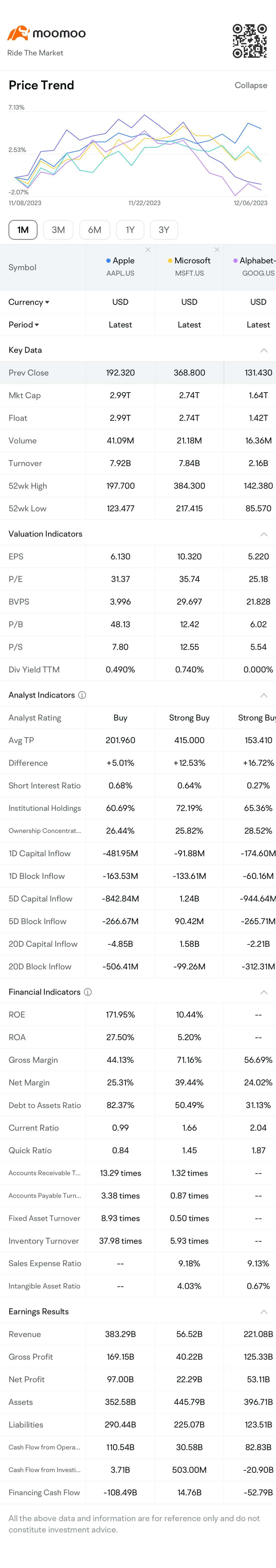

In a year boosted by AI advancements and rate cut expectations, the S&P 500 entered a bull market, with the "Magnificent Seven" ( $Apple (AAPL.US)$ , $Microsoft (MSFT.US)$ , $Alphabet-C (GOOG.US)$ , $Amazon (AMZN.US)$ , $NVIDIA (NVDA.US)$ , $Tesla (TSLA.US)$ , and $Meta Platforms (META.US)$ ) representing over 20% of the index's weight, acting as the driving force behind the U.S. stock surge. Without the "Magnificent Seven," the S&P 500's growth would likely be 8%, not the current 19%.

However, recent trends indicate a shift as the Magnificent Seven faces a decline, experiencing net sales on 15 out of the last 17 trading days. Conversely, small-cap and value stocks are gaining favor, with small-cap stocks exhibiting a noticeable "size premium."

However, recent trends indicate a shift as the Magnificent Seven faces a decline, experiencing net sales on 15 out of the last 17 trading days. Conversely, small-cap and value stocks are gaining favor, with small-cap stocks exhibiting a noticeable "size premium."

Are the Magnificent Seven Losing Momentum?

Goldman Sachs trader Michael Washington notes in his latest market commentary that the "Seven Sisters" are falling out of favor, with 15 days out of the past 17 witnessing sales. Both bullish traders and hedge funds have been in a net selling position recently.

Market participants are shifting their focus from the seven giants to other stocks, as the performance of these seven major tech stocks has significantly lagged behind the broader market in the last two weeks. While there was some moderate buying interest yesterday, Goldman Sachs points out that hedge funds have actively reduced positions in mega-cap tech stocks, driving net sales on 15 out of the past 17 trading days, predominantly led by bullish exits.

Goldman Sachs trader Michael Washington notes in his latest market commentary that the "Seven Sisters" are falling out of favor, with 15 days out of the past 17 witnessing sales. Both bullish traders and hedge funds have been in a net selling position recently.

Market participants are shifting their focus from the seven giants to other stocks, as the performance of these seven major tech stocks has significantly lagged behind the broader market in the last two weeks. While there was some moderate buying interest yesterday, Goldman Sachs points out that hedge funds have actively reduced positions in mega-cap tech stocks, driving net sales on 15 out of the past 17 trading days, predominantly led by bullish exits.

It's worth noting that the overall cumulative net trading volume for the Magnificent Seven has remained roughly flat since the beginning of the year, despite experiencing net purchases of over 50% in August.

Furthermore, the latest data reveals that the weight of the U.S. stock "Seven Sisters" in the Prime portfolio has decreased from the previous peak level of approximately 20% to 17.6%. However, relative to the past five years, their performance still remains at a higher level, ranking at the 91st percentile.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment