Goldman Sachs 3Q23 Preview: CRE Marks Continue, but Capital Markets Showing Signs of Life

On October 3, 2023, Barclays released its outlook for Goldman Sachs's 3Q23 earnings report. Goldman Sachs will release the 3Q23 earnings report on October 17.

Valuation

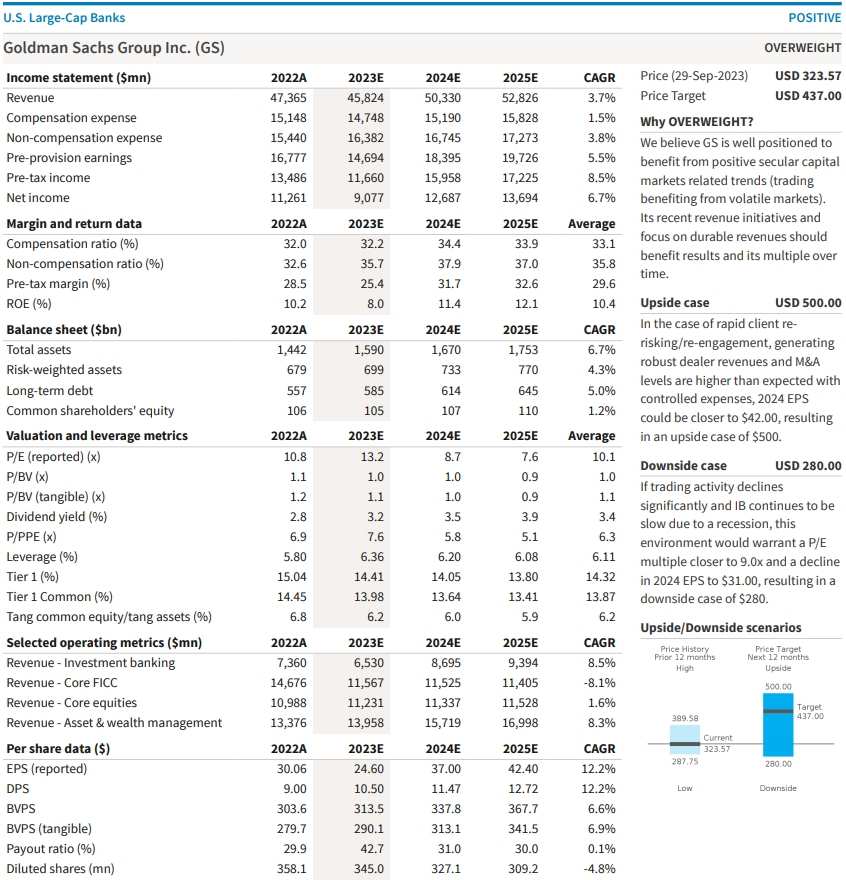

Stock Rating:Overweight

Industry View: Positive

Closing Price: $323.57 (29-Sep-2023)

Target Price: $437.00

Preview

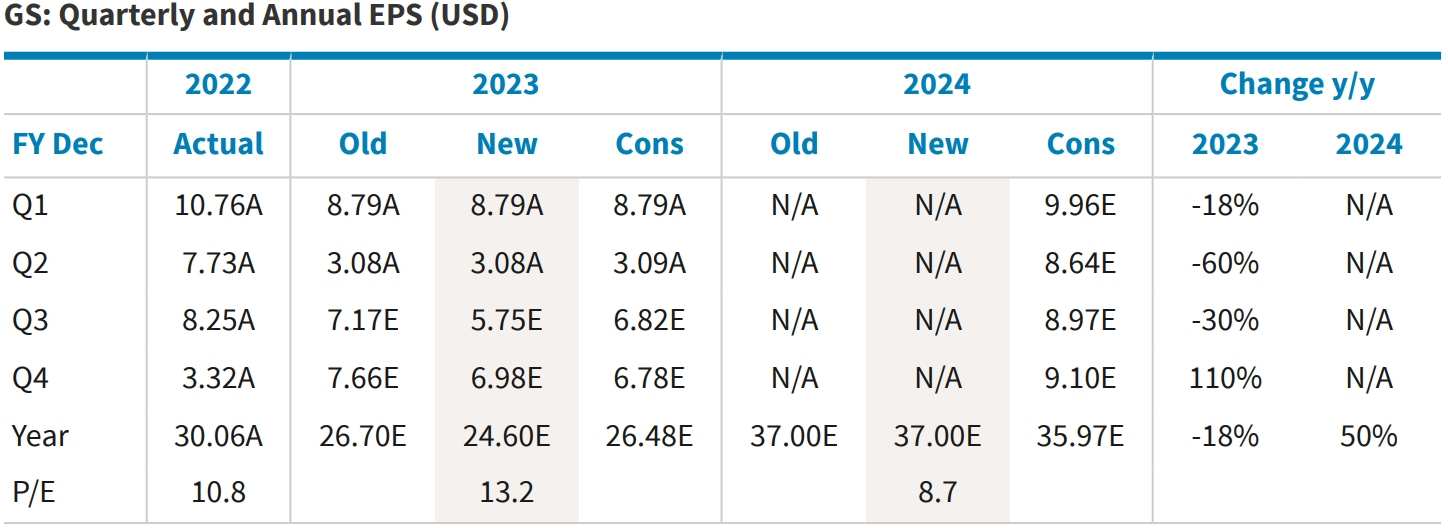

Barclays expect GS to report 3Q23 EPS of $5.75 (-$1.42) vs consensus of $6.82.

Expected results: Barclays' new estimate includes ~$250 of CRE-related write downs after GS mentioned that 3Q should include CRE impairments, albeit less than 2Q23 (~$400mn). Barclays are modeling GS's investment banking to be up 7% y-o-y, driven by higher ECM (pick-up in IPO) offset by lower M&A.

Gains/Charges: Looking at 3Q23, Barclays expect results in Asset Management & Wealth to face ~$150mn headwind q-o-q given 2Q23 results included a $100mn gain related to sale of its Marcus portfolio as well as the corresponding NII related to these loans (Barclays estimate ~$50mn of NII per quarter).

Expected drivers: Relative to 2Q23, Barclays expect lower trading revenues (-11%; both equity and FICC down), higher IBD fees (+15%; ECM, DCM and M&A higher), higher asset management (losses in Equity Investments shrinking partially offset by headwinds from recent sale of Marcus loans), flat Platform Solutions revenues, slightly lower provision for credit losses, stable core expenses (lower comp, but higher non-comp), a lower tax rate (-800bps as 2Q23 was impacted by write-downs), and a reduced share count (-1.3%; modeling $1.5bn share repurchase vs. $750mn in 2Q23).

Key Factors to Watch

1. Consumer Strategy

While only making up ~5% of total revenues, GS's consumer business continues to receive a great deal of investor attention after it recently announced that it plans to narrow its ambitions in the space.

2. Expenses

In terms of expenses, GS is looking to drive its efficiency ratio toward 60% over time (73% in 1H23). In order to rightsize, in early January 2023, it conducted a 6% headcount reduction exercise, impacting 3,200 employees.

3. Capital

Capital will be another area of focus, especially with the Basel III endgame proposal being released intra-quarter.

4. Investor Day

GS's "through-the-cycle" targets include a 14-16% ROE, 15-17% ROTE and a ~60% efficiency ratio. GS previously used the phrase "medium-term" when describing these objectives.

Revenues and Expenses

1. Global Banking & Markets

For 3Q23, Barclays are modeling GS's investment banking to be up 7% y-o-y, driven by higher ECM (pick-up in IPO) offset by lower M&A. According to Dealogic, GS's 3Q23 IB fees were tracking up 18% q-o-q with DCM (-28%) and ECM (-8%) down but more than offset by higher M&A (+47%). In terms of trading, Barclays expect total Global Markets revenues to be down 11% y-o-y with FICC down 6% and Equities down 12%.

2. Asset & Wealth Management

Barclays expect revenues in asset management to increase 21% q-o-q in 3Q23 after 1Q23 Asset Management losses included $403mn of losses in Equity investments as GS continues to wind down the portfolio. In Private Banking & Lending, Barclays expect results to be down 20% q-o-q or ~$150mn.

3. Platform Solutions

Barclays expect Platform Solutions revenues to be little changed. GS's total provision for credit losses to be $555mn, compared to $615mn in 2Q23.

4. Expenses

For 3Q23, Barclays are modeling a comp ratio of 31%, which is up 100bps y-o-y, but down 200bps q-o-q. In terms of core non-comp, Barclays are modeling it to be flat y-o-y. (or up 5% q-o-q).

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment