$Alphabet-A (GOOGL.US)$ reported a solid beat on growth and margins along with positive commentary across the business lines.

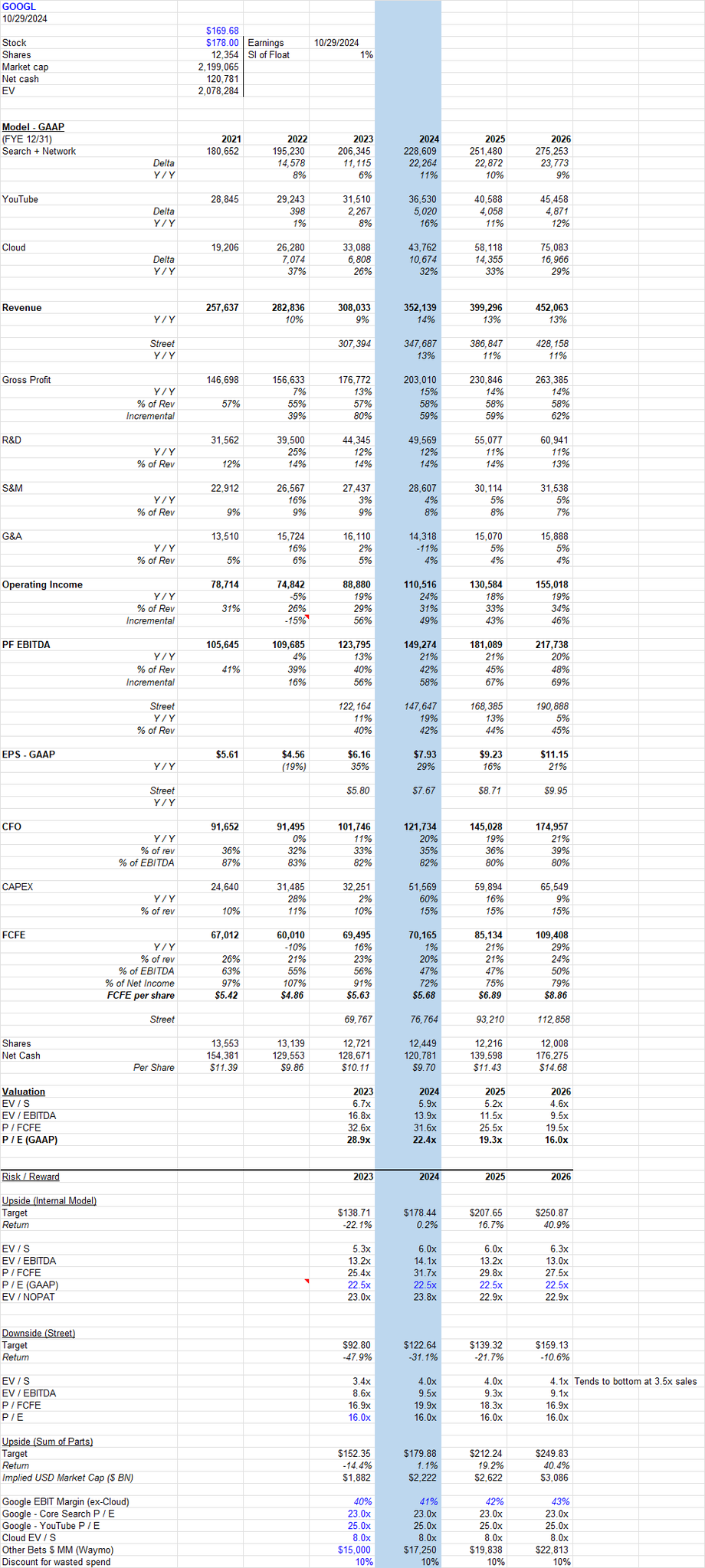

Story likely moves sideways (positive business fundamentals offset by concerns about AI impact on search, and regulatory impacts) while numbers move higher (revenue / profits seem low but FCF seems high).

Risk / reward remains decent even w/ regulatory overhang. I am denting the multiple by 10% to account for potential loss of 10% of profits. Other point I would make is given the jump in CAPEX from 10% of revs to 15% which likely sustains, the FCF multiple is materially higher than GAAP EPS multiple.

Upside of 41% to 22.5x my CY26 GAAP EPS which is 28x FCF. 57% upside to 25x if no impact from government.

Downside of -22% to 16x street CY25 GAAP EPS (again assuming this would normally bottom at 18x but market handicapping 10% loss of profits from government takes it to 16x), and downside of -11% on 16x street CY26.

The Quarter

Search rev of 49.4b grew 12.2% yy (decel from 13.8% last qtr and consistent w/ 11.3% yy last Q3) > street at 49.0b – net rev delta of 876m down from 1,398m last Q3. Importantly, company noted that AI is increasing length and number of searches, integration of ads is going well, and that monetization is at an approximately similar rate.

Cloud rev of 11.4b accelerated to 35% yy from 29% last qtr and up from 23% last Q3 > street at 10.9b – net rev delta of 1b up meaningfully from 773m last qtr and 380m last Q3. Operating margin of 17.1% up meaningfully from 11.3% last qtr and 3.2% last Q3. Business line is on fire driven by AI.

YouTube rev of 8.9b grew 12.2% yy (decel from 13..0% last qtr) = street at 8.9b – net rev delta of 258m down from 287m last Q3 which included ramp of large APAC retailer (Temu or Shein). Q4 should be pretty big with political spend – probably accelerates to high teens. Short video form is doing really well – 70% of video submissions and views growing rapidly.

Network rev of 7.5b shrank -1.6% yy which was less of a decline than the -5% last qtr and -3% last Q3. This is low margin revenue anyway so the decrease here is helping search gross margins.

Mixed expense control. GAAP OM of 32.3% was down sequentially from 32.4% last qtr which rarely happens and was partly due to employee count increasing by 1.7k qq (headcount otherwise has been flat to down over the past 6 qtrs). So question will now arise as to whether company is back to hiring mode which will dampen margin expansion from here.

And margin expansion could be further dampened by D&A ramping off the large increase in capex this year.

Capital return in place w/ shares on track to decrease -2% this year.

72614950 : Just MM trying to throw us off. Tesla was basically a trash report with one good set of numbers and went off the map. Goggle was beyond perfect and there’s a concern?