* All comments, links, and content posted or shared by users of the community are the opinion of the respective authors only and do not reflect the opinions, views, or positions of Moomoo Financial Inc., Moomoo Technologies, any affiliates, or any employees of MFI, MTI or its affiliates. Please consult a qualified financial professional for your financial planning and tax situations.

102362254 : Both candidates' policy agendas will significantly impact different sectors of the economy. By analyzing their stances on trade, taxes, and economic stimulus, I aim to safeguard my portfolio's resilience by understanding how these policies could affect specific industries or investments. Although the impending U.S. presidential election introduces added uncertainty, thorough research and strategic adjustments to our portfolio can help mitigate any potential concerns.

mr_cashcow : I will be keeping a close eyes on $Trump Media & Technology (DJT.US)$ if trump wins![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Personal portfolio wise I think I will still go along for a ride with whichever waves comes along

Thanks again for the reward points and congrats to all winners

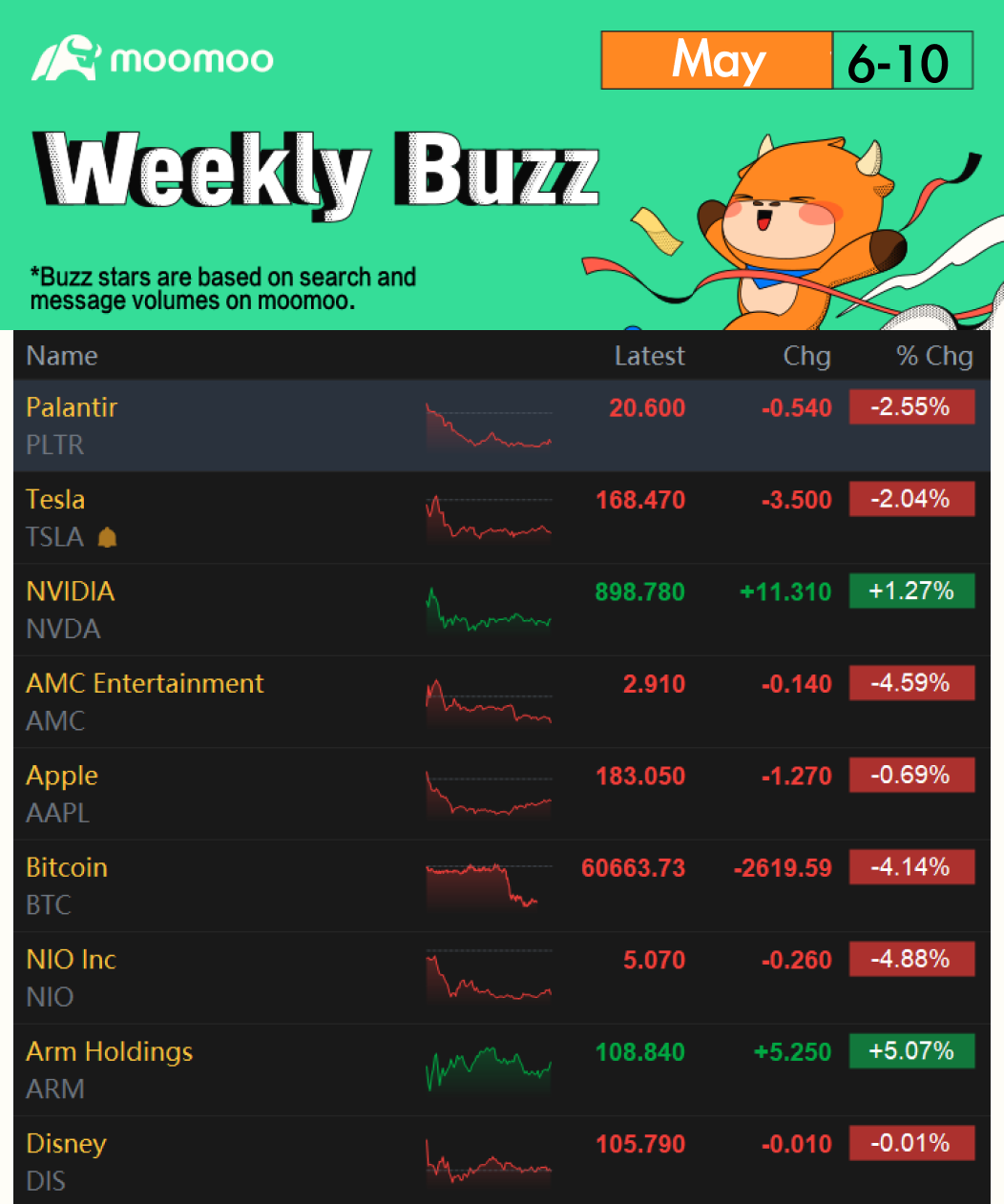

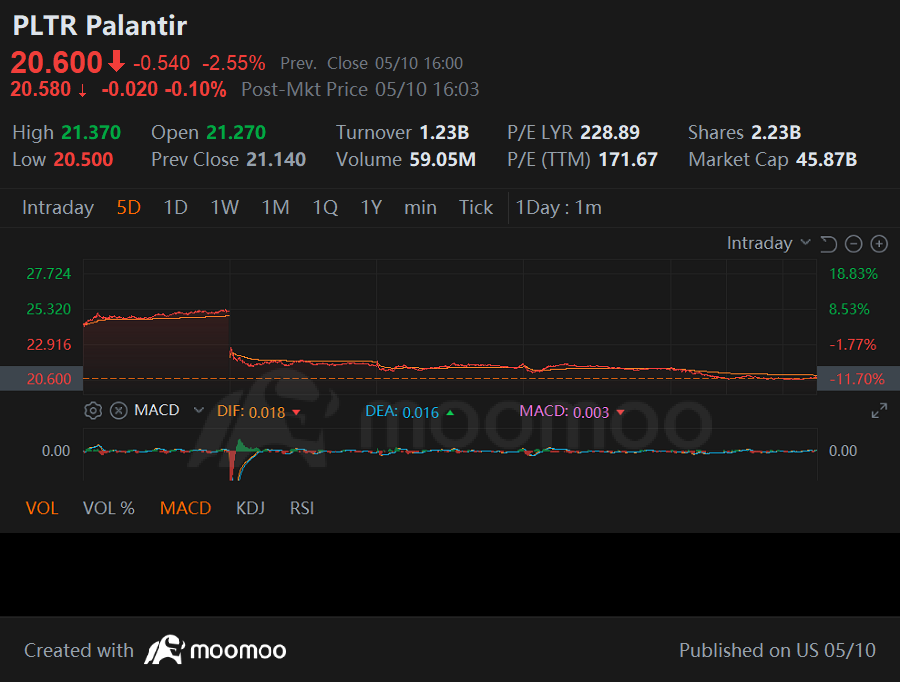

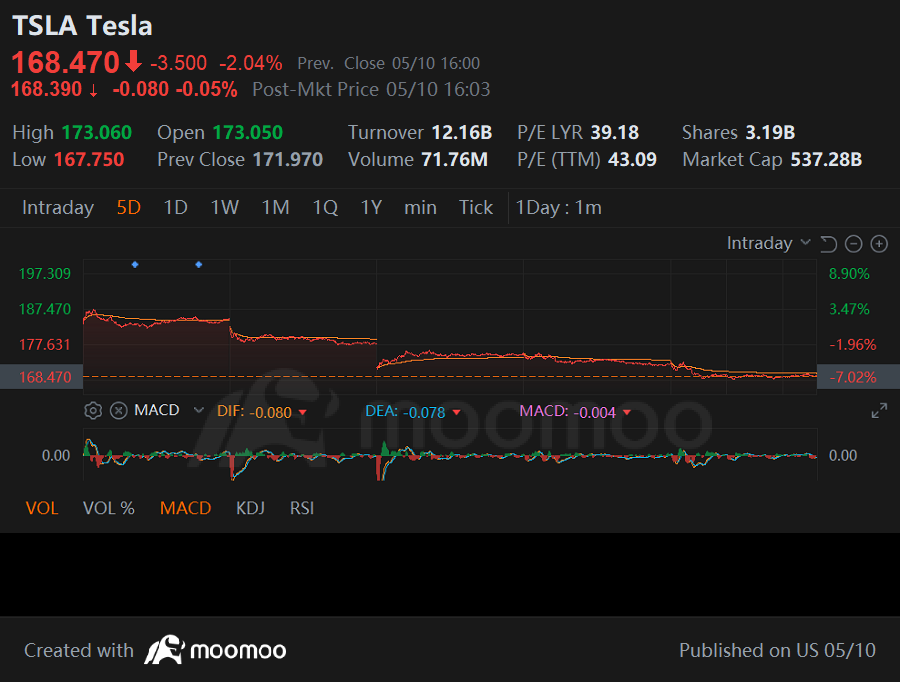

010Leo : adjust holdings based on their policies. tesla vs nio/xpev. accumulate on weakness solid companies aapl/pltr/nflx/sofi. bet on indexes splg/tqqq/spyv.

HuatEver : With the upcoming US presidential election stirring up uncertainty about trade and the economy, it’s crucial to stay composed when managing your portfolio. Emotional reactions to election news can lead to impulsive decisions. While no strategy guarantees success, diversifying your investments can help buffer against market turbulence during election cycles.

reactions to election news can lead to impulsive decisions. While no strategy guarantees success, diversifying your investments can help buffer against market turbulence during election cycles. ![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

HuatLady : Regardless of the outcome of the US Presidential Election and the decisions made thereafter, I maintain my position as a steadfast long-term investor. My strategy involves accumulating high quality stocks![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) at low prices, prioritizing long-term growth. The primary concern lies in assessing the extent to which changes in policies and regulations will impact the economies. So diligent monitoring of the market is crucial to navigate any potential shifts effectively.

at low prices, prioritizing long-term growth. The primary concern lies in assessing the extent to which changes in policies and regulations will impact the economies. So diligent monitoring of the market is crucial to navigate any potential shifts effectively.

BFSkinner 102362254 : This is AI

ZnWC : 3 hard stances on trade may happen:

1. Fed is determined to bring down inflation to 2%. This implies that the probability of Fed rate cut by the end of the year is slim and we may not see QE policy coming anytime sooner.

2. US- China tension will continue. The question remains if the 2 countries will decouple. I don't think it will deteriorate further after the US election but no one is 100% sure.

3. US economy slipping into stagflation - probability is low but is still possible if a black swan event occurs.

My investment portfolio is based on the following principles which are adjusted quarterly:

1. No one can be 100% prepared for volatility risk hence I buy stocks within my means.

2. Know the objective of my investment - long or short term, P/L limit, rationale of buying a stock etc.

3. Split my portfolio based on risk level. About 10% will be invested in high risk securities. This cap is important to avoid YOLO or FOMO buy (greed) but at the same time be prepared to reap a profit if the stock market rallied.

4. Always prepare an Emergency Fund (EF) currently at 6 months. EF is an important tool to avoid panic sell (fear).

5. Diversify my investment - a portion will go into earning passive income like Moomoo cash plus fund, government saving bond or T- bill, stocks to earn dividend, property to earn rental income, sell covered call at calculated risk etc

Disclaimer: The above is not financial advice - for educational purposes only. Always DYODD. Selling options is a high risk investment and may result in unlimited loss if you don't know what you are doing.

DavidCCL : No matter who win, the world isn't going to be better. Both will continue to stir shit, mess up the world's economy, intervene into other countries internal affairs and create more conflicts between countries in order to maintain their global leadership position.

Popular on moomoo OP BFSkinner : haha most likely yeah

PAUL BIN ANTHONY : very helpful thanks again for your wonderful comments today