Harris Trade vs. Trump Trade: Here's What You Need to Know

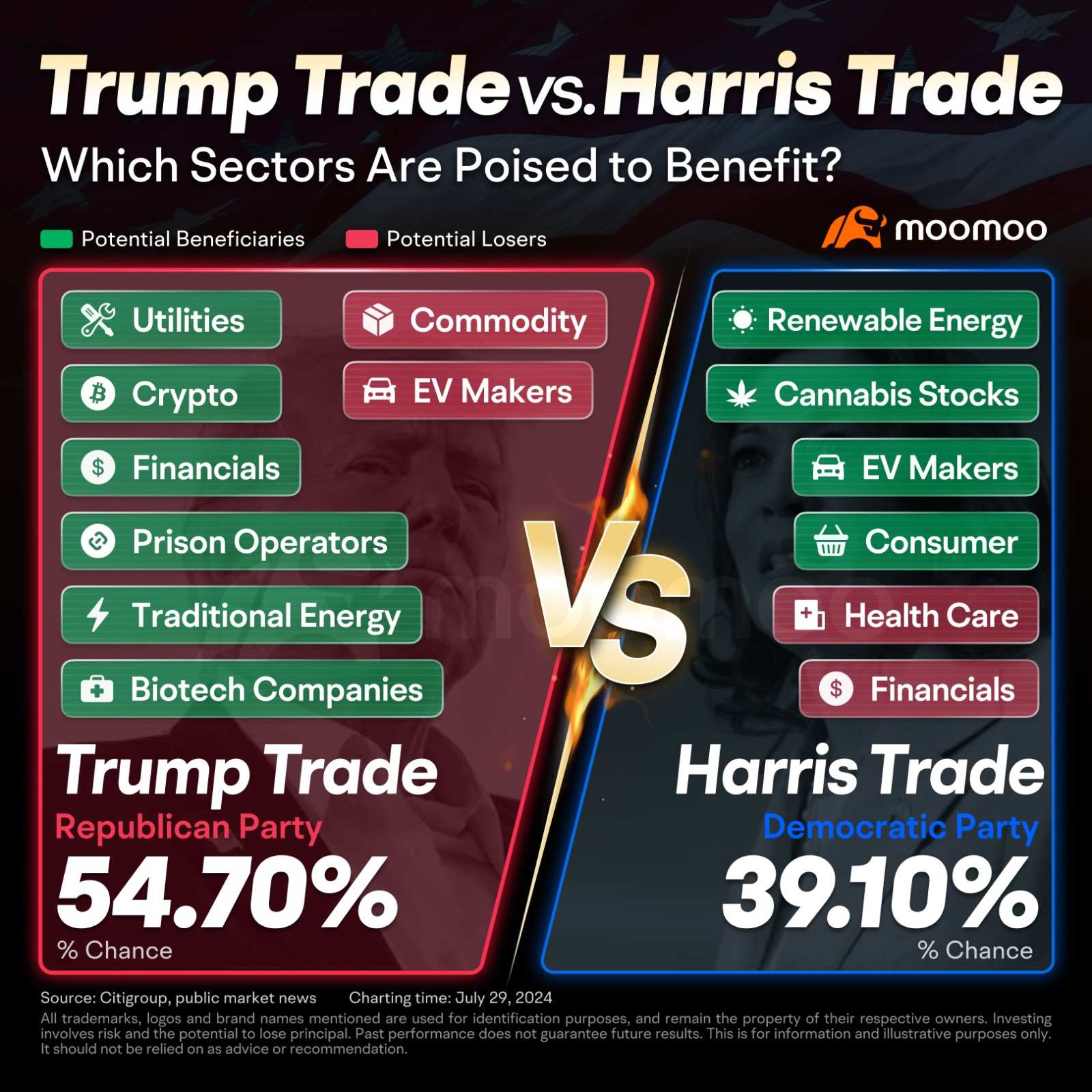

As the US presidential election enters its 100-day countdown, Vice President Harris, the top of the Democratic ticket, is seeing a narrowing gap in support between her and Trump gradually. With the election's uncertainty rising, the market has begun to reprice the 'Trump trade', while scrutinizing Harris's policies to gauge their impact on investors and identify 'Harris trades' to watch.

Harris raised $200 million in her first week as the potential Democratic candidate for the 2024 presidential election, highlighting the party's strong enthusiasm for her candidacy. Multiple polls also indicate her rising popularity, with a narrowing gap between her and former President Donald Trump.

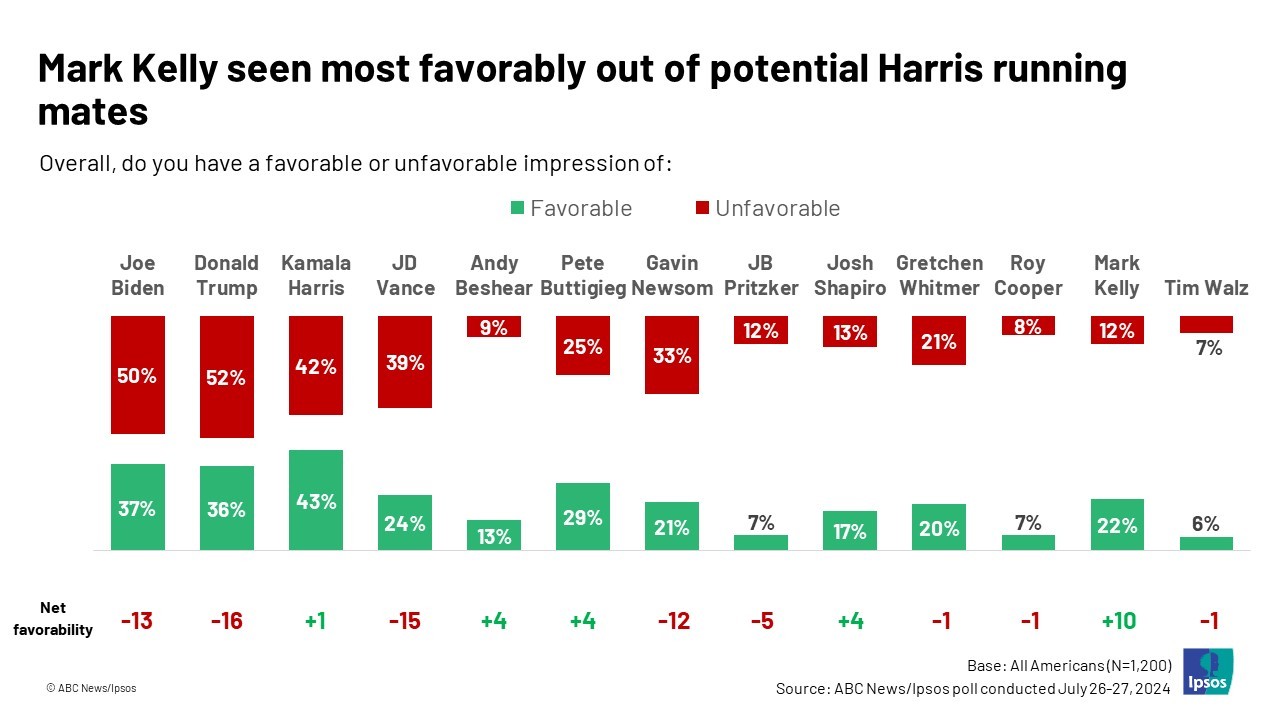

According to the ABC News/Ipsos poll conducted on July 26 and 27, Harris' favorability has surged from 35% a week ago to 43%, while Trump's has slightly cooled, dropping from 40% to 36%.

Bookies and gamblers are increasing their wagers on Kamala Harris winning in November. At the betting market Polymarket, Harris has a 39% chance of defeating Donald Trump, which is significantly higher than the approximately 29% chance she had shortly after Joe Biden withdrew from the race on Sunday evening.

Polymarket Vice President of Strategy David Rosenberg said:

“We've really found an insane amount of product-market fit recently, as we're currently in the US going through probably the most unpredictable and volatile election in living memory.”

According to a recent poll published by The Wall Street Journal on the 25th, the support rates for both Harris and Trump are neck-and-neck, with Trump leading Harris by a slim margin of 2 percentage points. Another poll jointly conducted by Reuters and Ipsos on the 23rd even indicated that Harris was leading Trump by 2 percentage points, with 44% of the nationwide support compared to Trump's 42%.

According to the latest research released by Citigroup analyst Scott T Chronert on Friday, if elected, Harris is likely to continue the policy line of the Biden administration while incorporating some of her own policy leanings. This includes increasing government spending, raising the corporate tax rate to 35%, expanding Medicare to cover all Americans, and increasing investment in clean energy. In addition, she has a history of advocating for more tech regulation and is particularly strong on AI regulation.

Citigroup has compiled a list of key policy items for Harris based on various sources such as White House press releases, campaign videos, and media interviews. The realization of these policies ultimately depends on control of Congress.

Here are several areas that are expected to benefit from Harris' victory:

● Consumer sector: Harris' policy approach is similar to Biden's, advocating tax cuts for the middle and lower-income groups while increasing taxes on the wealthy and corporations. Additionally, she supports student debt relief, opposes Trump's tariff plans, and her immigration policies are expected to promote consumer spending, thereby boosting the consumer sector.

● Large multinational corporations: Harris' attitude towards tariff policies is more moderate than Trump's, and she hopes to promote US exports. This means that global trade and large multinational corporations with significant overseas income exposure are likely to benefit.

● Renewable energy and electric vehicle manufacturers: In contrast to Trump's support for traditional fossil fuels, Harris is seen as a champion of renewable energy. During her tenure as Vice President, she closely followed Biden's climate policy and clean energy stance, emphasizing that developing clean energy and maintaining environmental justice is a top priority. Some analysts believe that Harris may hold a more radical position on clean energy issues than Biden. This means that solar stocks such as $First Solar (FSLR.US)$, $Maxeon Solar Technologies (MAXN.US)$, $Daqo New Energy (DQ.US)$, $Canadian Solar (CSIQ.US)$, as well as electric vehicle stocks such as $Tesla (TSLA.US)$, $Rivian Automotive (RIVN.US)$, and $Lucid Group (LCID.US)$ are expected to benefit from Harris' victory.

Michael Leverty, founder and CEO of Leverty Financial Group, said, "If investors prefer the 'Harris trade,' it is likely to support renewable energy plans and stricter environmental regulations."

Marijuana stocks: The Democratic Party is pushing for federal legalization of marijuana. Harris herself is also open to marijuana and promised in a debate with then-Vice President Mike Pence four years ago that the Biden-Harris administration would "decriminalize marijuana and expunge the criminal records of those who have been convicted for marijuana offenses." In addition, she has criticized marijuana restriction policies as "ridiculous" and urged the Drug Enforcement Administration (DEA) to amend current marijuana classifications. Therefore, marijuana stocks are also one of the significant beneficiaries of Harris' victory. Keep an eye on marijuana companies such as $Tilray Brands (TLRY.US)$, $Canopy Growth (CGC.US)$, $Cronos Group (CRON.US)$, and $SNDL Inc (SNDL.US)$.

Despite the fact that the Democratic Party has no clear stance on cryptocurrencies, it seems to be reaching out to the industry. According to a Financial Times, advisors of Kamala Harris have been in talks with top cryptocurrency companies such as Coinbase, Circle, and Ripple Labs to "reboot" the Democratic Party's relationship with the cryptocurrency industry.

Here are the potential losers of Harris' victory:

Compared to Trump's lenient financial policies, the prospect of increased regulatory measures under Harris' leadership may harm financial stocks. In addition, Harris supports expanding healthcare insurance to all Americans, opposes consolidation in the healthcare industry, and advocates for drug price reform, which may put pressure on the operational flexibility and profitability of healthcare-related companies. Regarding large tech stocks, Harris has a strong stance on AI regulation and believes that ensuring customer privacy is more important, which means that her relationship with the tech industry needs to be closely monitored.

Source: Bloomberg, Financial Times, Polymarket

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Scorched earf : Blocked

Joe P : Take note of the source. Mini Mike Bloomberg has an ax to grind with Trump. I wish that MooMoo wouldn't shove this shit in my face.

Jacob Strunk Joe P : Amen.

Markiek Gibson : so how is promoting illegal immigration gonna make me spend more money if everything is going up because of illegal immigration

Kendadon1 Joe P : Nobody wants a dictator

White_Shadow Joe P :

White_Shadow Markiek Gibson :

Kendadon1 White_Shadow : True

White_Shadow Scorched earf :

Kendadon1 Markiek Gibson : Economic Strategy: Effective immigration policies can help regulate the labor market and reduce the exploitation of workers, which can ultimately stabilize wages and working conditions for all employees .

4. Inflation and Prices:

• Inflation Factors: Inflation and rising costs are influenced by various factors, such as supply chain disruptions, global market trends, and economic policies, not solely immigration .

• Role of Immigrants: Immigrants contribute to economic growth by increasing the labor force and consumer base, which can help balance inflationary pressures rather than exacerbate them .

In summary, it’s important to recognize that immigration, when managed through comprehensive and fair policies, can have a positive impact on the economy. Kamala Harris’s proposals aim to address these issues holistically, focusing on long-term solutions rather than short-term fixes. By understanding the multifaceted nature of immigration and its economic implications, we can engage in more informed and constructive discussions.

View more comments...