Bull Run in US Stocks May Have Just Started. Here's Why.

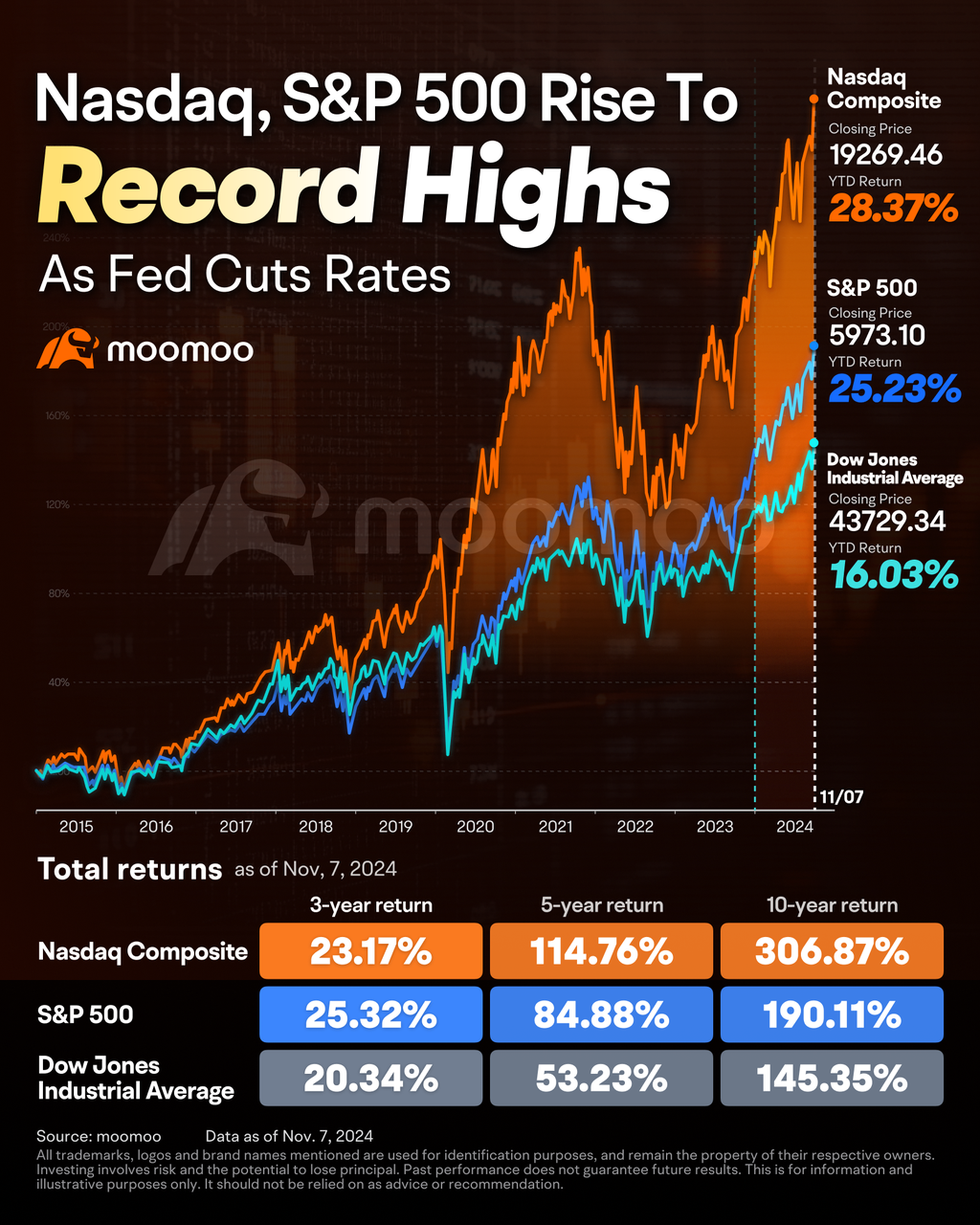

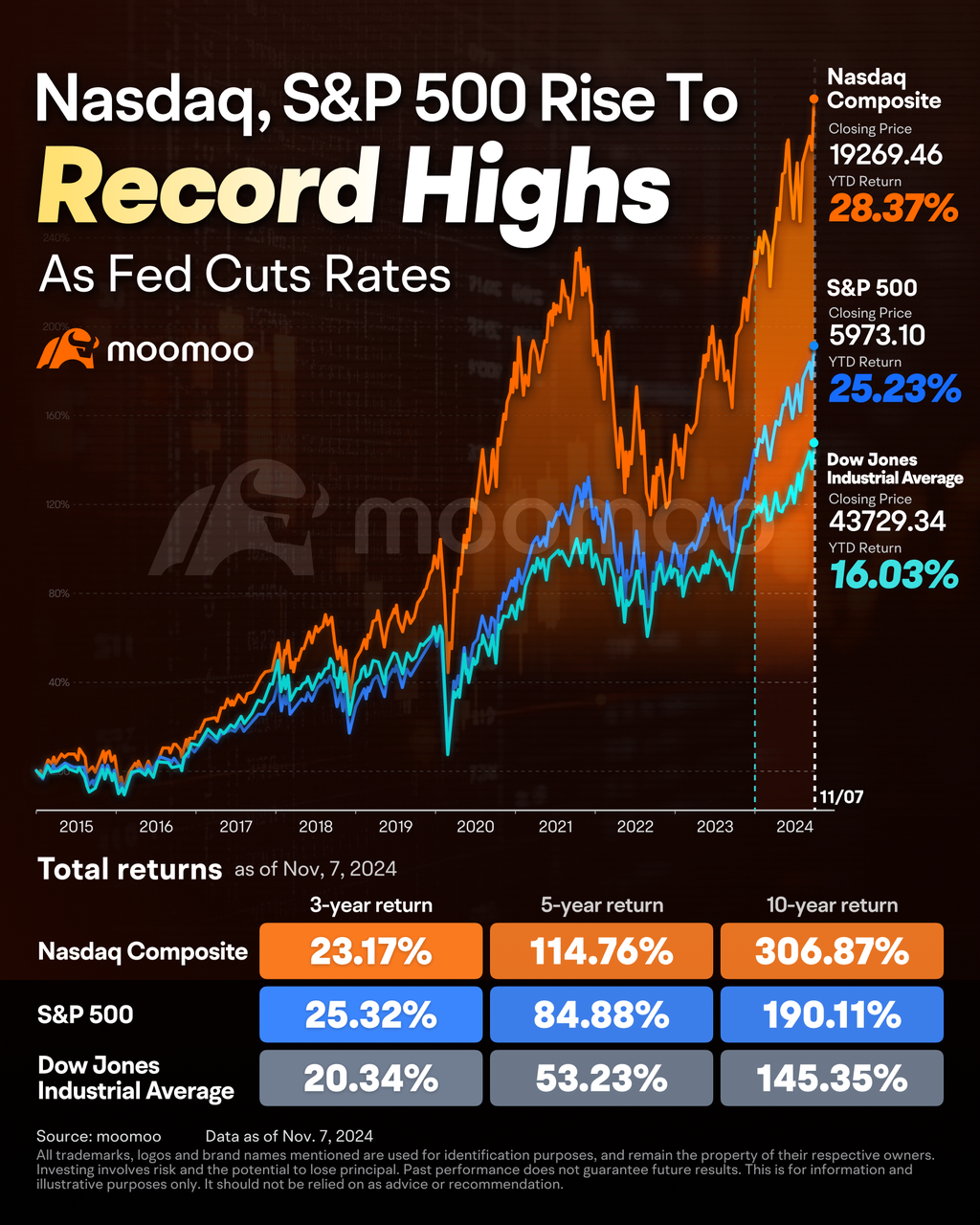

Thursday marked a significant milestone for the US stock market, with the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ reaching new all-time highs. This surge in the stock market continues as part of the post-election rally, further fueled by the Federal Reserve's decision to cut rates by 25 basis points, aligning with expectations.

Analysts at Evercore ISI Research suggest that this stock-market rally is far from over. They project that the S&P 500 could soar to 6,600 by mid-2025, driven by the political landscape shaped by Donald Trump’s unexpected return to the White House and a potential Republican majority in Congress. Julian Emanuel, a senior managing director at Evercore ISI Research, notes that historical data indicates the current bull market, which began in October 2022, is still in its early stages. Typically, bull markets have lasted over 50 months and have seen an average gain of 152% over the past decade. However, the current bull market has advanced 65% and is only 25 months into its cycle.

The implications of a 'decisive and uncontested' victory by Trump and a possible 'red sweep' were unexpected, but such outcomes are likely to bolster policy expectations of deregulation that could further drive up the stock market. Evercore's forecast indicates an additional upside of 10.5% from Thursday’s closing level of 5,973.10.

Adding to the optimistic outlook, Carson Investment predicts a robust year-end rally, noting that many investors remain underinvested, having prioritized cash and bonds and missed much of the current rally. Historical patterns show that in years when the market was up by at least 17.5% heading into the final two months, gains continued through year-end. This pattern has repeated 14 times, with November and December typically showing strong performance.

While presidential influence is undeniable, broader economic indicators often play a more pivotal role for investors. The Federal Reserve remains optimistic about the economic outlook. During the overnight conference, Jerome Powell highlighted that both inflation and interest rates are trending downwards, aligning with the Fed’s expectations for continued economic growth and a healthy job market.

"This further recalibration of our policy stance will help maintain the strength of the economy and the labor market, and will continue to enable further progress on inflation as we move toward a more neutral stance over time," Powell said.

"We think that the economy, and we think our policies, are both in a very good place, a very good place."

Source: Bloomberg, Carson Investment, Reuters

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

74337812 : I want in

intuitive jackal : that's what they always say

韭菜-盒子 : Leek, quickly get on board.

103152649 : hiii ty

103152649 韭菜-盒子 : ty

103152649 韭菜-盒子 : ty

Deals Gap 129 : huge eye roll

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Bullish Law : I m ready for a Bull Ride!

123asv : Good

View more comments...