Has the Tide Turned for US Stocks? Hedge Funds Dump and Short at Fastest Pace in Two Years

Hedge Funds Rush to Close Long Positions, Scaling Back Risk Exposure

According to $Goldman Sachs(GS.US$ , hedge funds are actively reducing their risk exposure by engaging in long position liquidations and modest short covering. The total leverage ratio for long and short positions in US fundamentals has declined for the sixth consecutive week, dropping to 190.8%, while the net leverage ratio fell by 2% to 53%, marking the largest decline this year. This trend underscores the growing caution among hedge funds as they progressively de-leverage and minimize their risk exposure. Moreover, flow data reveals that hedge funds have been net sellers of US equities for three consecutive weeks, driven primarily by long position liquidations.

Diving deeper, eight out of the eleven major sectors in the US stock market have seen net selling, encompassing IT, consumer staples, real estate, and financials. Notably, the consumer sector has been heavily shorted, experiencing net selling for the third straight week and recording its largest net sell-off since November 2023 last week. Conversely, the industrial, materials, and energy sectors have witnessed net buying.

Goldman Sachs highlights that a key factor behind the short selling in the consumer sector last week was the disappointing earnings reports from several major consumer companies, including Levi's and Nike, coupled with a weak core Personal Consumption Expenditures (PCE) price index, which negatively impacted market sentiment.

According to $Goldman Sachs(GS.US$ , hedge funds are actively reducing their risk exposure by engaging in long position liquidations and modest short covering. The total leverage ratio for long and short positions in US fundamentals has declined for the sixth consecutive week, dropping to 190.8%, while the net leverage ratio fell by 2% to 53%, marking the largest decline this year. This trend underscores the growing caution among hedge funds as they progressively de-leverage and minimize their risk exposure. Moreover, flow data reveals that hedge funds have been net sellers of US equities for three consecutive weeks, driven primarily by long position liquidations.

Diving deeper, eight out of the eleven major sectors in the US stock market have seen net selling, encompassing IT, consumer staples, real estate, and financials. Notably, the consumer sector has been heavily shorted, experiencing net selling for the third straight week and recording its largest net sell-off since November 2023 last week. Conversely, the industrial, materials, and energy sectors have witnessed net buying.

Goldman Sachs highlights that a key factor behind the short selling in the consumer sector last week was the disappointing earnings reports from several major consumer companies, including Levi's and Nike, coupled with a weak core Personal Consumption Expenditures (PCE) price index, which negatively impacted market sentiment.

Have Retail Investors Become the Catchers for Hedge Funds' Exits?

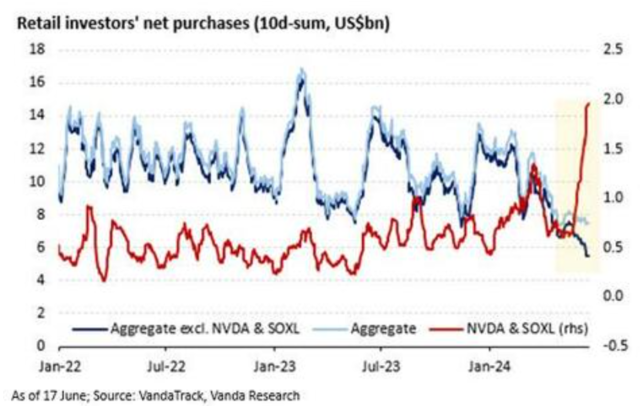

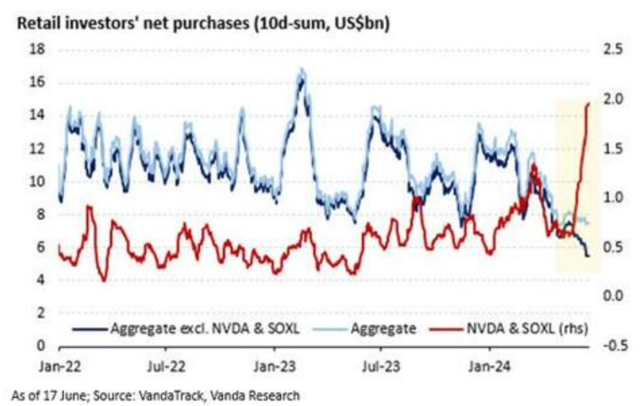

In contrast to the recent rapid selling and shorting of US tech stocks by hedge funds, retail investors continue to hold onto hope for these equities.

As of June 17, Vanda Research noted that retail traders were allocating more funds towards semiconductor stocks, particularly $NVIDIA(NVDA.US$ and $Direxion Daily Semiconductor Bull 3x Shares ETF(SOXL.US$.

In contrast to the recent rapid selling and shorting of US tech stocks by hedge funds, retail investors continue to hold onto hope for these equities.

As of June 17, Vanda Research noted that retail traders were allocating more funds towards semiconductor stocks, particularly $NVIDIA(NVDA.US$ and $Direxion Daily Semiconductor Bull 3x Shares ETF(SOXL.US$.

While hedge funds are swiftly "fleeing" from tech stocks, retail investors are pouring in. Vanda Research suggests that hedge funds have likely offloaded significant quantities of tech stocks to retail investors, indicating that beneath the calm surface of the market, substantial share exchanges may have already taken place. In essence, hedge funds could be unloading record amounts of tech stocks onto retail investors.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment