TSLA

Tesla

-- 436.170 MU

Micron Technology

-- 87.090 NVDA

NVIDIA

-- 130.680 QUBT

Quantum Computing

-- 15.140 NUKK

Nukkleus

-- 52.100

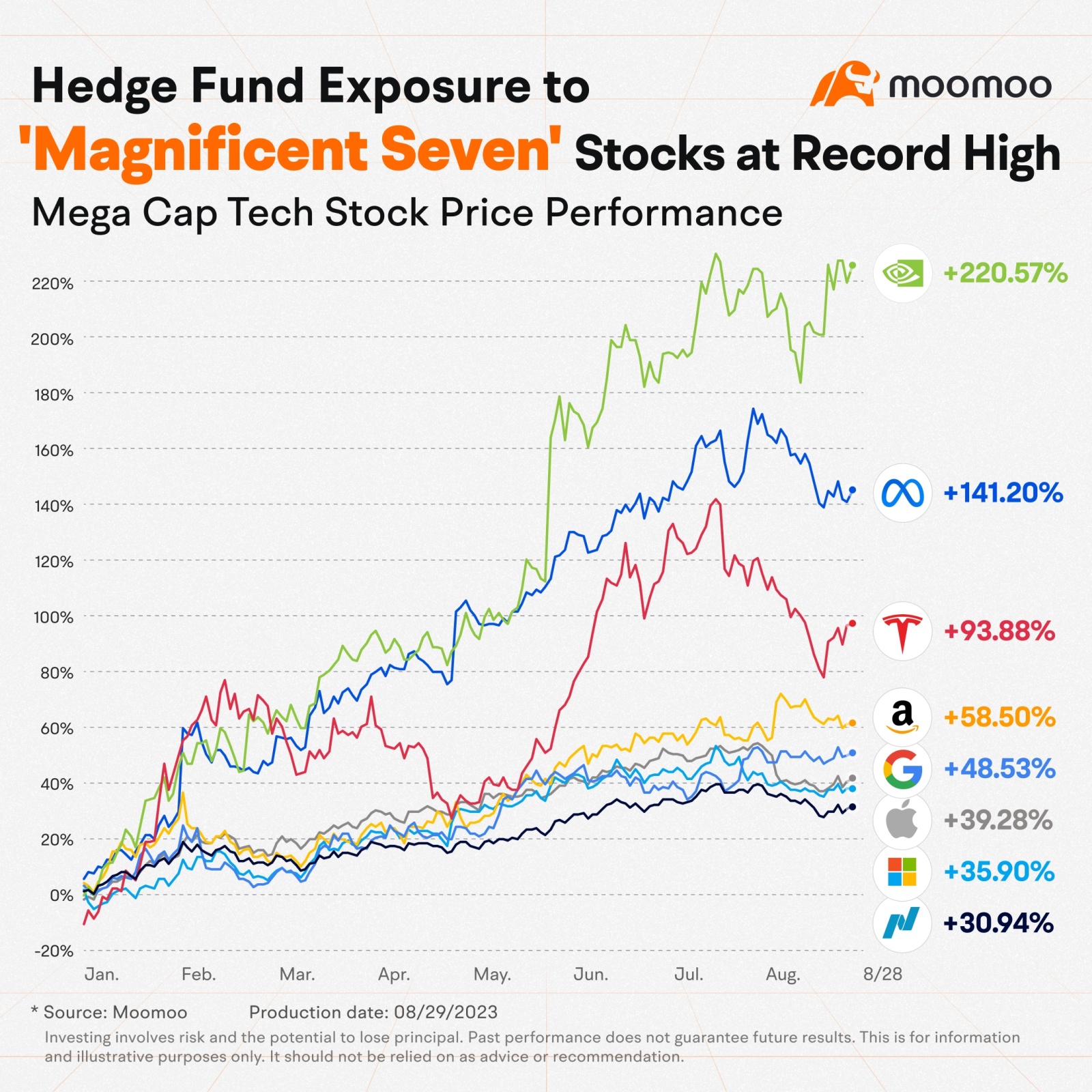

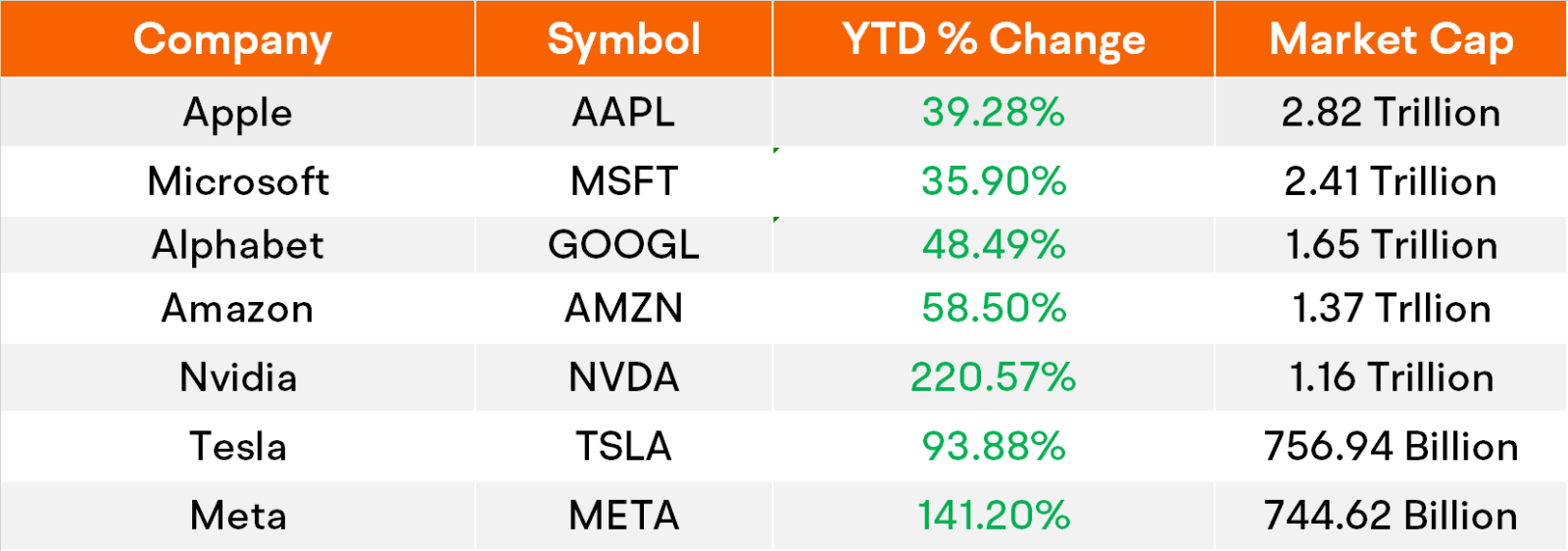

Hedge funds continue to embrace mega cap technology and artificial intelligence themes," lead brokerage Goldman Sachs said in a note sent to a restricted group of clients and obtained by Reuters.

“It's momentum on steroids," he said, adding that it may be harder for stock-picking hedge funds to outperform investments in other asset classes such as fixed income.

Hedge funds and mutual funds both entered 3Q with largest Info Tech underweight since at least 2012," strategist David Kostin of Goldman Sachs wrote in a note.

Hedge funds and mutual funds rotated into cyclicals at the expense of growth sectors like Info Tech and Consumer Discretionary," Kostin said. "Earlier this year, the seven mega-cap tech stocks lifted the S&P 500 in an extremely narrow rally. Returns have since broadened out and funds cut exposure to the two sectors."