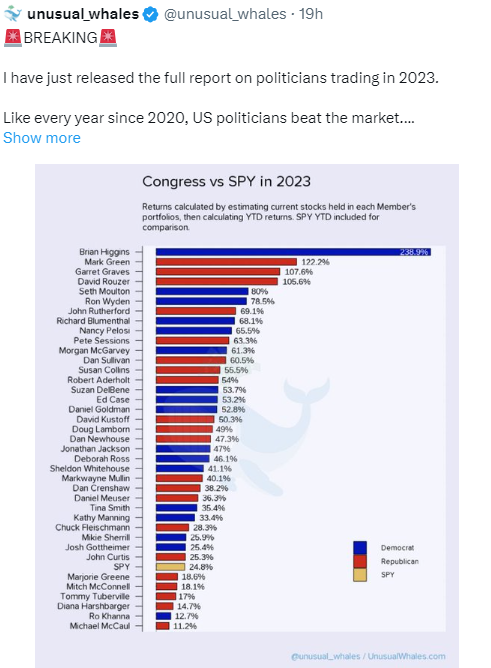

Congress' Top Stock Traders of 2023: Nancy Pelosi Leads with Democrats Averaging 31.18% Gains

Congress did a great job beating the market again this year, with a third of the 100 members beating the S&P 500 with their portfolio. Democrats outdoing their Republican colleagues and the S&P 500 index by far, according to a new report.

In 2023, 115 members of Congress revealed their transactions, a decrease from previous years. Approximately one-third of the trading members outperformed the S&P 500 in the previous year. Compared to the S&P 500's gain of 24.8%, the average gains for Democrats and Republicans were 31.18% and 17.99%, respectively, according to the report compiled by Unusual Whales, a market analysis group.

"One thing people always say is that members are very good at picking stocks, that's often assumed … but to be quite frank, members were also quite good at avoiding losses," the founder of Unusual Whales said in an interview with ABC News last year.

Members of the House Oversight and Accountability Committee made some of the largest purchases, including 435 distinct transactions for healthcare stocks, 328 separate transactions for financial services companies, and 272 separate transactions for technology companies. Similar conflicts were observed in the House Armed Services Committee, where members bought financial services stocks in 277 transactions and healthcare equities in 392 different transactions, according to data from Unusual Whales.

Here are the top 10 stock traders in Congress:

The top performing Congress traders include notable names such as Rep. Nancy Pelosi, whose portfolio was up 65% on the year; Rep. Dan Crenshaw, up 38%; and Sen. Susan Collins, up 55%. Rep. Brian Higgins (D-N.Y.) notched the highest returns for 2023 at 238%.

Nancy Pelosi is one of the Congressmen who is scrutinized the most for her trading activity. Regarding the timing of several trades made by her husband, venture investor Paul Pelosi, the former Speaker of the House has been the subject of inquiries. The Pelosis recently purchased $1–$5 million worth of Nvidia options, according to Benzinga.

In 2012, President Barack Obama signed the STOCK Act, banning members of Congress from trading with nonpublic information, meaning details they glean in their work that are not available to the general public. The current state of affairs, however, is that members of the House and Senate are free to trade equities, provided that the trade is disclosed within 45 days. The current legislation that would outlaw stock trading by members of Congress has reached a deadlock in a number of House and Senate committees.

Source: Benzinga

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

ghazan khan :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)