Summary analysis of today's hot stocks.

The Nikkei Average today closed at 39,367.58, up 0.53%. This relatively optimistic movement reflects investors' sentiments and is influenced by positive market news.

Analysis of today's star stocks

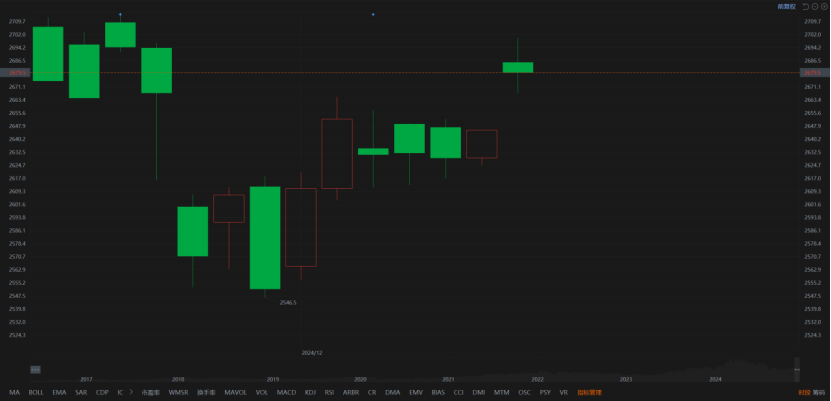

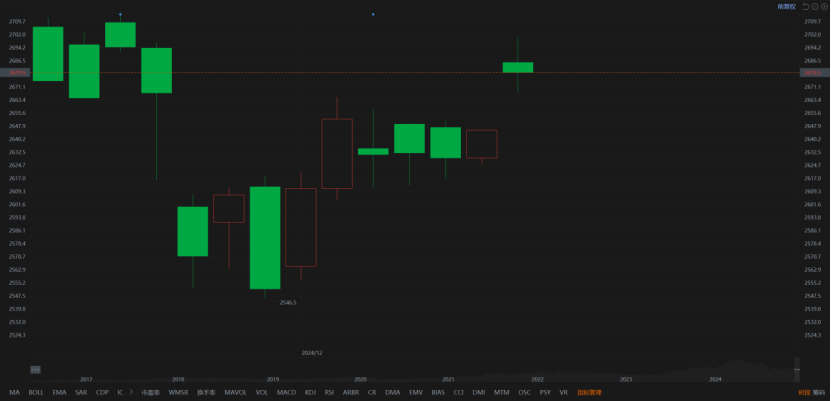

1. Toyota Motor Corp (7203.T).

The closing price today is 2679.5.

The volume is 29.2971 million shares.

The increase rate is 1.29%.

Personal opinion: Today, it seems to be rising as it did a few days ago. Suddenly, the rise of dark candles may indicate that there is not enough pressure, but I think the momentum of the continued rise can sustain bold risks for a long time. Please continue the upward trend.

Analysis of today's star stocks

1. Toyota Motor Corp (7203.T).

The closing price today is 2679.5.

The volume is 29.2971 million shares.

The increase rate is 1.29%.

Personal opinion: Today, it seems to be rising as it did a few days ago. Suddenly, the rise of dark candles may indicate that there is not enough pressure, but I think the momentum of the continued rise can sustain bold risks for a long time. Please continue the upward trend.

2. Sony Group Corp. (Sony Group Corp., 6758.T)

$Sony Group (6758.JP)$

Today's closing price is 3338.

Trading volume is 728 trillion 870 billion yen.

The increase is 4.12%.

Sony Group Corp still has uncertainty, but now is a good mood, let's go for it! While it may not last long, it can make an impact within days.

Today's closing price is 3338.

Trading volume is 728 trillion 870 billion yen.

The increase is 4.12%.

Sony Group Corp still has uncertainty, but now is a good mood, let's go for it! While it may not last long, it can make an impact within days.

3. SoftBank Group Co (SoftBank Group Corp., 9984.T).

$SoftBank Group (9984.JP)$

The closing price today is 9269.

The volume is 613.31 million shares.

The range is 0.42%.

Although there have been two consecutive minor adjustments as the market rises, with strong support and resistance lines, my recommendation for those holding positions would be to be patient, as it is likely to fluctuate at this price, as we have seen in many previous cases, until the final outcome is clear.

The closing price today is 9269.

The volume is 613.31 million shares.

The range is 0.42%.

Although there have been two consecutive minor adjustments as the market rises, with strong support and resistance lines, my recommendation for those holding positions would be to be patient, as it is likely to fluctuate at this price, as we have seen in many previous cases, until the final outcome is clear.

There are many hot stocks, but I haven't analyzed them much.

Secondly, it's a wrap.

The Nikkei 225 continues to maintain a long-term upward trend, currently positioned above 39,000 points, close to its recent all-time high, which may bring new upward energy.

The trading volume is relatively stable, and the market atmosphere is relatively healthy, but caution is needed regarding the potential adjustment risk at record high levels.

In the short term, Japanese stocks are expected to continue to fluctuate upward, particularly with the support of external markets and exchange rates of the yen, the improved performance of exporting companies can support the market.

The medium to long-term trend depends on Japan's economic data and changes in the global macro environment, particularly on the trends in the US economy and global financial policies.

Thank you for viewing. If you found this helpful, we apologize for any inconvenience caused.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment