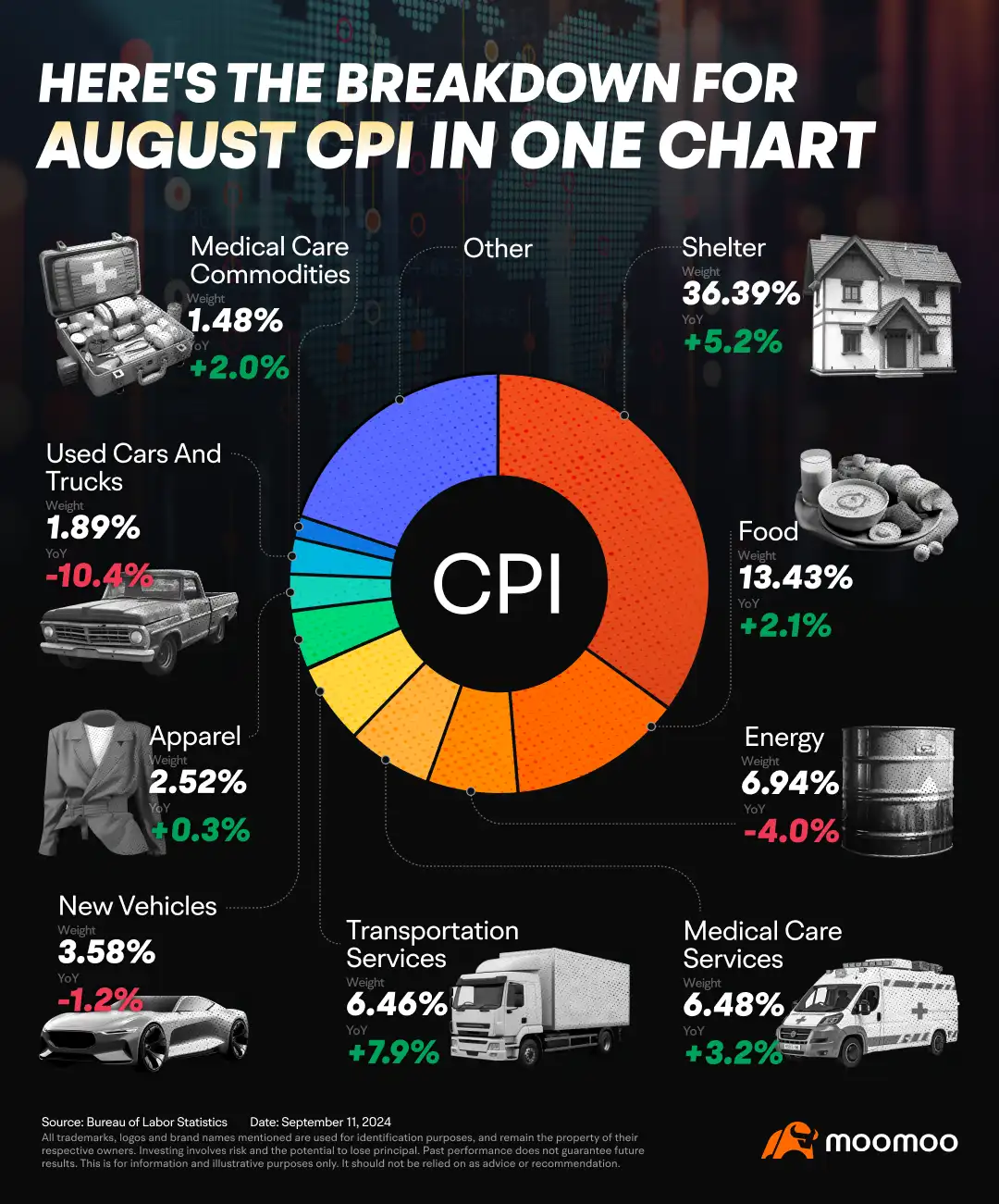

Here's the Breakdown for August CPI, in One Chart

The US annual inflation rate decreased for the fifth straight month to 2.5% in August 2024, marking the lowest level since February 2021, down from 2.9% in July and falling below the anticipated 2.6%. Month-over-month, the Consumer Price Index (CPI) increased by 0.2%, consistent with July's figures.

Additionally, while core inflation remained stable at a low not seen in over three years at 3.2%, the monthly rate of core inflation rose slightly to 0.3% from 0.2%.

Food costs were up 2.1% compared with one year ago, after increasing by 2.2% YoY in the previous month.

Energy costs decreased by 4.0% YoY, after increasing by 1.1% YoY in July.

Used cars and trucks prices decreased by 10.4% YoY, after decreasing by 10.9% in the previous month.

Shelter costs were up 5.2% compared with one year ago, after increasing by 5.1% YoY in July.

Seema Shah from Principal Asset Management note that the latest CPI report didn't deliver what the market was hoping for. With the core inflation rate exceeding expectations, the Federal Reserve faces a more complex route to implementing rate cuts. Although this report won't necessarily block policy actions next week, it provides the more hawkish members of the committee with substantial grounds to argue for a more cautious approach, potentially leading to a smaller cut of 25 basis points.

Futures for the Dow Jones Industrial Average dropped by 259 points, or nearly 0.6%. S&P 500 futures declined by approximately 0.4%, and Nasdaq 100 futures also fell by 0.4% after the release.

Related Article: Here's the Breakdown for US July CPI, in One Chart

By Moomoo North America Team Calvin

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

73029059 : One chart is awesome.

103306701 73029059 : May I know the meaning of this chart towards the market?

104668340 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Daring Lu : I see it as people selling their used cars to stay afloat.

new cars prices down too due to low demand.

prices of housing, food, and commodities are up since they are imported and necessities.

Logistic up since more demand to transport cheaper goods from Mexico and neighbouring countries. Oil drop should reduces the logistic but went up instead.

USD dropped so imported goods are more expensive.

More terrible days ahead, climate change will affect harvest, USD will drop more, biz cutting staff strength.....

This is how I interpret the data.

Donald Perkins : everything is still up in price. The only thing that is down are vehicles and auto makers are laying people off as car sales collapse as the average consumer is barely able to afford the essentials. The average consumer is swimming in credit card debt. What a wonderful economy.

Money Thrill Daring Lu : Very good insight

Coolingdown 103306701 : Core cpi goes up steadily last 3 months. I think it’s not good. Shelter the most contributor, people can afford houses

Laine Ford : all good but no comment on this stock here

Boganji4 : hi

Anita Zeng Donald Perkins : such is the case