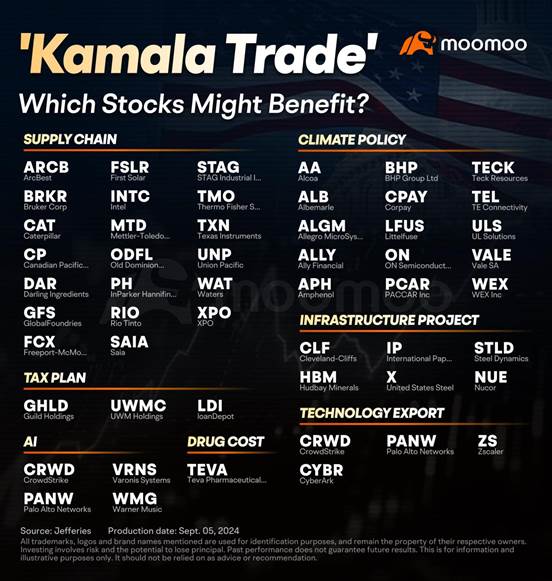

As the U.S. presidential election approaches in just two months, focus intensifies on the crucial debate between Vice President Kamala Harris and former President Donald Trump, scheduled for 9 p.m. ET on Tuesday, September 10. For investors strategizing around the "Trump trade" or the "Harris trade," the market's forward-looking reaction to their governing policies is critical. The election outcome will shape expectations of their administration, leading to early capital allocation in sectors poised to benefit.

Bunny R :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

TheOracleOfBroMaha : If Harris wins im selling everything & investing in Gold

Tonyco :

Joe P :

tough Platypus_9271 : Harris will say anything to get elected . She has no experience in anything but a prosecutor for California and you see how that went. The emergent.czar , you see how that went too. If she is president, she will not be in charge, she knows nothing about the job, and you really want her to sit down with Putin? This is the worst time to even consider her. Watch the debate tonight at 9 eastern time.

73372627 : So according by this really bios article no M7 will benefit????? LOL. , but nice cannabis will benefit and replace the millions of jobs lost in energy, auto and their 's collateral.

Yee, we will grow pot with solar panels.

judah in Singapore : When the rampant use of marijuana in the usa comes, let russia and china be great again! Let the new generation of americans indulge themselves. A president who supports marijuana is the punishment that the leftists should win.

103721817 : good

muhamad Hazairudin s : Muhammad hazairudin shadan

Steve Kovacek TheOracleOfBroMaha :

View more comments...