Here to share some positive info! Returns On Capital Are Showing Encouraging Signs At Super Micro Computer

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Speaking of which, we noticed some great changes in Super Micro Computer's (NASDAQ:SMCI) returns on capital, so let's have a look.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Super Micro Computer, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

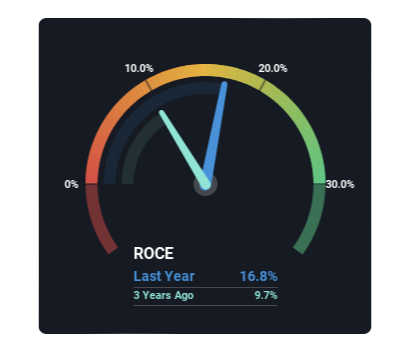

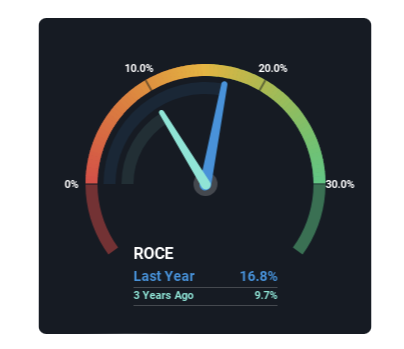

0.17 = US$1.3b ÷ (US$9.9b - US$2.4b) (Based on the trailing twelve months to June 2024).

Thus, Super Micro Computer has an ROCE of 17%. On its own, that's a standard return, however it's much better than the 11% generated by the Tech industry.

Above you can see how the current ROCE for Super Micro Computer compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Super Micro Computer for free.

What The Trend Of ROCE Can Tell Us

The trends we've noticed at Super Micro Computer are quite reassuring. Over the last five years, returns on capital employed have risen substantially to 17%. Basically the business is earning more per dollar of capital invested and in addition to that, 600% more capital is being employed now too. The increasing returns on a growing amount of capital is common amongst multi-baggers and that's why we're impressed.

On a related note, the company's ratio of current liabilities to total assets has decreased to 24%, which basically reduces it's funding from the likes of short-term creditors or suppliers. So shareholders would be pleased that the growth in returns has mostly come from underlying business performance.

The Bottom Line

A company that is growing its returns on capital and can consistently reinvest in itself is a highly sought after trait, and that's what Super Micro Computer has. And with the stock having performed exceptionally well over the last five years, these patterns are being accounted for by investors. Therefore, we think it would be worth your time to check if these trends are going to continue.

From Yahoo Finance

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment