Canadian ETFs? Canadians talk.

Hey mooers!

Market watchers are keenly observing $NVIDIA (NVDA.US)$'s impact on the tech-heavy Nasdaq Composite Index, while the Dow Jones Industrial Average, more industrially focused, hit a new high on August 29, 2024, with a 9.67% year-to-date gain. However, it trails other major U.S. indices.![]()

Given these disparities, Warren Buffet recommends broad market index funds to individual investors for simpler and diversified market access. Read more to learn about index ETFs! ![]()

However, for Canadians, after seeing so many US stocks and their ups and downs. Time to change flavors for some Canadian ETFs. ![]()

No clue? Don't worry. We have collected other mooers' ideas on Canadian ETFs for you!

See how they feel and think, and you probably will have a better clue![]()

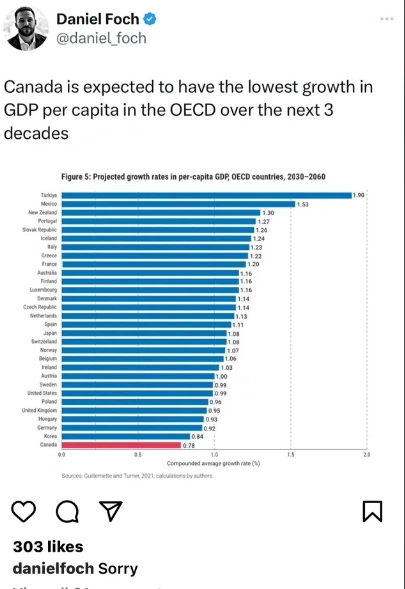

I’m scared. What does this mean for us investors? $VANGUARD FTSE CDN HIGH DIVID YIELD TRUST UNIT (VDY.CA)$ $BCE Inc (BCE.CA)$ $Canopy Growth Corp (WEED.CA)$

I’m looking for thoughts/pros/cons on putting it all into XBAL which I believe provides this ratio, vs putting the 60% into $ISHARES CORE EQUITY ETF PORTFOLIO UNITS CAD (XEQT.CA)$+ $VANGUARD S&P 500 INDEX ETF TR UNIT (VFV.CA)$ and the remaining 40% into a bonds ETF. I’m leaning towards the latter as if the market dips, he can hold onto the stocks portion and withdraw from bonds, and vice versa if it grows. Am I overlooking or misunderstanding something?

As time passes my risk tolerance has gone way down, pretty pumped to officially have 50% index funds in thee ole portfolio! Just consistently buying thru highs and lows and don’t sell till retirement $VANGUARD S&P 500 INDEX ETF TR UNIT (VFV.CA)$ $ISHARES S&P/TSX 60 INDEX ETF UNIT (XIU.CA)$ $VANGUARD FTSE CDN HIGH DIVID YIELD TRUST UNIT (VDY.CA)$ $Vanguard S&P 500 ETF (VOO.US)$

$VANGUARD FTSE CDN HIGH DIVID YIELD TRUST UNIT (VDY.CA)$ would be another good option to look at but, you'll want to watch overlap though with any other ETF you look at. Canada's dividend markets tend to be dominated by our banks and a couple of utilities/railways.

If you want to learn more about Canadian ETFs, check this out!

For more readings on the Canadian economy and ETFs, we also picked these for you:

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Meme_Short_Queen : GLCC is my main holding for two years

tsla trader : moo moo does NOT carry aapl.ne , xxxx.ne , cad hedged

bmo has qqq cad hedged to avoid currency risk

not sure what moo is recommanding

Jason Fung : $VANGUARD S&P 500 INDEX ETF TR UNIT (VFV.CA)$ would be my top pick for an index ETF for Canadian Investors. It is a well diversified fund and management fee is very low. It also makes investing easy and simple. You can buy it every 2 weeks from your pay cheque and let the fund grows. The only downside is that it includes only US companies and to get some Canadian exposure, I also invest in a few individual stocks on TSX.