Housing: How Much Can Canada's Housing Benefit From Rate Cuts?

Monetary easing has started in Canada and the central bank has telegraphed it will continue. But it has also warned that interest rate cuts wouldn't go down as fast as they went up and not as low as they were prior to the pandemic. So far, the Bank of Canada has cut the overnight rate target twice by a total of 50 basis points to 4.50%.

Can the housing sector, among the most interest rate sensitive, fully benefit from rate cuts?

The answer is complicated.

It depends on the horizon

Just like your investments, the time horizon you're considering matters.

In the BOC's minutes of the July monetary policy meeting, the central bank expects the imbalance between supply and demand to persist in the short term.

The housing sector is projected to contribute a modest 0.1 percentage point to the 1.2% 2024 real GDP growth, the BOC Monetary Policy Report shows. But the central bank expects residential investment to increase in 2025, when housing contribution is projected to rise to 0.5 percentage points as GDP growth accelerates to 2.1%.

Firms surveyed by the BOC in May expect the policy rate to decline to 4.0% at best by next spring - this would be just 50 basis points. Such a modest easing wouldn't be enough to substantially boost housing demand, supply or prices.

Mixed forces impacting housing demand

Downside forces

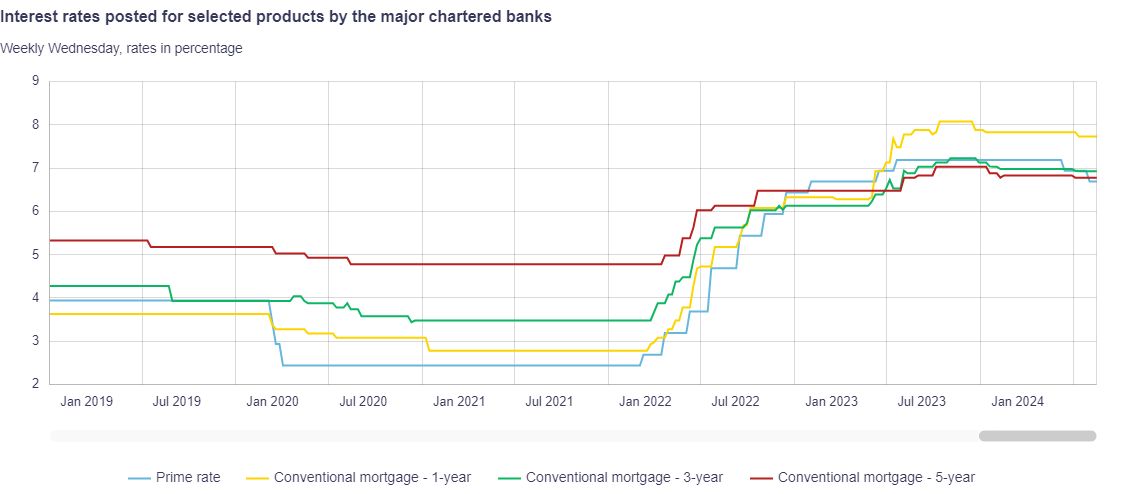

On the consumer side, despite lower interest rates, affordability remains a challenge as refinancing will continue to come at higher rate than just after the pandemic.

First-time home buyers today also face a much higher bar to pass banks' stress tests to qualify for a mortgage than a few years ago. The conventional 5-year mortgage was around 6.80% at the end of July, up about 2 precentatge points from where it stood right before the tightening cyle started in 2022.

Source: Bank of Canada

Sharp price gains over the recent years, including shelter prices, have also eaten up into households' budgets, while past interet rate hikes will continue to work their way through the economy.

Upside forces

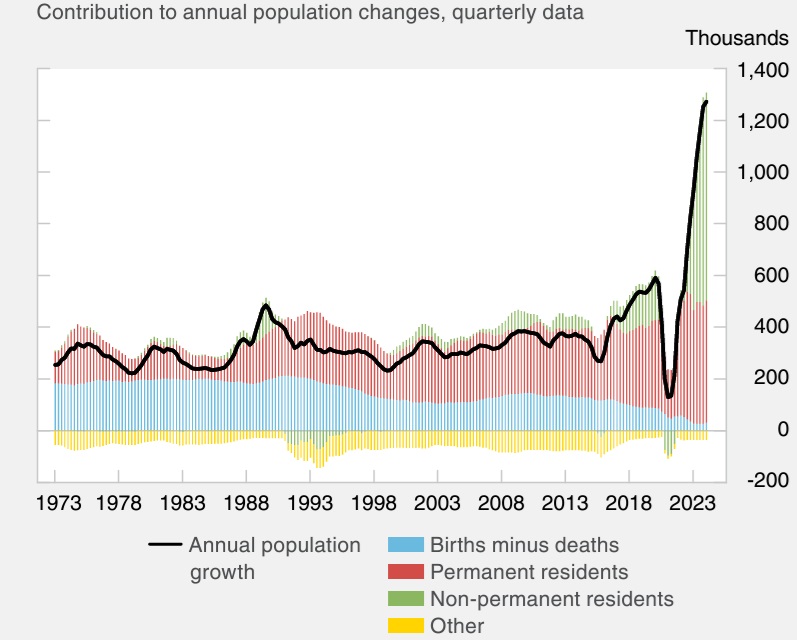

On the upside, immigration is a key factor behind housing demand.

The BOC's second quarter survey of Survey of Consumer Expectations showed that the share of consumers planning to buy a home was close to the survey average and higher than the average of the previous four quarters. "This higher level of homebuying intentions continues to be supported by newcomers, who typically exhibit stronger intentions than other Canadians," the survey said.

Canada's population has grown by 6% over the past two years, almost entirely due to the arrival of newcomers.

Newcomers are boosting Canada’s population growth

Source: Bank of Canada

The impact of immigration gains has been felt across all types of housing, but mostly on rentals initially.

Supply outlook

Supply hasn't kept up with demand.

Weak permits

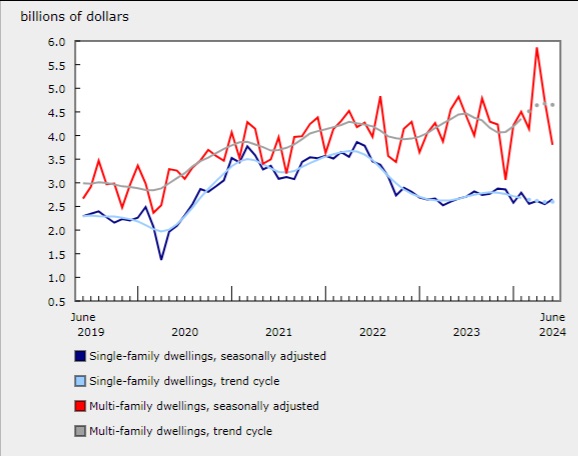

Looking at the supply side, The Canada Mortgage and Housing Corporation (CMHC) forecasts a pickup in construction in 2025-2026, although it doesn't expect activity to reach the 2021-2023 levels owing to the lagged effects of higher interest rates.

In June, housing starts were down 9% from May and building permits, an indicator of construction activity ahead, dropped nearly 14% to their lowest level since December 2023, following a 12.7% retreat in May. July brought some relief with a 16% rebound in housing starts from June. However, actual starts year-to-date between January and July showed a decline of 18% from the same period last year in Vancouver and a 9.5% decrease in Toronto. Montreal fared better, with a 47% gain from a historically low year in 2023.

Value of building permits for the single-family and multi-family components

Source: Statistics Canada

In Ontario, home to the most populous city in the country, Toronto, construction intentions in June plunged nearly 26% from May, the largest monthly decline since December 2023. Permits in British Columbia contracted 31%.

So what's ahead for housing supply?

Homebuilders' sentiment is still "quite low", Kevin Lee, CEO of the Canadian Home Builders' Association, told The Financial Post in an interview at the end of June. He added that the declining interest rates wouldn't translate into starts "for a little while" as he anticipates slow sales in the short term.

Even after a 50 basis point rate cut, material prices remain high despite a stabilization and investors might look twice before financing new projects with interest rates still higher than at the beginning of the pandemic.

Structural contraints on supply

Structural constraints are also weighing on the outlook for construction activity.

The BOC cites:

- Municipal zoning restrictions

- High development fees

- Time-consuming and expensive permitting processes

- Construction worker shortages.

So how much can the housing sector benefit from the BOC's rate cuts?

Immigration puts demands on housing that are felt sooner than supply issues can be solved, making it unlikely for the BOC's rate cuts to significantly change the balance, at least in the coming few months.

This means affordability issues could continue to weigh on purchase decisions until interest rates come down enough to incentivize potential homebuyers. In fact, even though the BOC cut rates in July, activity in Canada’s housing market weakened in July when sales of existing homes contracted 0.7% on the month, data from The Canadian Real Estate Association (CREA) showed Thursday.

Source: CREA

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

john song : k