How do major Australian chain supermarkets adapt to high interest rates and inflation?

Despite maintaining the cash rate at 4.35% during its August meeting as expected, RBA expressed concerns about inflation remaining above its 2-3% target range and plans to continue restrictive monetary policies until inflation is effectively controlled.

Under the dual pressures of high interest rates and inflation, Australian households are experiencing reduced disposable income and rising living costs. This shift is not only forcing consumers to alter their shopping habits but also directly impacting the revenues of retailers, including supermarkets. Large chain supermarkets like Woolworths, Coles, and Wesfarmers are facing the dual challenges of tightened consumer spending and increased operational costs. To adapt to the evolving economic landscape, these ASX-listed retail giants, are actively adjusting their business strategies in hopes of maintaining or even improving their financial performance under adverse conditions.

This article will delve into the challenges faced by these three companies and the strategic adjustments they are making to navigate the current economic environment.

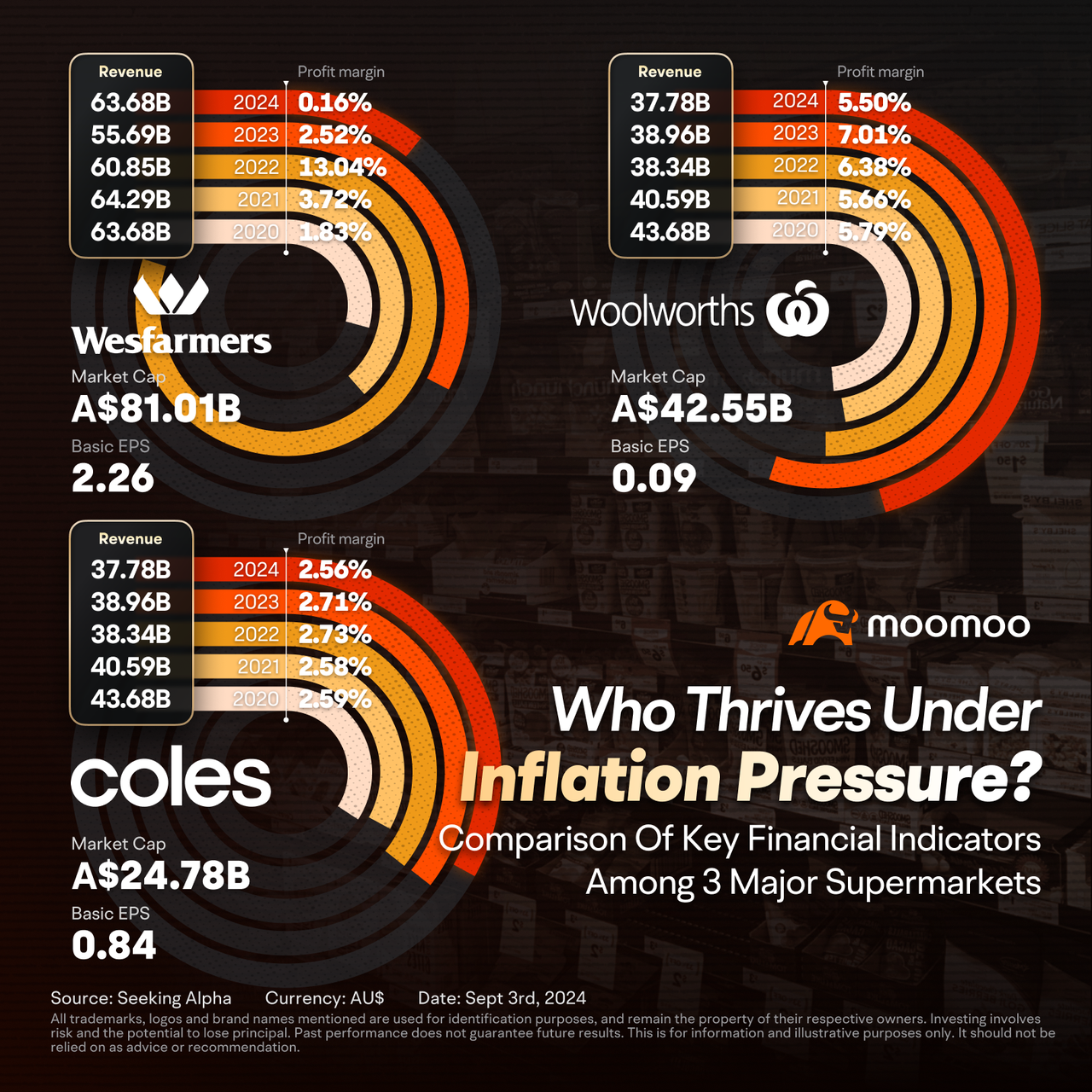

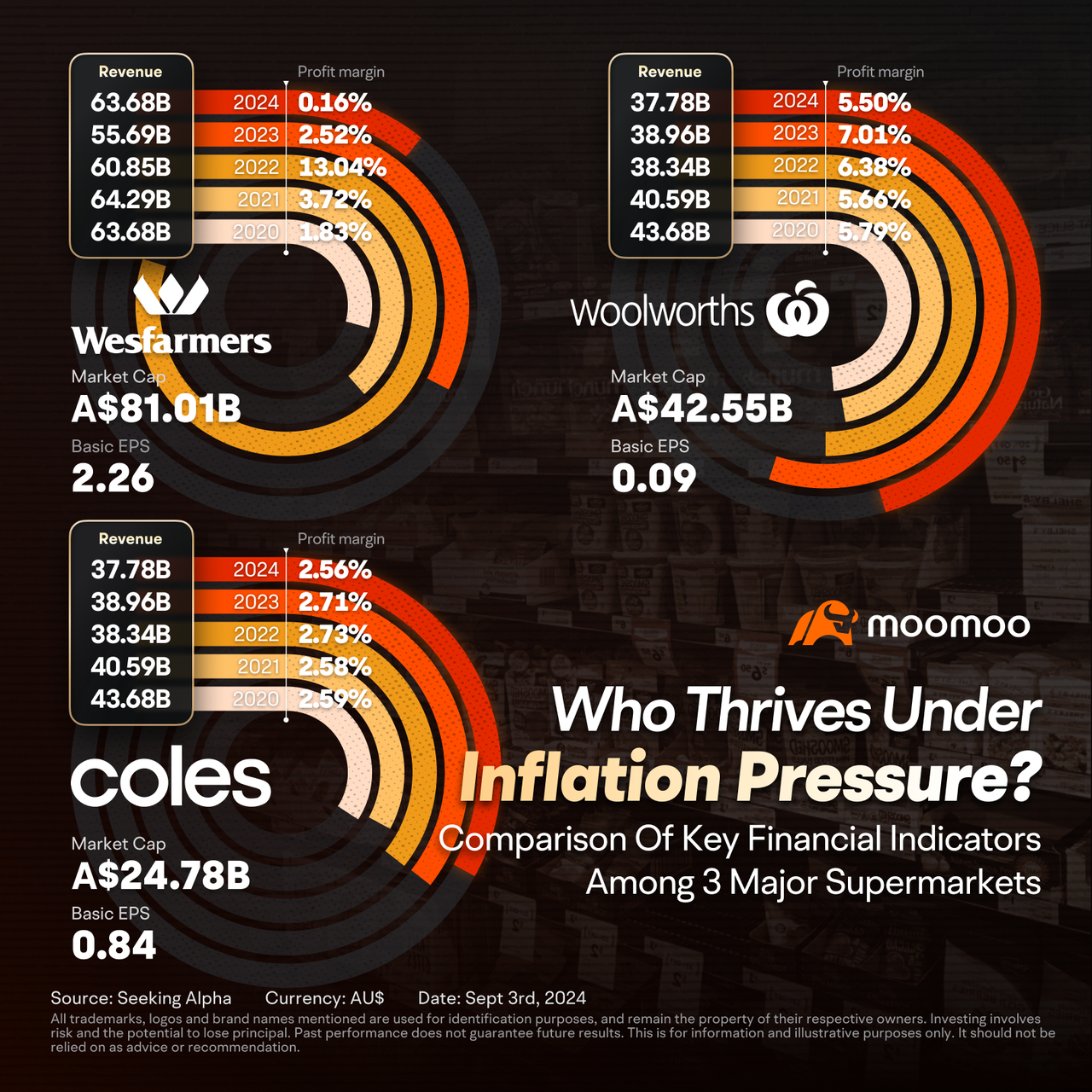

Financial performance breakdown

In uncertain economic conditions, investors often seek investment options that provide relatively stable returns. Consequently, investing in defensive stocks, particularly retail giants like Wesfarmers, Coles, and Woolworths, becomes a common choice due to their focus on everyday consumer goods, which typically ensures stable performance during economic fluctuations.

However, the financial performance of these retail giants varies due to their different strategies and market responses, reflecting in their stock prices. As of September 4, over the past year, Wesfarmers has risen by 37.28%, Coles has increased by 21.06%, while Woolworths has declined by 4.35%. In comparison, the ASX200 index increased by only 13.00% during the same period.

Now, let's review the annual financial data of these companies.

Wesfarmers

Key financial results

– Revenue: AU$44.2b (up 1.5% from FY 2023).

– Net income: AU$2.56b (up 3.7% from FY 2023).

– Profit margin: 5.8% (up from 5.7% in FY 2023). The increase in margin was driven by higher revenue.

– EPS: AU$2.26 (up from AU$2.18 in FY 2023).

$Wesfarmers Ltd (WES.AU)$ delivered strong results in this challenging environment, driven by effective cost management, strategic investments in technology, and robust performance in key retail segments. Their customer-centric approach, including a consistent low-price strategy at Bunnings, Kmart, and Officeworks, resonated well with customers. The company expanded its product and service offerings to meet changing customer needs, capturing greater spending from younger generations and maintaining strong omnichannel experiences. Enhancements to the OnePass membership program further drove sales and improved customer retention. Wesfarmers' commitment to sustainability and social responsibility solidified their market position and long-term value creation. Through flexible operations and market adjustments, Wesfarmers successfully navigated the economic pressures of high interest rates and inflation.

Coles

Key financial results

– Revenue: AU$43.7b (up 7.6% from FY 2023).

– Net income: AU$1.12b (up 1.8% from FY 2023).

– Profit margin: 2.56% (down from 2.71% in FY 2023).

– EPS: AU$0.84 (up from AU$0.82 in FY 2023).

In the high-interest and high-inflation environment, $Coles Group Ltd (COL.AU)$ successfully achieved performance growth by expanding private labels and meeting consumer demand for low-priced products. For the 53 weeks ending June 30, Coles reported a 3.2% increase in group revenue to $43.5 billion, a slight 0.2% rise in EBITDA to $3.64 billion, and a 1% decrease in EBIT to $2.04 billion. Underlying NPAT grew by 4.1% to $1.21 billion, and the total dividend was 68 cents per share, surpassing Citi analysts' forecasts.

Moreover, the decrease in Coles' Days Sales Outstanding(2024:3.44 vs 2023:3.7) indicates an improvement in its collection efficiency. The Days Inventory Outstanding remained relatively stable(2024:28.87 vs 2023:28.91), suggesting consistent inventory management efficiency. The increase in the Inventory to Sales Ratio(2024:6.19% vs 2023:5.72%) reflect the company's positive expectations for future demand and strategic adjustments to address supply chain risks. These changes demonstrate that Coles is striving to maintain competitiveness by enhancing operational efficiency and adjusting inventory strategies.

Woolworths

Key financial results

– Revenue: AU$67.92b (up 5.6% from FY 2023).

– Net income: AU$2.56b (down 93.3% from FY 2023).

– Profit margin: 0.16% (down from 2.5% in FY 2023).

– EPS: AU$0.09 (down from AU$1.33 in FY 2023).

$Woolworths Group Ltd (WOW.AU)$ ' financial performance was mixed, impacted by consumers facing financial pressure and shifting unexpectedly to private label products. Additionally, its New Zealand operations heavily burdened its balance sheet, with normalized earnings plummeting 57% due to a 19% wage increase outpacing sales growth, resulting in a A$1.5 billion writedown. Investment losses in Endeavour Group further slashed profits by over 90% to A$108 million. BIG W also experienced a 3.9% sales decline and a 90.3% drop in earnings due to increased discounting in home and apparel categories. Consequently, Woolworths decided to end its long-standing relationship with Endeavour Group, selling its remaining 4.1% stake to fund the acquisition of the remaining 35% in food service distributor PFD Food Services Pty Limited.

In summary, Woolworths faced more challenges in the high-interest and high-inflation environment, while Wesfarmers and Coles effectively navigated these economic pressures through strategic measures and customer-focused approaches.

Future outlook

When discussing their outlook for the fiscal year 2025, the three major retailers—Wesfarmers, Coles, and Woolworths—emphasized the need to gain a stronger value proposition as a key strategy to differentiate themselves from competitors, acknowledging that this will be a challenging task.

In the face of such an economic environment, these retailers have clearly stated that they will continue to focus on offering market-leading value and maintaining an everyday low-price strategy, a positioning that has been widely recognized by consumers in the current climate. By reducing costs, they aim not only to alleviate the financial burden on households but also to support business clients, helping them balance their budgets while still obtaining the necessary goods and services.

Meanwhile, Wesfarmers highlighted that its operations will be dedicated to meeting the evolving needs of customers by introducing new products and services to broaden its target market, with particular attention to attracting younger generations such as Gen Z and Millennials. This aligns with its strategic initiative to support its diversified business model.

Coles and Woolworths, on the other hand, are focused on enhancing operational efficiency, particularly through the use of digital tools and technology, to strengthen their competitiveness. These initiatives reflect the determination of these companies to seek sustainable growth amidst a complex and dynamic market environment.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

xing6600 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)