The challenges facing the growth of power infrastructure include insufficient capacity of existing transmission lines, project delays due to complex planning and permitting procedures, supply chain bottlenecks, the need for new technologies and innovation, substantial capital investments, changing policy and regulatory environments, public acceptance issues, as well as geographical and climatic constraints.

Fred Guarino : Totally agree with this logic, as an electrical engineer, it makes sense to me. I would also add nuclear power plays SMR and BWXT to this list.

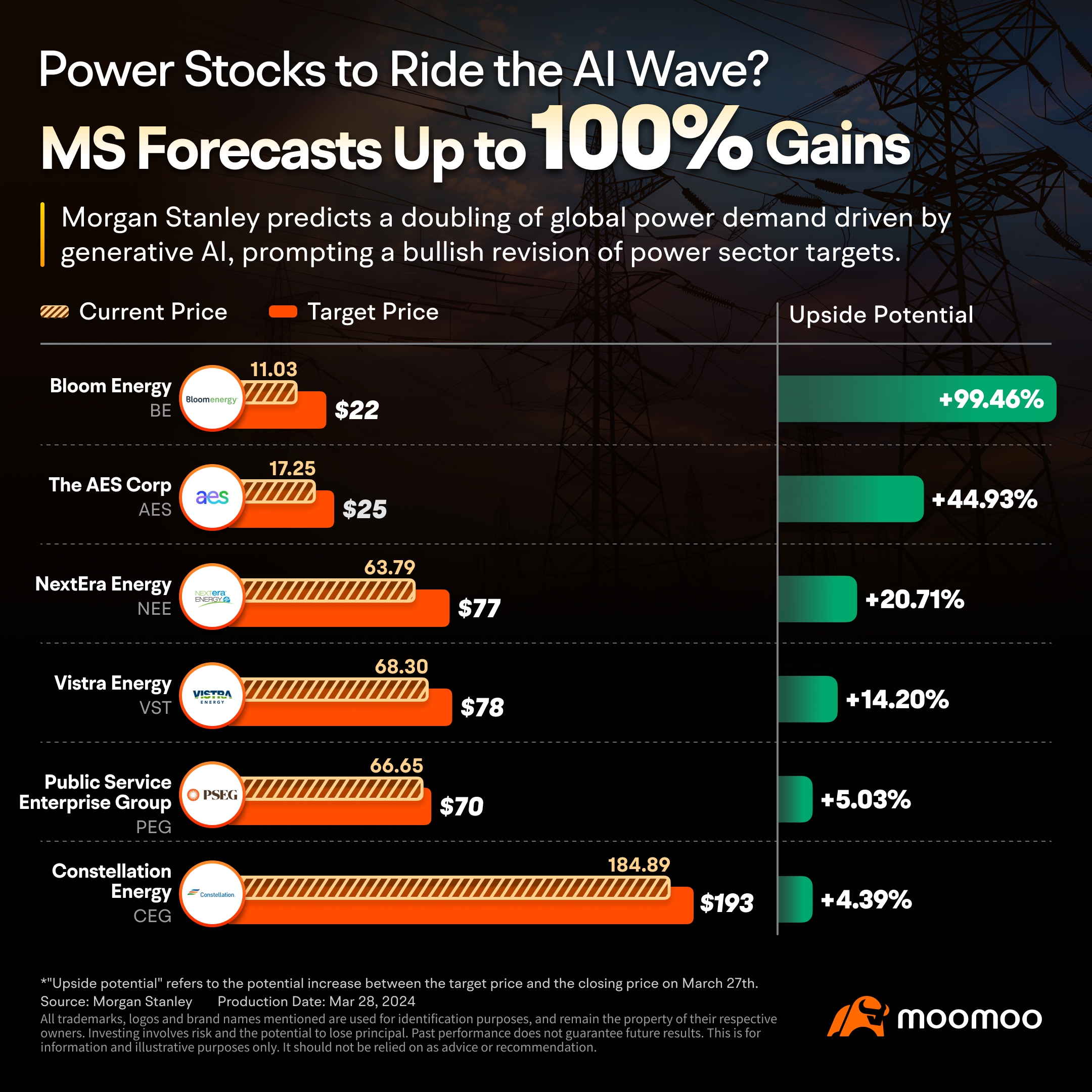

101533033 : Bloom Energy is a turn around play.

Setiadana Fred Guarino : indeed, im accumulating SMR-WRT