Why did global markets tank the last few days?

It’s all about the Yen carry trade.

In short:

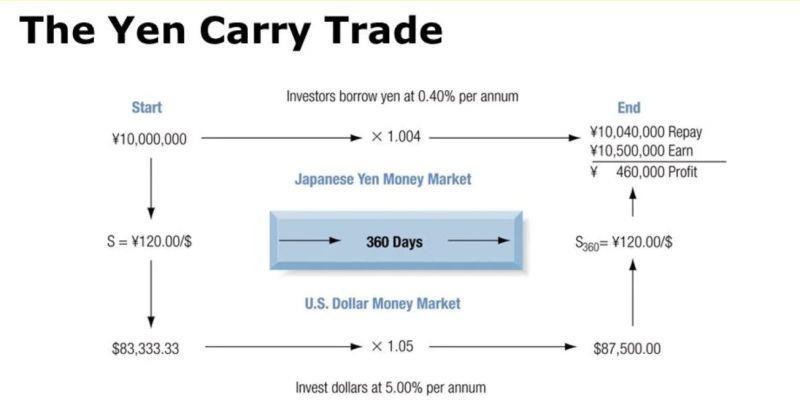

1. Asset management firms were borrowing Japanese yen for super cheap and investing the borrowed money in money markets or global stocks.

2. Japanese central bank rates have remained low for almost 20 years, and even negative for much of the last 10. So basically you borrow money for free, invest it for a 5%+ profit elsewhere and pocket the difference. Amazing

3. But last week the central bank of Japan raised interest rates (to 0.25%) for the first time since 2007, at the same time as central banks in Europe & the US are considering rate cuts.

4. This caused the Yen to rapidly strengthen against the dollar, leading brokers to “margin call” asset managers - i.e. force them to deposit cash to cover potential losses.

5. To do this they had to quickly sell their (typically dollar-denominated) assets ("unwind" their trades), which were falling in Yen-value, in order to basically pay back the Yen they owed.

6. Unwinding lots of trades fast caused the stocks to fall in value. This meant their yen-value was falling even faster, meaning they had to sell even more to pay back the Japanese lenders.

A domino effect, a bit like a short squeeze.

This, combined with fears of a US recession, led to a significant market correction.

爱发财 : Thanks

kettlebell : good read