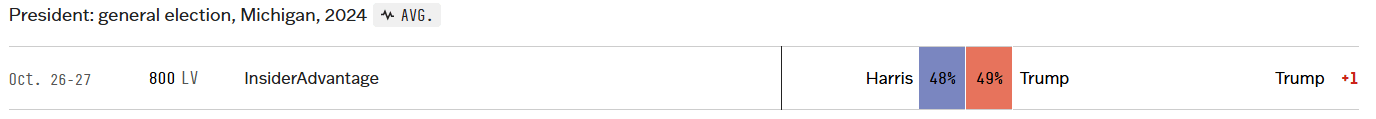

According to official data from ABC News, Trump currently holds 49% support nationwide, closely followed by Harris at 48%. However, data from the Polymarket website, the largest prediction market, shows Trump significantly leading Harris in state support. As of October 29, 2024, 66.3% of Americans support Trump, while 33.8% support Harris. At present, Trump’s chances of winning appear much higher than Harris's.

104770195 Naddy : true true