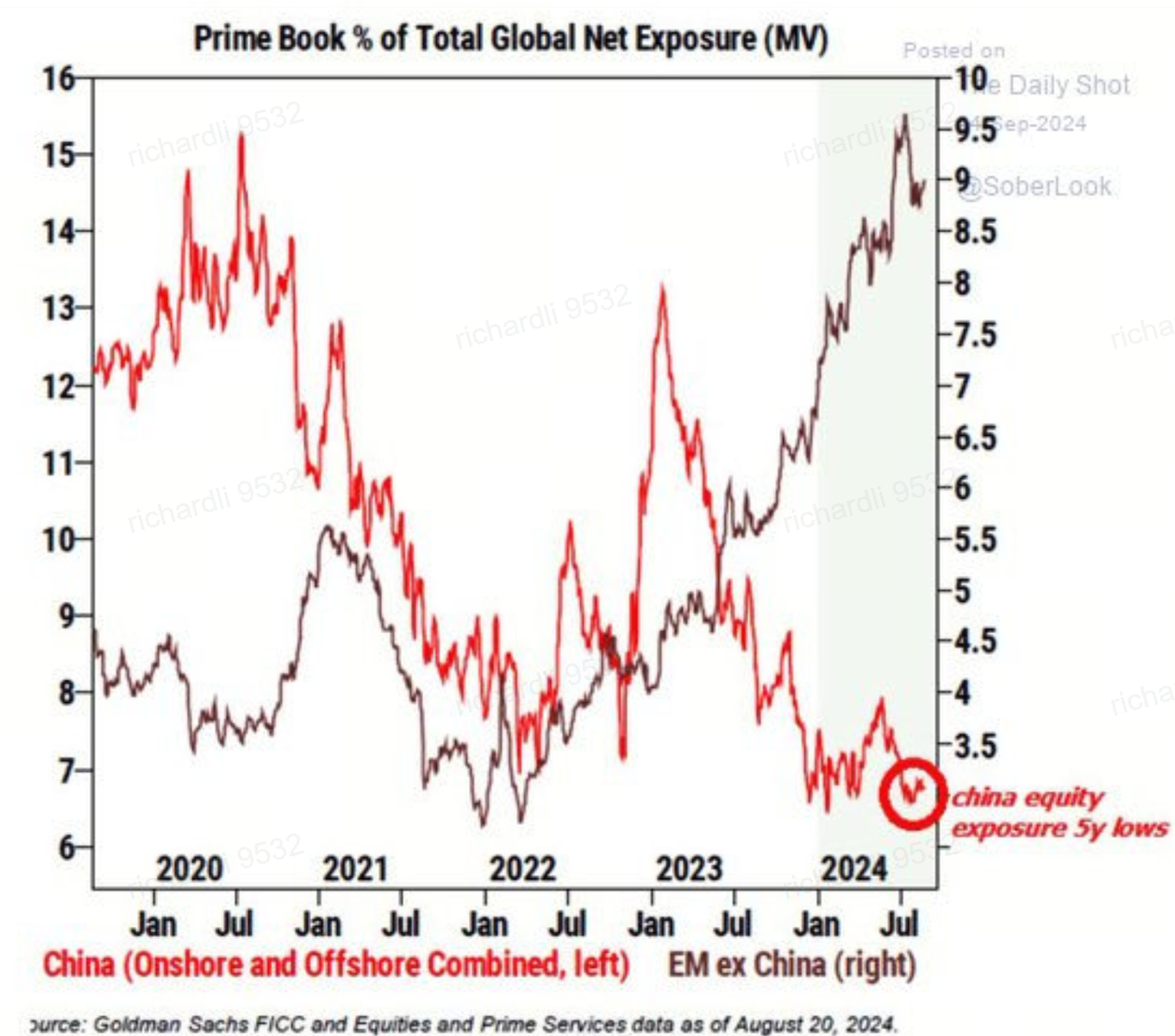

However, after the U.S. opened up space for monetary policy, China's recent actions on Tuesday, including lowering reserve requirement ratios, interest rates, and the rates on existing mortgage loans, have led to an improved expectation for China's macroeconomic fundamentals. As a result, the profit expectations for Chinese assets are also likely to improve, which may break the current extremely low valuations.

KK momo : Chinese market strong rebound

Panda busy KK momo : China is hiding a youth unemployment rate of nearly 25%. I don’t think this is the beginning of a bull market.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

delavie Panda busy : wow... so high?

103286208 : ok

104065181 : Chong Ah!

104838493 : China is very conservative on economic stimulation in view of the high population. Everyone's spending will cause the inflation rise in the rocket .Heard that the Huawei 3 folds new hp selling more than rmb40k , how many can afford to buy it?

suffian bin amat : $GRN HOLDING CORPORATION (GRNF.US)$

KWONG8888 : good

Northsea9 : This policy adjustment will continue for a very long time, that is, the current rebound will last for more than a few years. This is a full recovery after complete stabilization of the regime. It is likely that it will enter a new giant bubble in 5 to 8 years!

104704843 Panda busy : question is if that is the worst it is already, or it will rebound, some will say it will not, but with low interest and strong stimulus, jobs will also rebound in my opinion.

View more comments...