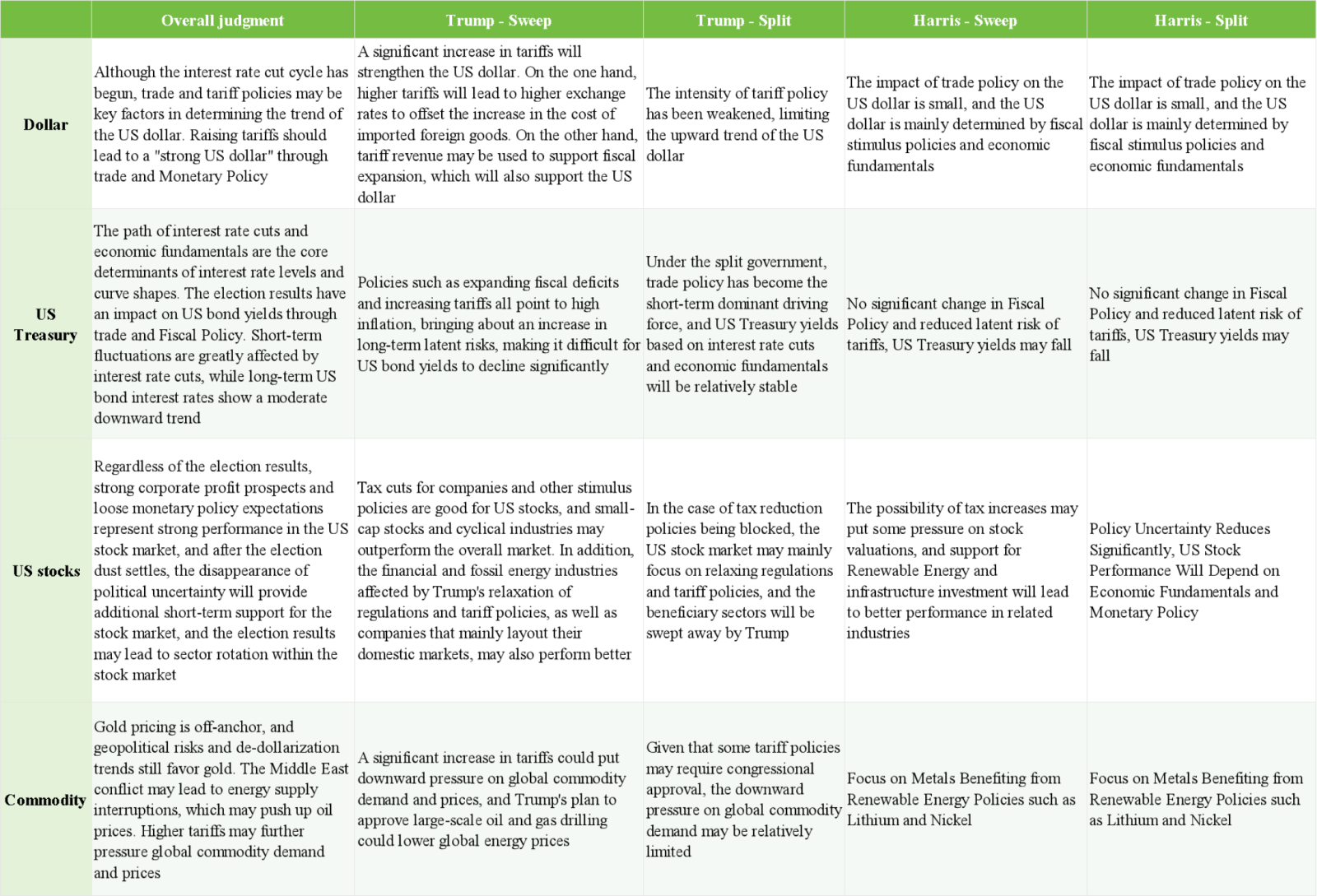

The US election is approaching, and the global Financial Marekt is once again focusing on how the election results will reshape the investment environment. The election results will not only determine the policy direction of the US in the next few years, but may also have a profound impact on Financial Marekt: from the US dollar exchange rate to US bond yields, from stock market performance to commodity prices, every policy change may trigger a chain reaction globally.