How TLTW Can Enhance Your Returns in a Rate-Cut Environment | Moomoo Research

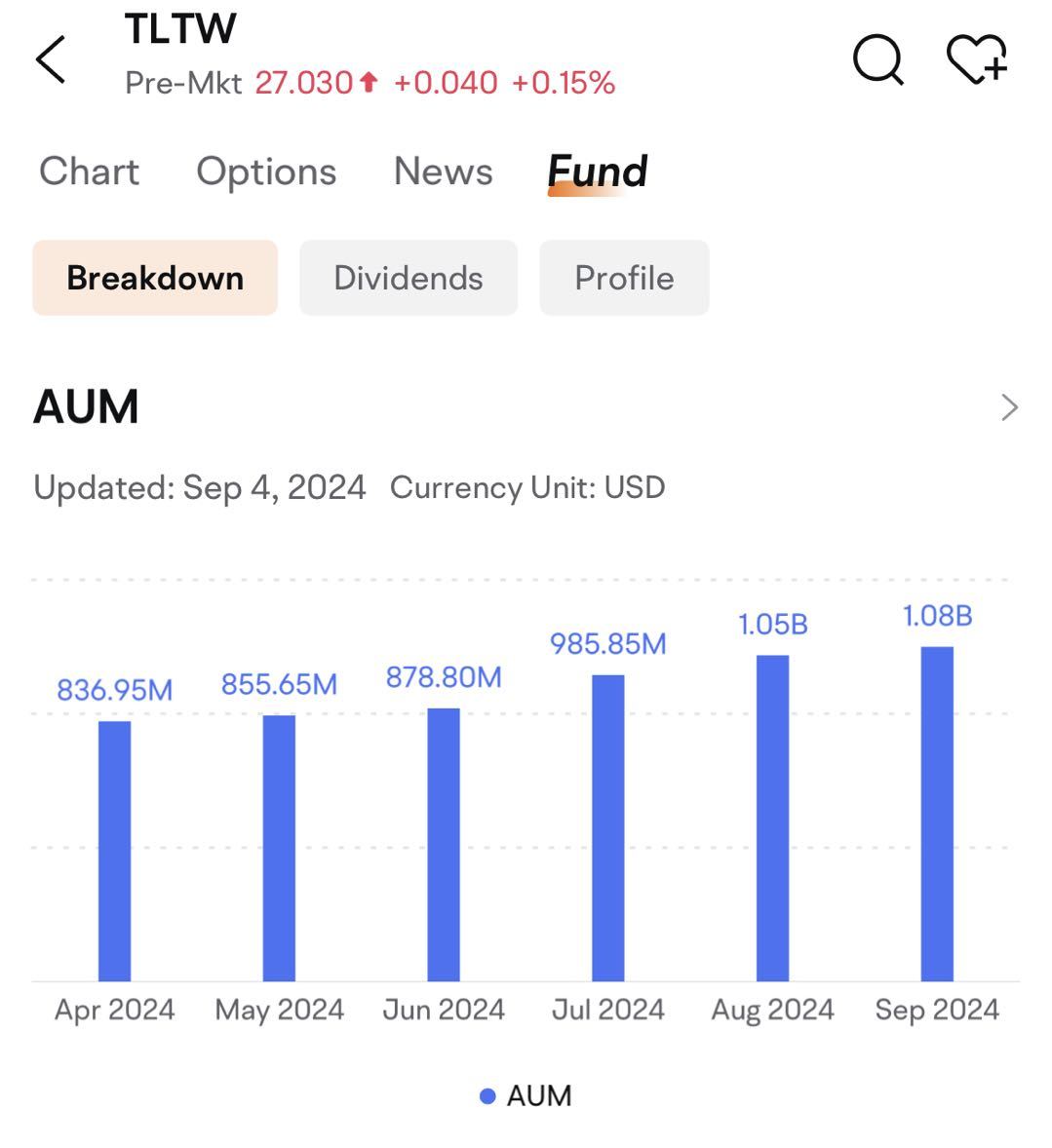

Recent market trends indicate an increasing likelihood of a rate cut in September. In such an environment, long-term Treasury bonds have garnered more attention from investors. For those looking to amplify their Treasury yield, the iShares 20+ Year Treasury Bond BuyWrite Strategy ETF (ticker: TLTW) emerges as an ideal choice, boasting a dividend yield of 15%, significantly higher than that of TLT. This year, TLTW's assets under management have shown consistent growth.

This article will delve into TLTW's product strategy, advantages, and applicable scenarios.

What Differentiates TLTW from TLT?

TLTW is an actively managed ETF under iShares, with the following disclosed investment objective:

The fund holds the iShares 20+ Year Treasury Bond ETF (TLT) while selling call options expiring in approximately 30 days (one month). The number of calls sold corresponds to the number of TLT units held by the fund (i.e., one call contract covers 100 units of TLT). Each month, on the trading day before the sold call options expire, TLTW buys back the call options and sells new call contracts, which expire in about a month with a strike price approximately 2% higher than the current TLT price.

TLTW's portfolio is relatively straightforward, essentially employing a covered call strategy on TLT. As shown below, TLTW currently holds TLT, constituting 99% of the total portfolio, and has sold call options expiring on September 20 with a strike price of $100. TLT's current price is $99.57. The portfolio also includes a small amount of money market funds.

Since the premium income from selling call options provides additional revenue, TLTW pays out not only the dividends from the underlying TLT but also the option premiums as dividends, resulting in a dividend yield significantly higher than traditional U.S. Treasury bonds.

As of September 6, TLTW's dividend yield (TTM) was 15%, far surpassing TLT's 3.6% yield, making it a more attractive option for investors seeking enhanced returns.

TLTW's total expense ratio is 0.35%, which includes a 0.2% management fee and 0.15% in Acquired Fund Fees and Expenses (AFFE). This is higher than TLT's 0.15%. However, considering the monthly option activities and the over 15% dividend yield, we believe the expense ratio is still reasonable.

In addition to its dividend advantage, under what circumstances might TLTW be more worth investing in compared to TLT?

In What Scenarios Is TLTW a Better Investment Than TLT?

Since 2023, we have observed that, besides the dividend income, TLTW's price appreciation (purple line) has consistently outperformed TLT (blue line) for most of the time. This is because TLT's price has mostly fluctuated within a certain range, and covered call strategies tend to perform better when the underlying price remains stable or rises slightly.

When investors employ a covered call strategy, three potential outcomes may occur. Since 2023, all three scenarios have manifested at different times. Below, we analyze these scenarios using examples of significant TLT rebounds, substantial sell-offs, and range-bound movements.

Scenario 1: Range-Bound Movements Below the Strike Price

In this scenario, the underlying asset may trade sideways and remain below the strike price. At this point, returns will be primarily driven by the income generated from option premiums, making the covered call strategy significantly outperform TLT.

For example, from March to July 2023, TLT was range-bound. During this period, TLT declined by 2%, while TLTW easily outperformed, rising by 6%. (Corresponding to Stage 1 in the chart)

Scenario 2: Significant Decline in the Underlying Asset

In this case, the price of the underlying asset may fall sharply, causing the options to become "out-of-the-money" and expire worthless. The premium income can help offset some of the losses in the underlying security.

From August to mid-October 2023, TLT experienced a significant sell-off due to market concerns over persistently high interest rates. Both TLT and TLTW incurred losses, but the premium income helped mitigate TLTW's decline. During this period, TLT dropped by 16.5%, while TLTW fell by approximately 15%. (Corresponding to Stage 2 in the chart)

Scenario 3: Significant Rise in the Underlying Asset Above the Strike Price

In this scenario, the underlying asset (in this case, TLT) may rise significantly, exceeding the strike price of the sold call options. The options then become "in-the-money," and the buyer can exercise the options for a profit. This means the seller loses out on further gains in the underlying asset's price, but the premium income helps offset some losses.

From October 2023 to early January 2024, TLT experienced a rapid increase. During this period, both TLT and TLTW posted positive returns, but TLT outperformed TLTW due to the latter’s embedded call option sales limiting its upside. (Corresponding to Stage 3 in the chart)

However, among these three scenarios, TLTW only significantly underperforms TLT when the underlying asset experiences a sharp rise. Therefore, our question is:

How likely is it for TLT to experience a significant short-term rebound in the current environment?

When we observe a significant short-term rise in TLT, its catalysts usually fall into two categories:

1. The Federal Reserve is making efforts to stimulate growth amid rising recession risks, as seen in 2020, 2011, and 2008.

2. A rapid rebound in TLT following a large-scale sell-off, similar to what occurred at the end of last year.

If neither of these conditions exists, the likelihood of a significant short-term rise in TLT is low, making TLTW likely to outperform TLT in this scenario. Conversely, if recession risks increase and the likelihood of strong stimulus measures from the Federal Reserve rises, TLT would perform better in that case.

Therefore, investors should carefully assess market conditions and adjust their portfolios flexibly. Over time, through precise market analysis and strategic asset allocation, investors can effectively seize market opportunities, achieving stable asset growth and optimized risk management.

$iShares 20+ Year Treasury Bond BuyWrite Strategy ETF (TLTW.US)$

$iShares 20+ Year Treasury Bond ETF (TLT.US)$

$iShares 20+ Year Treasury Bond BuyWrite Strategy ETF (TLTW.US)$

$iShares 20+ Year Treasury Bond ETF (TLT.US)$

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Soyamilkmilk : Just curious, the high 30% US tax on dividends will definitely be a concern, 15% dividend will roughly put the actual expenses up to a 0.15*0.3 =4.5% extra on top of the initial expense ratio, while tlt bears much lesser of that given the lower yield. is there actually a chart plotted to reflect the eventual payoff after tax?