How to Capitalize on the Rebound of Canadian Bank Stocks Amid a Wave of Rate Cuts

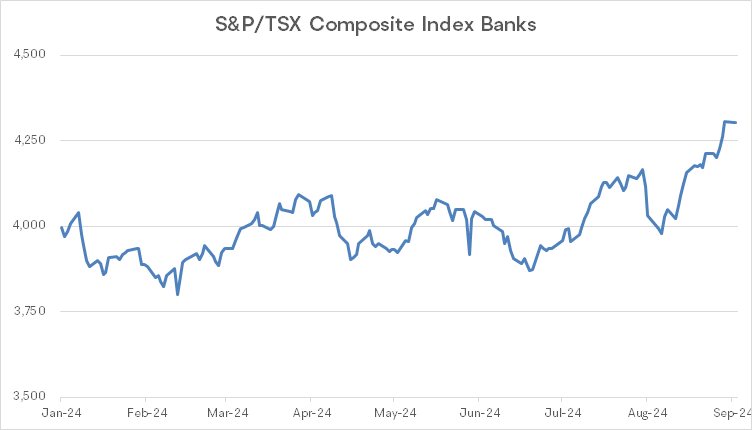

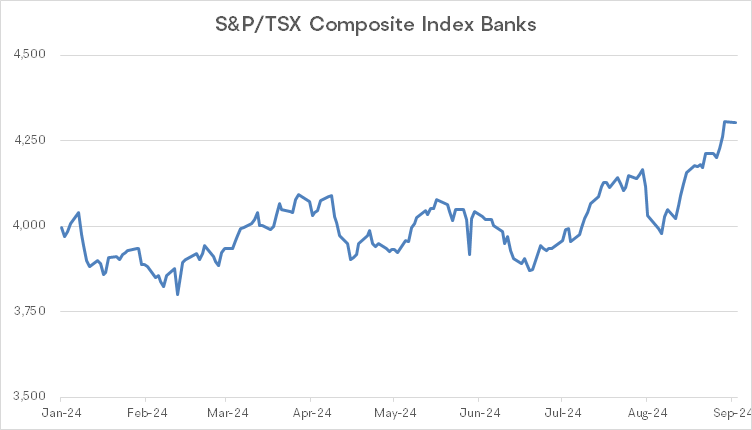

With the Bank of Canada cutting interest rates in June and the latest earnings coming in stronger than expected, the S&P/TSX bank index has risen some 11% since late that month.

In fact, since late 2022, analysts have maintained a negative outlook on Canadian banks as the industry dealt with the impact of interest-rate hikes, slowing mortgage growth, and tighter capital rules. But that backdrop has shifted.

Source: S&P Global

Additionally, the $BMO EQUAL WEIGHT BANKS INDEX ETF TRUST UNIT (ZEB.CA)$, which tracks Canadian bank performance, broke above the C$37 mark that it had stalled at during the previous two years.

Canadian banks' Q3 performance stronger than expected

Four out of the big six lenders reported lower-than-expected Provisions for Credit Losses (PCLs) for the period ending July 31.

This was a “positive surprise,” National Bank of Canada analyst Gabriel Dechaine write in a note. The banks with the largest positive deviations were $Canadian Imperial Bank of Commerce (CM.CA)$ and $Royal Bank of Canada (RY.CA)$, reflecting an improvement in their wholesale portfolios, he said.

Jefferies Financial Group Inc. analyst John Aiken echoed the sentiment, noting that the pace of provisions wasn’t increasing “precipitously” and that the banks were “very stringently” controlling costs. While it’s still early days, he added that there were “signs of life” in the lending arena with Canadian households increasing their lending capacity in the quarter.

$Royal Bank of Canada (RY.CA)$ exceeded expectations mainly due to the acquisition of HSBC's Canadian business. Operating income was CAD 14.688 billion, a year-over-year increase of 13.67%; net interest income was CAD 7.327 billion, a year-over-year increase of 16.56%. Royal Bank of Canada stated that the performance improvement in personal and commercial banking, capital markets, and wealth management partially offset the decline in corporate support and insurance business performance.

$Canadian Imperial Bank of Commerce (CM.CA)$ stood out as the second of the Big Six banks to significantly exceed analysts' expectations for the third quarter. With operating income of CAD 6.604 billion, a year-over-year increase of 13%; net interest income was CAD 3.532 billion, a year-over-year increase of 9%, and non-interest income was CAD 3.072 billion, a year-over-year increase of about 17%. Net profit was CAD 1.795 billion, a year-over-year increase of 25%. The main reason for the growth in performance was the realization of CAD 163 million in the US commercial banking and wealth management business, a sequential increase of 101% and a year-over-year increase of 163%, which was better than expected.

Besides, the $Bank of Nova Scotia (BNS.CA)$’s international operations showed strength in the third quarter, with the international banking segment reporting adjusted earnings of approximately $709 million, marking a 10% increase from the previous year due to “strong margin expansion.”

The $National Bank of Canada (NA.CA)$ also beat analysts’ expectations in the third quarter, reporting profit gains in all of its business segments.

Economists are predicting more rate cuts for the remainder of the year and into 2025

The Bank of Canada is widely expected to cut its policy interest rate by 25 basis points on Wednesday and there are few indications that it will stop there. Economists are predicting cuts at every meeting for the remainder of the year and into 2025.

Charles St-Arnaud, chief economist with Alberta Central and former economist at the Bank of Canada, said the slowing inflation, rising unemployment and weak outlook for the third quarter will reinforce the Bank of Canada’s intention to cut in September. He expects the central bank will also cut in October and December “bringing the policy rate to 3.75 per cent.”

Wells Fargo also sees the BoC will cutting its policy rate by 25 bps at its September, October and December meetings this year for an end-2024 policy rate of 3.75%.

Source: Wells Fargo Economics

“The rate cut moves will improve pace of loan growth, slow provisions for credit losses and alleviate concerns around a mortgage renewal wave,” Scotiabank’s Meny Grauman and Felix Fang wrote in a note.

How to seize the opportunity for a rebound in the banking stocks?

While Canadians can purchase individual bank stocks, a more hands-off and diversified approach might be purchasing a Canadian bank ETF.

Canadian bank ETFs hold a basket of different Canadian bank stocks. Like bank stocks, bank ETFs can be bought and sold daily in a market with great liquidity on most stock exchanges intra-day. They’re eligible to be traded in all brokerage accounts, including tax-free savings accounts (TFSA) and registered retirement savings plan (RRSP).

ZEB is currently the most popular Canadian bank ETF in terms of assets under management. The ETF holds all of the “Big 6” Canadian bank stocks in an equal-weighted allocation, with each stock receiving a 15-17% weighting.

XFN tracks the S&P/TSX Capped Financials Index, a market-cap weighted index of Canadian financial sector stocks. In addition to Canadian bank stocks, XFN holds insurance companies, lenders, and asset managers. Still, the “Big 6” Canadian bank stocks currently account for approximately 67.3% of the ETF by weight.

HEWB provides equal weight exposure to the “Big 6” Canadian bank stocks like ZEB does. This ETF has rebounded by more than 12% since the end of June.

Source: Financial Post, The Motley Fool, BNN Bloomberg

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment