TSLA

Tesla

-- 431.660 RGTI

Rigetti Computing

-- 17.0800 NVDA

NVIDIA

-- 137.010 LAES

SEALSQ Corp

-- 9.080 PLTR

Palantir

-- 79.080

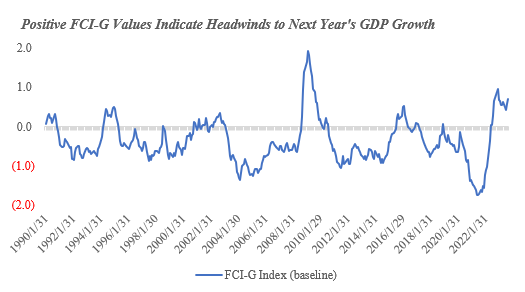

As JPMorgan's Global Market Strategist Meera Pandit stated earlier this year, " Financial conditions are important to the Federal Reserve (Fed) because the Fed influences the economy through financial conditions – it is how they know monetary policy is working."

According to Mark Hackett, Chief of Investment Research at Nationwide, these indexes can be viewed as "scorecards" that consider the factors influencing the economy, businesses, and consumers.

SpyderCall : There is really valuable information here. It is important to know what the Fed is thinking about. Especially if you are a long-term investor.