How I invest amid the September Fed rate cut

Here are my analysis about the coming Fed rate cut:

1) Real Estate

When interest rates decline, the likelihood of people buying homes and seeking home loans increases. Real estate stocks that have remained flat or in the red so far this year could experience price movement if interest rates decrease.

2) Automotive

Just like with homes, when interest rates goes down, the number of people buying cars and seeking car loans increases.Auto stocks that have struggled this year and remain down YTD could see a boost in sales if interest rates fall. It’s likely that lower interest rates would increase their stock prices as a result.

3) Consumers goods

Lower borrowing costs may prompt consumers to purchase goods and services they’ve delayed due to expensive loans, particularly in the non-essential and retail categories, such as jewelry and electronics. It could be an opportune time to invest in undervalued retail stocks.

4) Small cap stocks

If interest rates decrease in September, providing investors with an opportunity to diversify beyond big cap stocks, it is not surprising that the first to benefit are the small cap value stock. Big cap stocks will see rally but at a slower rate.

5) Gold

Gold price has gained about $460 or 22% so far this year which is due to multiple factors such as geopolitical tensions and uncertainty created by the upcoming US presidential election. But the correlation between gold price and interest rate is not so straight forward because gold price is also affected by USD exchange rate which may not necessarily drop due to rate cut.

6) Cash plus funds , Treasury Notes (TN) and Bond funds.

With the monies flow to stocks, the return of the Bonds funds and TN may reduce because such long term investments become less attractive. Cash plus funds which are made of short term T-Bill may still be attractive as long as uncertainty looms the stock market.

Bottom line

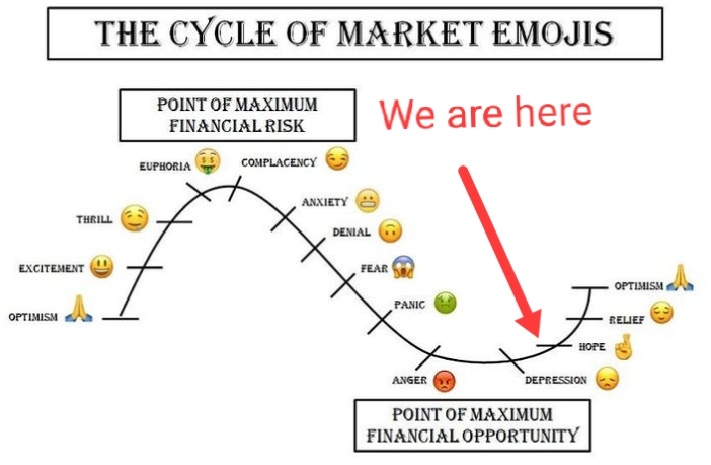

I take a long position and have been invested in big tech stocks and ETFs. I have already seen gain in my investment which means my portfolio is going in the right direction. My H2 outlook remains optimistic (hope![]() ) with caution (not sure if the Fed will change their mind in cutting interest rate

) with caution (not sure if the Fed will change their mind in cutting interest rate ![]() ). I'll continue to buy covered calls to protect my upper limit. Read here:

). I'll continue to buy covered calls to protect my upper limit. Read here:

2024 H1 Recap: Four "D" Trading Strategy and H2 Outlook

1) Real Estate

When interest rates decline, the likelihood of people buying homes and seeking home loans increases. Real estate stocks that have remained flat or in the red so far this year could experience price movement if interest rates decrease.

2) Automotive

Just like with homes, when interest rates goes down, the number of people buying cars and seeking car loans increases.Auto stocks that have struggled this year and remain down YTD could see a boost in sales if interest rates fall. It’s likely that lower interest rates would increase their stock prices as a result.

3) Consumers goods

Lower borrowing costs may prompt consumers to purchase goods and services they’ve delayed due to expensive loans, particularly in the non-essential and retail categories, such as jewelry and electronics. It could be an opportune time to invest in undervalued retail stocks.

4) Small cap stocks

If interest rates decrease in September, providing investors with an opportunity to diversify beyond big cap stocks, it is not surprising that the first to benefit are the small cap value stock. Big cap stocks will see rally but at a slower rate.

5) Gold

Gold price has gained about $460 or 22% so far this year which is due to multiple factors such as geopolitical tensions and uncertainty created by the upcoming US presidential election. But the correlation between gold price and interest rate is not so straight forward because gold price is also affected by USD exchange rate which may not necessarily drop due to rate cut.

6) Cash plus funds , Treasury Notes (TN) and Bond funds.

With the monies flow to stocks, the return of the Bonds funds and TN may reduce because such long term investments become less attractive. Cash plus funds which are made of short term T-Bill may still be attractive as long as uncertainty looms the stock market.

Bottom line

I take a long position and have been invested in big tech stocks and ETFs. I have already seen gain in my investment which means my portfolio is going in the right direction. My H2 outlook remains optimistic (hope

2024 H1 Recap: Four "D" Trading Strategy and H2 Outlook

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment