US Stock Market Continues to Set Records: What's the Next Chapter?

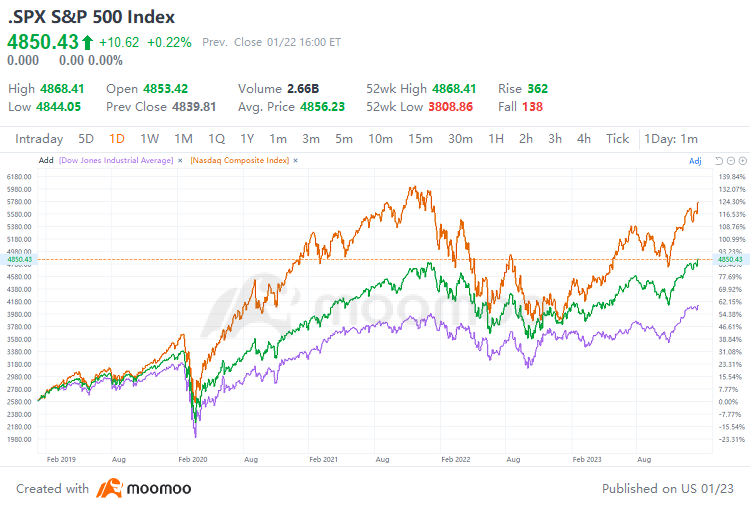

Wall Street continued its upward trend on Monday after reaching historic highs last Friday. At the close, the $S&P 500 Index (.SPX.US)$ and $Dow Jones Industrial Average (.DJI.US)$ continued their climb, rising 0.22% and 0.36%, respectively, after breaking through the historic high set in January 2022. The $NASDAQ 100 Index (.NDX.US)$ also hit a new high for three consecutive days. Multiple signs indicate that after experiencing a correction at the beginning of the year, the AI theme has once again ignited market sentiment, with technology stocks, led by $NVIDIA (NVDA.US)$, leading the US stock market into a new chapter.

However, amid a wave of optimism, some cautious analysts are warning of potential hidden risks. For investors, it is equally important to manage risks reasonably while seizing opportunities.

1. Excessively Optimistic Rate Cut Expectations Are Being Revised

The strong anticipation of a shift in monetary policy by the Federal Reserve had lifted the US stock market to a robust rebound by the end of 2023. However, in 2024, the hawkish statements of Federal Reserve officials and hotter-than-expected economic data have led to the revision of aggressive rate cut expectations. This has briefly triggered a pullback in the US stock market, with the $Nasdaq Composite Index (.IXIC.US)$ plunging by 3.25% and the $S&P 500 Index (.SPX.US)$ falling by 1.52% in the first week.

Although the market has since found new support and regained momentum, data suggests that rate-cut expectations continue to cool down. As of the latest update, traders have abandoned expectations of a rate cut by the Fed as early as March, pushing the expected time for the first rate cut of the year to May. Additionally, the probability of at least a 25bp rate cut in May has also dropped to 84.48%, significantly lower than 97.47% a month ago.

2. The AI Craze Triumphs Over the Federal Reserve Once More, as in 2023

Reflecting on the impressive performance of the recent U.S. stock market, it appears that the enthusiasm for thematic investments has overshadowed the significant adjustments in rate cut expectations. The 2024 kickoff's pullback lasted only a week, and the market found new upward support driven by technology stocks, particularly the semiconductor sector. As the bullish momentum from the AI craze continues into 2024 and extends from the midstream models to upstream computing power and downstream applications, a new round of technology stock rally has begun. Among them, the upstream computing power sector with stronger earnings certainty, such as NVIDIA and AMD, have seen an increase of 20.46% and 14.09%, respectively, from the beginning of the year.

According to Michael Hartnett, Chief Investment Strategist at Bank of America, the leaders of the 2023 U.S. stock market rally have once again become the top picks for traders. Investors are now repositioning themselves with growth stocks, technology stocks, AI concept stocks, and blue-chip technology stocks, the so-called Magnificent Seven.

3. Robust Economic Growth Expectation is Another Vital Driver of the Market's Rebound

Despite the slim prospects of an early interest rate cut, robust economic data is bolstering the consensus of a "soft landing".Specifically:

1) December's U.S. retail sales figures released last Friday showed a substantial increase of 0.6%, surpassing the estimated 0.4%. The University of Michigan's Consumer Confidence Index also surged from 69.7 in December to 78.8 in January, marking the largest monthly increase since 2005 and exceeding market expectations, indicating the resilience of U.S. consumer spending. Meanwhile, consumers are predicting a 2.9% rise in inflation over the next year, lower than previous expectations, and a 2.8% inflation rate in the next five to ten years, hitting a four-month low.

2) On the employment front, initial jobless claims in the U.S. dropped to 187,000 last week, the lowest level since September 2022, indicating that job growth in January may remain steady.

Peter Tchir, head of macro strategy at Academy Securities said:

‘Good news is good news’is working right now; It takes some recession fears off the table.

According to Bank of America's monthly survey, 79% of institutional investors currently expect a 'soft landing' or 'no landing' for the global economy in 2024, marking the highest percentage in nine months. Additionally, 41% of institutional investors believe that there will be no economic recession in the U.S. in the next 12 months, higher than at the end of last year. With the market beginning to price in stronger economic growth and corporate earnings, the U.S. stock market is receiving significant support.

As the market continues to surge ahead, analysts are assessing how long the trend can last. If stable financial liquidity, a resilient economy, optimism about AI development, and positive expectations for rate cuts jointly drove the stock market's rise in 2023, the continuation of these positive factors in 2024 appears to be good news. The hot topic of AI has not been absent this year, and expectations for the economy and loose monetary policy are still at play. The question now is whether the AI trend can lead the U.S. stock market for much longer, and whether the high valuations of U.S. stocks can be offset by high earnings growth.

In terms of valuations, Citigroup strategist Scott Chronert believes that U.S. stocks are not as expensive as they appear, and the P/E ratio of the S&P 500 index may be misleading. On the one hand, after removing the excessive influence of the seven tech giants on the U.S. stock market, the forward P/E ratio of the S&P 500 equal weight index is around 16, which is 17% lower than the standard valuation of the benchmark. On the other hand, only about 60% of the constituents of the S&P 500 index are measured by P/E ratio, while 40% are measured by other indicators. Currently, the S&P 500 valuation is closer to a P/E ratio of 19, rather than well above 20.

As for how long the trend of the Mag seven and other tech newcomers leading the market can last, this may depend on various factors, including earnings realization, market sentiment, and more. Taking Nvidia, which rose more than 200% last year, as an example, although its valuation appears to be high, repeatedly exceeding earnings expectations has repeatedly proven the reasonableness of its valuation. The market currently generally believes that except for Tesla, the six companies among the tech 'seven giants' will continue to drive the earnings growth of the S&P 500. This week, U.S. tech stocks such as Tesla and Intel will release their financial reports one after another, and whether they can deliver convincing performance will largely determine how far this round of market trends can go. In addition, from last year's situation, FOMO (fear of missing out) sentiment may also be an important reason for the upward momentum of U.S. stocks.

Solita Marcelli of UBS Global Wealth pointed out that the premium valuation of large tech stocks is justified. Global semiconductor stocks are currently trading at a premium of about 25% compared to their five-year average, and this premium is supported by "the significant evolution of semiconductors over the past five years with exposure to many mega-trends and strong pricing power."

Despite the strong performance seen so far, we believe the investment case for AI and related companies, especially those in the semiconductor industry, will persist in 2024 and is set to strengthen.

The options market has also sent out bullish signals. SpotGamma data shows that the call wall benchmark has moved up from 4,800 to 5,000, indicating that options traders believe the U.S. stock market is poised for further gains. This is consistent with the latest predictions from Citigroup and Goldman Sachs, which expect the S&P 500 index to potentially hit 5,100.

However, there are still some cautious analysts issuing risk warnings, considering the uncertainty of the Federal Reserve's monetary policy, the crowded trading of the tech 'seven giants,' potential inflation resurgence, the risk of recession, and the continuously complex geopolitical tensions. Therefore, investors still need to remain vigilant.

Some analysts have proposed a relatively balanced allocation strategy, which involves simultaneously allocating to relatively high-risk tech stocks and low-risk money market funds. This approach not only allows investors to enjoy the high growth potential of tech star stocks and avoid missing out on high returns, but also uses low-risk investments to provide stability and security to the investment portfolio, achieving a balance between risk and return.

Source: Bloomberg, Dow Jones, Goldman Sachs, JPMorgan

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment