How We Can Trade Broadcom (AVGO) Upcoming Stock Split

$Broadcom(AVGO.US$ has announced that they will carry out a 10-for-1 forward stock split, in a bid to make its shares more affordable for retail investors. The split-adjusted trading is expected to begin on 15 July 2024.

The announcement of an impending stock split can cause many investors to examine the company in question closely. Most investors will want to see if this development will impact their investment strategy.

Nvidia Stock Split - Current Selling Seem to Happen

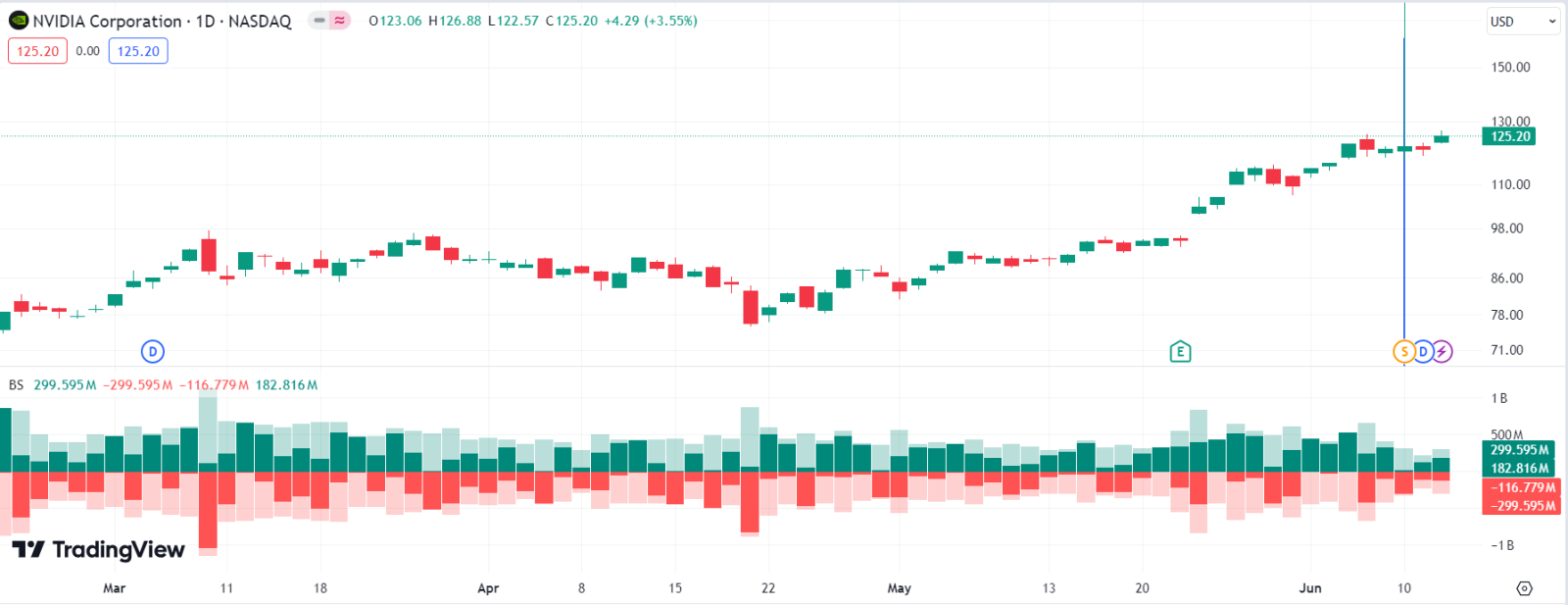

If we have been following how Nvidia have been trading before and after the stock split, we could see that Nvidia did have a nice move upwards before the stock split.

But after the stock split, there is no significant bullish upside move for $NVIDIA(NVDA.US$ from the chart below, it is actually trading sideway, and KDJ is actually predicting that we are going to see some downward trend trading.

On the buy and sell volume, we are not seeing a significant high BUY volume forming, this could mean Nvidia might still be providing small gains and there will still be selling happening.

Stock splits can play important roles for companies and their shareholders. In this article I would like to see how we can actually trade Broadcom before and after its stock split.

But first, let us have some basic understanding.

What is a stock split?

A stock split is the term used when a company decides to increase the number of shares they offer to their shareholders on the stock exchange. Making this decision can help boost the business’s liquidity and impact the trading prices.

Trading a stock before and after a stock split involves understanding how stock splits work and how they impact the trading process. Here is a step-by-step guide:

Before the Stock Split

Research the Stock Split Announcement:

Check the company's press releases, SEC filings, and financial news to get details about the stock split, including the split ratio and the effective date.

Evaluate the Impact:

Assess how the stock split might affect the stock's price and market perception. Splits can signal company confidence but don't change the underlying value of the company.

Trading Strategy:

Decide whether to buy, hold, or sell based on your analysis. Some investors buy before the split, anticipating a rise in stock price due to increased investor interest.

During the Stock Split

Understand the Split Ratio:

A split ratio like 10-for-1 means you will receive 10 shares for every 1 share you own, but the price of each share will be halved.

Monitor Key Dates:

Pay attention to the "record date" (the date you must be on the company's books to receive additional shares) and the "ex-date" (the date the stock trades at the new split-adjusted price).

After the Stock Split

New Share Price and Quantity:

Post-split, your brokerage account will show the adjusted number of shares and the new stock price. For example, if you owned 100 shares priced at $200 each before a 10-for-1 split, you will own 1000 shares priced at $20 each after the split.

Re-Evaluate Your Position:

Review your investment goals and the company’s performance post-split. Splits can attract new investors, potentially increasing liquidity and volatility.

Trading Execution:

Continue trading as usual, with the new stock price and share quantity. Use limit orders if you want to control the price at which you buy or sell shares, especially if there's increased volatility post-split.

Broadcom Performance From Stock Split Announcement

If we looked at the buying volume for Broadcom before its earnings, it has been quite impressive, and with the earnings and forecast given to be positive, I would be expecting the buying volume to increase.

So there is potential that the price would go higher before the stock split, my strategy would be to watch the buy-sell volume, this is to help us to determine if there are any traders or investors which might be exiting some of their positions for profit taking.

If that happen, then we might be able to see a dip in the stock price, we can consider to buy at this point. But the time to the final stock split for Broadcom is about a month away, I will be updating this as and when I find that there are some significant updates.

Broadcom Current Performance and How It Would Be Trading Moving Forward

If I were to look at how the stock price for Broadcom is going to move with KDJ, it looks like there is a very nice upside formed.

So we might not be seeing any price correction for Broadcom in the next 2 weeks, the existing shareholders might want to wait out for a good price to take profit before the stock split.

So I think we should be looking out for any breakout price level for Broadcom and whether there is going to be further upside, or Broadcom is going to make some adjustment downwards.

Summary

I personally think that there is a potential profit taking just before the stock split for Broadcom, so if you have the resources, you might want to consider loading some shares.

We could sell off some positions while keeping the rest for stock split. But we need to expect that there might be sideways trading just after the stock split start trading.

Appreciate if you could share your thoughts in the comment section whether you think Broadcom would continue to make upside before its stock split.

Disclaimer: The analysis and result presented does not recommend or suggest any investing in the said stock. This is purely for Analysis.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment