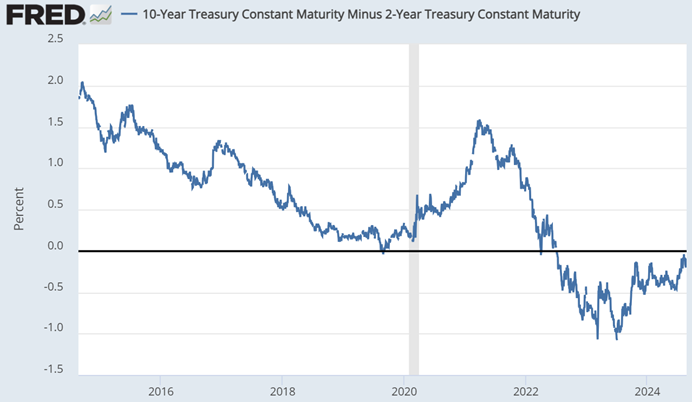

Under normal circumstances, long-term bonds tend to have higher yields than short-term notes, reflecting the risks and uncertainties associated with the longer time horizon. However, when investors expect economic growth to slow down or a recession to occur, they might flock to long-term bonds as a safe haven. At the same time, short-term interest rates might rise due to actions by the central bank, such as the Federal Reserve, in trying to control inflation or economic overheating.