Live reply: How will US rate cuts influence the global market?

Hey Mooers!

The Fed announced a 50 basis point interest rate cut on Sep 18, once again starting a monetary easing cycle after four years.

How will US rate cuts influence the global market?

What assets are more likely to outperform in the U.S. interest rate cut cycle?

Join moomoo’s global strategists for an in-depth discussion on how the Fed’s move could potentially impact your portfolio in the short and long term. And here’s a recap that could enhance your investment strategy, whether you're planning for retirement or looking to diversify your portfolio.

00:30—10:30 What did Justin say about the Fed's interest rate cuts?

💡It's the start of a Fed rate-cutting cycle

When you look at this cut, you have to look at it holistically. They're just kicking it off with 50 basis points, and there will be more cuts to come.

💡The fear of possible recession

They're cutting rates for some reason, which may be an economic slowdown or a possible recession. There's a delicate balance at play: while rates are decreasing, unemployment may be rising and economic output could be declining. And If this situation unfolds, a lot of people have to rejust their thoughts on what these earnings are going forward for the next year or two from a lot of these big companies.

💡What we should be aware of the US Election?

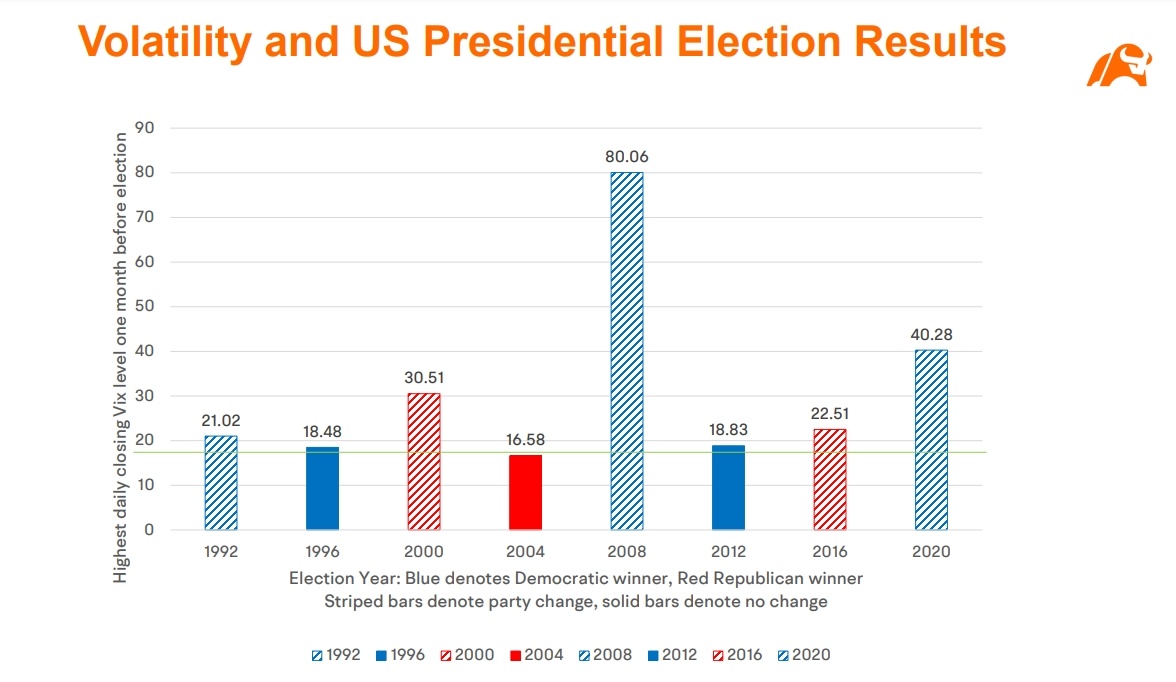

A lot of people are always looking at whether the market does better with the Democrat or Republican? But what I really like to look at is volatility. Currently, the VIX curve, which reflects market expectations around the election, is elevated, indicating that an increase in volatility is anticipated.When the VIX exceeds 20, we often see a shift in voter sentiment. The VIX is often referred to as the "fear gauge," and during times of uncertainty and fear, voters tend to lean towards the opposing party. So the VIX is something I'll be watching very closely to to figure out where we are with this election at which right. Now it is too close to call, too close to call. But the Fed's decision wasn't too close to call.

10:50—21:00 What did Michael say about the Fed's interest rate cuts?

There are very clear implications coming from this decision for investors and traders around the global. Those effects are felt in many ways, not just in interest rate differentials, but in the way they impact currencies and the outlook for growth for the globe, of course, directly effects commodities as well and investor behaviour. There's a lot to think about.

💡Dive into a different central banking world

The key factors that central banks focus on now are price stability and full employment. Full employment and stable prices generally means expanding economies, which brings good social and economic outcomes.

They're much more likely to tighten than to cut when inflation is running well above their target zones, although once again, it varies around the globe. Those target zones tend to be around the two to 3% level in most economies.

💡A buy the rumours sell the facts scenario

Despite the good news delivered today, it will be a period of digestion or corrective action in share markets as profit takers move in to lock in the gains that they've seen. In other words, what we could see is a buy the rumours sell the facts scenario.

All the buyers move into the market. When the news is delivered, it might be even better than expected and yet the market sells off because there are no buyers left to hold it up. There could be corrective action in the markets and, of course, for some, that could be an opportunity to move further cash into the markets.

Gold hit high levels in anticipation of the Fed cutting. This indeed sets up a scenario that we could potentially over the medium to longer term see higher prices for commodities.

29:00—58:00 Q&A

And on balance, higher interest rates tend to support a currency, lower interest rates tend to see it sold down. And the reason for that is, although trade flows in currency markets are important, investment flows can also be very important.

And sometimes when we see moves that confound us, we see the US dollar strengthening. It often has to do with the way investors respond to the news.

It seems likely with the the signals and the the delivery of interest rate cuts that we could see a weaker U.S.dollar in the weeks and months ahead as investors switch their attention away from the declining interest rates in the US to areas where they might be able to receive better returns.

None of us will ever know the future with certainty.

Justin just point out fiscal uncertainty, particularly as the US moves through its election cycle. So there are some unknown factors here, but overall, if the markets around the global, in US, in Australia and the other markets that are near their all time highs, if they can breakthrough those previous highs, to my mind from a technical point of view, there's a likelihood they could continue higher. If on the other hand, they keep bumping up against that ceiling and drop away, that could be a sign of a correction to come.

So rather than trying to break the future, which I've known as a lifelong trader is a very fraught business, I'm going to wait for the price action, particularly in share market indices to tell me what the markets are going to do.

These are real risks in the market. And the reality is that there is a direct relationship between risk and rewards. Those who seek to eliminate risk entirely will make will pay a very significant cost in terms of the returns that they'll get in eliminating that risk.Taking greater risk does open the door to potentially greater awards. Greater risk could also mean greater losses. So there's a it's a decision for every individual investor where they sit on the risk spectrum.Many risk averse, they prefer not to take much risk and they tend to use tools like diversification to lower their risk over the long term.That doesn't mean they won't be subject to fluctuations in the market, but a diversified approach can often help investors ride out the tough times in markets and seek longer term positive returns.So there are different ways and it depends very much on the individual

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

celia006 : Did I miss anything?

Gilley : crash these scam markets

105368965 : come Moomoo

105368965 : Malaysia

105368965 : new ic

Kenneth8K : Say hello to everyone.

OB1KENOB : How to influence Australian market

kensai : What do you think?

OB1KENOB : most of assets will benefit from it in the short term

William88888888 : Little chives are watching

View more comments...