How would you rank the Magnificent Seven in your mind?

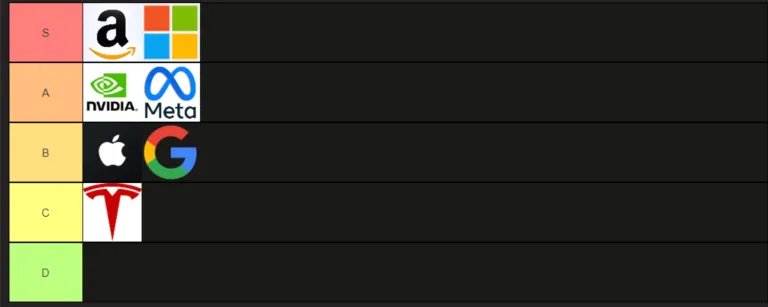

My tier list looked like this:

Before delving into each company’s placement, it’s important to note that this ranking serves as a tool to express relative preference rather than absolute quality. All companies listed are exceptional, and their investment appeal may vary depending on circumstances. Here are some important indicators I will consider:

Tier S:

![]() $Amazon (AMZN.US)$ :

$Amazon (AMZN.US)$ :

Leading the ‘Tier S’ is Amazon. At first glance, it may seem strange, given that one of the justifications for this tier position is valuation, and AMZN stocks are trading at almost 40x NTM earnings. However, Amazon’s short-term profit is not the best basis for its price. The company can generate a huge amount of cash (Cash From Operations), and even with high CapEx to develop its various initiatives, it still maintains a very robust Free Cash Flow.

This, combined with prospects for efficiency gains and a diversified operation full of moats, from its loyal customers, subscriptions, and logistics, to Cloud and Streaming, makes Amazon one of the best mag-7 in my view.

Leading the ‘Tier S’ is Amazon. At first glance, it may seem strange, given that one of the justifications for this tier position is valuation, and AMZN stocks are trading at almost 40x NTM earnings. However, Amazon’s short-term profit is not the best basis for its price. The company can generate a huge amount of cash (Cash From Operations), and even with high CapEx to develop its various initiatives, it still maintains a very robust Free Cash Flow.

This, combined with prospects for efficiency gains and a diversified operation full of moats, from its loyal customers, subscriptions, and logistics, to Cloud and Streaming, makes Amazon one of the best mag-7 in my view.

Microsoft, like Amazon, needs no introduction. Even though it is already at a highly consolidated level, the company continues to deliver stellar results, combining accelerated growth with high margins, which ultimately reflects in high FCF and value for the shareholder. It also has significant operations in the Cloud segment with Azure, which, together with its presence in GenAI, enterprise services with Office, and Copilot, puts the company at the forefront of one of the most important technologies for the coming years.

The only criticism I have regarding the stocks is their price, which already reflects a relatively large premium for the quality of operations, but it’s nothing out of this world either.

Tier A:

![]() $NVIDIA (NVDA.US)$ :

$NVIDIA (NVDA.US)$ :

The other big winner in AI (perhaps the biggest) is Nvidia. Here, two factors need to be emphasized: its strong technological leadership (with Blackwell, for example), which mitigates competition and provides more comfort for its growth, and of course, the growth prospects as AI advances, increasing investment levels in new industries and with existing hardware.

Like Microsoft, I believe that the stock prices are not too high, but they also reflect the quality of the company, its contracted growth, and leave little room for errors. Another reason I don’t put Nvidia in the S tier is the cyclicality of its market, as it is still uncertain whether the high investments will last for many years or not.

The other big winner in AI (perhaps the biggest) is Nvidia. Here, two factors need to be emphasized: its strong technological leadership (with Blackwell, for example), which mitigates competition and provides more comfort for its growth, and of course, the growth prospects as AI advances, increasing investment levels in new industries and with existing hardware.

Like Microsoft, I believe that the stock prices are not too high, but they also reflect the quality of the company, its contracted growth, and leave little room for errors. Another reason I don’t put Nvidia in the S tier is the cyclicality of its market, as it is still uncertain whether the high investments will last for many years or not.

Although seeing fewer moats than the previous companies, Meta certainly has an excellent operation, achieving interesting growth even though it already has over 3 billion users (Daily Active People). In addition to its new initiatives and ventures helping growth prospects, such as virtual reality, new partnerships, and investments in GenAI, the company is traded at a reasonable price.

Tier B:

![]() $Apple (AAPL.US)$ :

$Apple (AAPL.US)$ :

The Free Cash Flow chart already shows how robust Apple is. Over the past decades, the company has developed unique moats and reached the cash cow level, enabling significant shareholder remuneration via dividends and buybacks. And, even though B is a “mid-tier,” Apple (nor Google) are “mid” companies, but I consider them less interesting as investments compared to higher-tier ones.

One factor that makes it less attractive is the challenges encountered in maintaining reasonable growth in the short and medium term. The company seems to have difficulties restarting the iPhone cycle and developing new ventures (like Apple Vision Pro), worsening the prospects for growth in already significant revenue.

The Free Cash Flow chart already shows how robust Apple is. Over the past decades, the company has developed unique moats and reached the cash cow level, enabling significant shareholder remuneration via dividends and buybacks. And, even though B is a “mid-tier,” Apple (nor Google) are “mid” companies, but I consider them less interesting as investments compared to higher-tier ones.

One factor that makes it less attractive is the challenges encountered in maintaining reasonable growth in the short and medium term. The company seems to have difficulties restarting the iPhone cycle and developing new ventures (like Apple Vision Pro), worsening the prospects for growth in already significant revenue.

It’s challenging to envision a scenario in the medium/long term where LLMs don’t harm the search market, and to be clear, I don’t believe Google’s main market will die, but merely limiting future growth already makes the scenario more nebulous for the company.

However, the company is by no means bad; in fact, it’s a very good company with excellent segments like YouTube and Google Cloud, as well as being present in AI. Additionally, its P/E is the lowest among the companies, already pricing in uncertainties regarding its business model, so a tier B seems to make sense for Google.

Tier C:

![]() $Tesla (TSLA.US)$ :

$Tesla (TSLA.US)$ :

Alone in Tier C is Tesla. Like the others, the company is not bad, having revolutionized the EV market and collecting brand fans. From my standpoint, Tesla’s problem comes from its pricing; the stock is traded at rich multiples and will depend on the maturation of initiatives that are still embryonic, such as Robotaxi, Optimus, FSD, and the like.

I believe Tesla’s prospects are good, but I understand that all these new ventures related to innovation should not weigh heavily on the valuation thesis, considering that its main business is still the sale of EVs, which is also very sensitive to the macroeconomic scenario and competition.

It’s worth mentioning that its market cap is over $500 billion, while its Cash From Operations is around $11 billion, and its Free Cash Flow was $1.4 billion in the last 12 months.

Alone in Tier C is Tesla. Like the others, the company is not bad, having revolutionized the EV market and collecting brand fans. From my standpoint, Tesla’s problem comes from its pricing; the stock is traded at rich multiples and will depend on the maturation of initiatives that are still embryonic, such as Robotaxi, Optimus, FSD, and the like.

I believe Tesla’s prospects are good, but I understand that all these new ventures related to innovation should not weigh heavily on the valuation thesis, considering that its main business is still the sale of EVs, which is also very sensitive to the macroeconomic scenario and competition.

It’s worth mentioning that its market cap is over $500 billion, while its Cash From Operations is around $11 billion, and its Free Cash Flow was $1.4 billion in the last 12 months.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

MACKGforEver : MSFT> NVDA> AMZN> TSLA> AAPL> META> GOOGL

SharesGrow com : Tell you the top secret, buy these companies only :

MSFT, AMZN, GOOG, META

Why?

Software, code low cost, movable and copyable, remote access.

Much high margins

Avoid all hardware companies like NVDA, TSLA, AAPL, they will let you lose even your underwear!!!

118062799 MACKGforEver : TSLA will eat up all your gains

communicative Axolot : market cap