IEA raises oil demand growth forecasts, flags possible 2024 surplus

Energy stocks were up less than 1%, lagging the broader market move higher despite rising oil prices amid a stronger demand outlook.

The International Energy Agency (IEA) on Tuesday raised its oil demand growth forecasts for this year and next despite slower economic growth in nearly all major economies, although its 2024 outlook remains much lower than that of producer group OPEC.

Summary

While the recent move in oil prices reflected concerns about the global economy and oil demand, and “While this more bearish mood may be justified, world oil demand continues to exceed expectations,” the IEA said today.

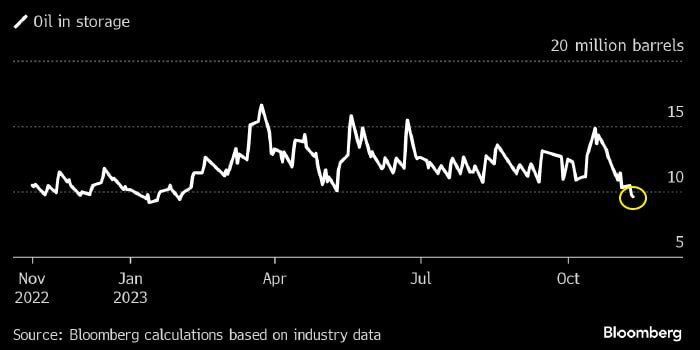

But supply growth is also exceeding expectations, according to the agency, which noted that “Barring large unforeseen outages, world oil supply is firmly on an upward trajectory.”

Early next year, the market could tip into a surplus due to weaker seasonal demand growth.

But “For now, with demand still exceeding available supplies heading into the Northern Hemisphere winter, market balances will remain vulnerable to heightened economic and geopolitical risks – and further volatility ahead,” the IEA said. $Exxon Mobil (XOM.US)$ $Occidental Petroleum (OXY.US)$ $Chevron (CVX.US)$ $Imperial Petroleum (IMPP.US)$ $Crude Oil Futures(MAY5) (CLmain.US)$

But “For now, with demand still exceeding available supplies heading into the Northern Hemisphere winter, market balances will remain vulnerable to heightened economic and geopolitical risks – and further volatility ahead,” the IEA said. $Exxon Mobil (XOM.US)$ $Occidental Petroleum (OXY.US)$ $Chevron (CVX.US)$ $Imperial Petroleum (IMPP.US)$ $Crude Oil Futures(MAY5) (CLmain.US)$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment