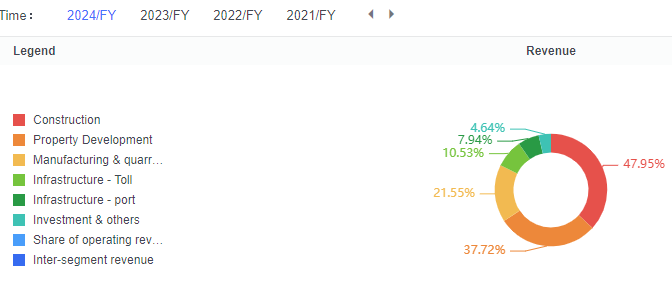

It is worth noting that industries such as construction, property development, and manufacturing and quarrying are highly correlated with economic conditions. When the economy is strong, confidence of businesses and individuals increases, leading to higher demand for housing, commercial space, and infrastructure, driving growth in construction and property development activities. Conversely, during an economic slowdown or recession, demand weakens, and these industries may face issues such as reduced orders and tight cash flows.