Index Options VS. ETF Options: Which One to Choose?

Hello everyone and welcome back to moomoo. I'm options explorer![]() . In today's [Options ABC], we'll be taking a look at index Options and ETF Options.

. In today's [Options ABC], we'll be taking a look at index Options and ETF Options.

Wordcount: 1000

Target Audience: Investors interested in index Options or ETF Options

Main Content: What are index Options? What are ETF Options? Which one to choose?

Target Audience: Investors interested in index Options or ETF Options

Main Content: What are index Options? What are ETF Options? Which one to choose?

Index options and ETF options have been gaining popularity among investors in recent years, and a 2021 study by Options Industry Council shows that index options outperformed individual stock options by 30% over the past decade.

Today, let's take a closer look at index options and ETF options. We'll explore what index options and ETF options are, how they work, and how investors can use them to enhance their investment strategies.

1.Index Options

What are index options? As the name suggests, index options are options contracts that track a stock market index. To understand how these options work, we first need to understand what a stock index is.

A stock index is like a basket of various stocks that together reflect the value of those stocks in the market. Stocks within the same index share common characteristics, such as trading on the same exchange or belonging to the same industry.

The stock index is a widely used benchmark that investors monitor to gauge the market's performance and its trend. In the US, the Dow Jones Industrial Average, S&P 500 Index, and NASDAQ Composite Index are the most commonly followed indices, while in Hong Kong, the Hang Seng Index is closely watched.

We'll briefly review two key stock indices: the Hang Seng Index and the NASDAQ Composite Index. The Hang Seng is a vital indicator of the Hong Kong stock market's performance, made up of 80 blue-chip stocks based on their market capitalization. Since March of this year, it has fluctuated between 18,649 and 21,181 points.

The NASDAQ Composite Index is a critical indicator of the US stock market's performance, comprising over 3,000 stocks listed on NASDAQ. Since the start of this year, it has shown an upward trend, reaching a new high of 16,062 on July 19th, 2023, before retracing to around 15,000.

Now that we have defined what Index Options are, let's compare them to Stock Options. There are three significant differences between the two types of options contracts:

Index options represent a basket of stocks, while stock options represent a single company's stock.

Stock options use physical settlement, which means that the actual underlying stocks will be delivered upon the specified delivery date. However, index options use cash settlement because of their large contract size and pay a cash amount instead of delivering the underlying asset upon the specific delivery date.

All stock options are American-style options, meaning they can be exercised at any time before or on the expiration date. Conversely, most index options are European-style options, meaning they can only be exercised on the expiration date, and not prior to it.

2.ETF Options

Now let's look at ETF options, which track ETFs. An ETF, or Exchange-Traded Fund, is a fund that tracks an index and trades on a stock exchange. While index funds and ETFs both track indices, they have several differences:

ETFs are traded like stocks on an exchange, meaning investors pay commissions to their broker per trade. Conversely, index funds are bought directly from the fund manager.

In addition, different dividend distributions result in varying fees and expenses. Index mutual funds automatically reinvest dividends into more shares, while ETF investors who use dividends to buy more shares incur additional commission costs.

ETFs allow for small investments, while index funds may require a minimum investment amount.

Liquidity is crucial for trading. ETFs are traded on stock exchanges like stocks, so investors can trade them anytime during market hours. By contrast, shares of index funds are traded after the market closes, meaning any orders placed during market hours will be executed at the closing price.

Investors can long or short ETF shares, but can only long index fund shares.

Index funds do not offer leveraging, while some ETFs use leverage to potentially amplify returns. For example, SQQQ and TQQQ are popular leveraged ETFs that track the NASDAQ Index.

3.Which One to Pick: ETF Options VS. Stock Index Options?

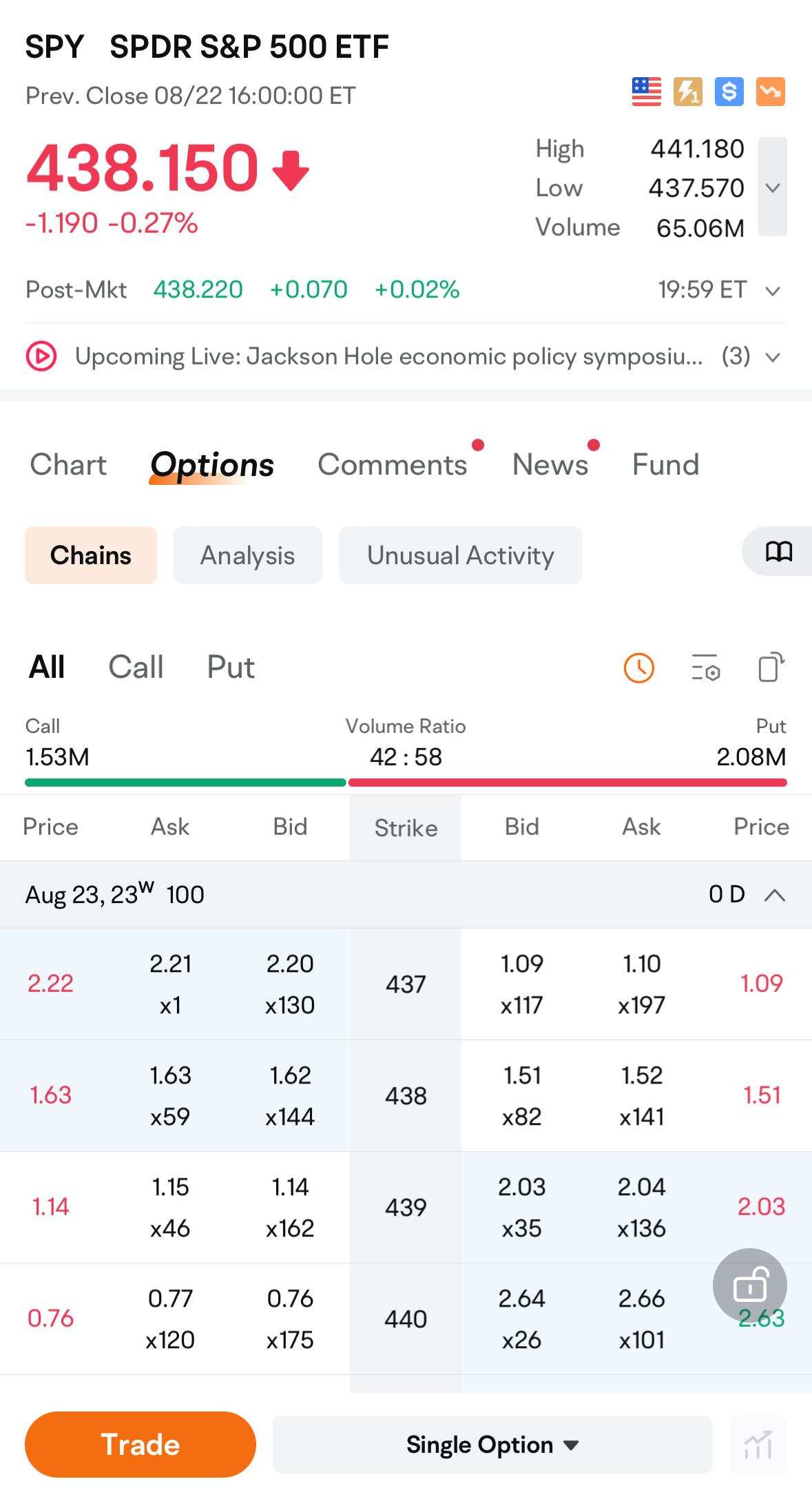

When deciding between ETF options and stock index options, investors should consider several factors. Let's take SPY (an ETF tracking the S&P 500) options and SPX (a stock index tracking the S&P 500) options as an example.

ETF options are usually American-style options, which buyers can exercise anytime before the expiration date. Stock index options are mostly European-style options, which buyers can only exercise on the expiration date.

ETF options are mostly settled in physical delivery, while index options are mostly settled in cash.

For instance, if Alice bought a call option for SPY and the price went up beyond the strike price at expiration, she would be able to receive 100 shares of SPY. If Alice bought a call option for SPX and the price went up beyond the strike price at expiration, she would receive cash instead of securities.

ETF options are much cheaper than index options tracking the same underlying asset, as ETFs have lower prices than index funds. For instance, an at-the-money SPY call option is around US$150, while an equivalent SPX option costs around US$2,350. This price gap should not be overlooked when choosing which options to trade.

ETF options have varying levels of liquidity, with popular options being more liquid than less well-known ones. In contrast, index options tend to have more evenly distributed liquidity. When trading ETF options, investors should prioritize liquidity and avoid illiquid options that may become worthless in their portfolios.

That's all for today! Please feel free to leave a comment if you have any questions or thoughts.

Don't forget to follow us to stay up-to-date on all things related to options trading.

Don't forget to follow us to stay up-to-date on all things related to options trading.

Additionally, I have some good news to share with you. Starting today, you have more options to choose from when it comes to pricing plans for US options trading. We're introducing a new Tiered Pricing Plan, offering you the flexibility to pay less based on your trading volume.

Risk Statement

The examples provided herein are for illustrative and educational purposes only and not intended to be reflective of results any investor can expect to achieve. The figures shown in the examples are not guarantees or projections, and no taxes or fees/expenses are included in the calculations which would reduce the figures shown. Actual results will vary.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

This article is for educational use only and is not a recommendation of any particular investment strategy. Content is general in nature, strictly for educational purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. All investing involves risks. Any examples provided herein are for illustrative purposes only and not intended to be reflective of results any investor can expect to achieve.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options (https://j.us.moomoo.com/00xBBz) before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment