Inflation Fluctuations and Interest Rate Outlook: Analyzing the U.S. September CPI Data|Moomoo Research

On October 11, 2024, the U.S. CPI data for September was released, showing an overall situation that exceeded expectations, with a rebound in core inflation. Correspondingly, U.S. Treasury prices declined. Given that interest rates are the gravitational force for asset prices, the prices of U.S. Treasuries are more directly linked to interest rates. We conducted a study on the U.S. CPI for September, and first, let's examine the overall situation:

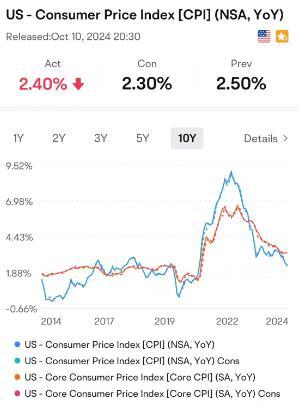

The U.S. Consumer Price Index (CPI) in September rose by 2.4% year-on-year, slightly above the market expectation of 2.3%, but lower than the previous value of 2.5%.

The seasonally adjusted CPI increased by 0.2% month-on-month, consistent with the previous value and higher than the market expectation of 0.1%. The core CPI rose by 3.3% year-on-year, surpassing both the expectation and the previous value of 3.2%.

The seasonally adjusted core CPI increased by 0.3% month-on-month, matching the previous value and exceeding the market expectation of 0.2%.

If we further dissect the components, we can see:

In terms of energy prices, the month-on-month growth rate for September fell to -1.9%, down from -0.8% the previous month.

The month-on-month growth rate for food prices rose to +0.4%, up from +0.1% the previous month, primarily driven by rising prices of grains, fruits, and vegetables.

In terms of core goods, prices for clothing, used cars, and trucks increased by 1.1% and 0.3% month-on-month, compared to 0.3% and -1.0% the previous month.

Regarding housing prices, the month-on-month growth rate fell to +0.2% in September, but the previous two months had seen housing prices rebound to +0.4% and +0.5%.

The month-on-month growth rate of medical care services prices rose to +0.7%, and the month-on-month growth rate for transportation services prices increased to +1.4%, both higher than the previous month.

Overall, the year-on-year U.S. CPI continued to decline in September, mainly due to lower energy prices compared to last year. However, the rebound in food, core goods, medical, and transportation service prices exceeded market expectations, keeping inflation still above expectations.

Given that asset prices are highly correlated with the interest rate environment, our outlook for the future indicates that the Federal Reserve's decision-making focus depends not only on inflation conditions but also on the labor market. The Fed may continue to lower interest rates to support the labor market, so a purely higher-than-expected inflation figure may only reduce the magnitude and probability of rate cuts.

However, from a medium to long-term perspective, the process of de-inflation in the U.S. remains volatile, making further declines in inflation more challenging and potentially slowing the pace of rate cuts. Considering that the probability of an economic soft landing is still significant, the Fed needs to seek a balance between stabilizing the labor market and controlling inflation. Therefore, we make a comprehensive judgment:

Currently, the intensification of geopolitical conflicts in the Middle East, the ongoing conflict in Ukraine, unresolved upward risks in oil prices, rising wage growth, persistent stickiness in service prices, and the uncertainty surrounding potential strikes by port workers in the eastern U.S. all contribute to the unpredictability of future rate cuts. The path for interest rate reductions remains uncertain, and the magnitude of the decline in the Fed's policy rate may be more cautious than the market estimates. We hypothesize the following scenarios:

1.If inflation data declines and unemployment rises, the probability of rate cuts will increase rapidly, leading to a significant rise in Treasury prices, while the market will trade on recession expectations, negatively impacting U.S. stock indices. Current data suggests a low probability for this scenario.

2.If inflation data fluctuates at its current level and unemployment data remains volatile, rate cuts will evolve into a gradual process accompanied by signals of economic deterioration, with Treasury prices rising in a tiered manner and the stock market showing upward fluctuations. Current data indicates a higher likelihood for this scenario, aligning with our previous viewpoints.

3.If inflation data rises rapidly while unemployment declines, the probability of rate cuts will drop significantly, potentially shifting into a rate hike cycle. In this case, gold prices will likely perform well, Treasury prices will decline, and indices will experience structural trends, benefiting sectors associated with inflation. We assess the likelihood of this scenario as unclear.

Therefore, for investors:

1.When tracking macro transactions, it is essential to construct forward-looking strategies. Choosing investments that perform well under all three scenarios will help navigate through bull and bear markets;

2.If investing in U.S. Treasury bonds and other commodities, it is essential to fully consider the scenario assumptions.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Alen Kok : o

pokemon pang : good

Adrianlim90 : good

4mayflower : lower USD have increased import prices?