Intel Attracts Millions of Dollars in Bearish Option Trades Even as Stock Pops

Not even a swath of deals that sent $Intel (INTC.US)$ shares advancing more than 5% is enough to deter the bears.

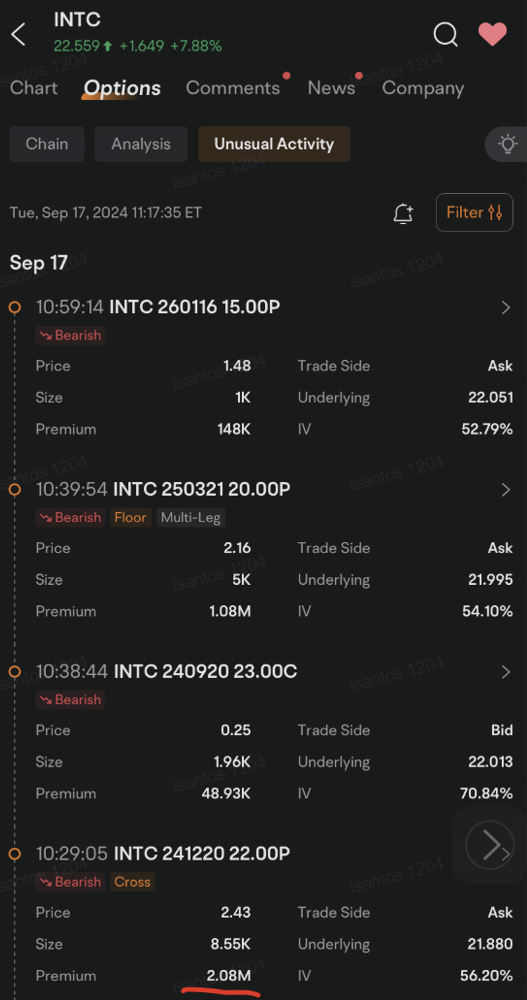

In the first two hours of trading on Tuesday, speculators and/or investors spent millions of dollars on bearish option positions against the semiconductor company even as the stock rallied. The trades were posted after the chipmaker announced it struck a multibillion-dollar deal with $Amazon (AMZN.US)$ and confirmed that it may get as much as $3 billion in funding to produce chips for the U.S. military.

The biggest among the bearish unusual options activities involved an active buyer paying a $2.08 million premium to purchase put options that give the holder the right to sell 855,000 Intel shares at $22 each by Dec. 20, data tracked by moomoo showed.

Intel said Monday that it will produce an artificial intelligence fabric chip for Amazon Web Services under a "multi-year, multi-billion-dollar collaboration." In a separate press release, Intel said it will get as much as $3 billion in direct funding from the U.S. government, on top of the proposed funding agreement reached with the Biden-Harris administration in March.

Still, analysts remain skeptic that yesterday's announcements could move the needle enough for Intel to stage a solid turnaround that could convince investors after the stock tumbled 56% this year. Intel has been lagging its peers, with the PHLX Semiconductor Index rallying 19% in the same period.

While the announcements provide some relief to the chipmaker, Bloomberg Intelligence analyst Kunjan Sobhani reportedly said, "this vote of confidence doesn't aid slowing product growth." Meanwhile, Evercore ISI analyst Mark Lipacis wants to see more visibility into Intel's foundry business, as he reiterated his in-line rating on the stock, according to a Bloomberg report.

Technical indicators tracked by moomoo are flashing a warning signal after the stock advanced more than 5%. Eight of the 15 gauges, including the oscillator, are showing the stock could be overbought and the trend may turn bearish.

Tuesday's rally sent Intel shares above the upper line of the Bollinger band. That signals to some who study charts that the stock price could revert, and the trend may turn bearish. Amid Tuesday's gains, inflows into the stock outpaced outflows by $89.5 million, capital trend data tracked by moomoo showed.

Share your thoughts on Intel and other chipmakers in the comments section. And if you have a price forecast for Intel, please vote below.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Narga101 : Why do they hate intel so much?

NakamuraKyo Narga101 : because their business is fucked up

74423696 : I love that

Clauchen : Still ain’t touching this crap their price tells you exactly how valuable they are how can they compete to all their competitors lol

FENNY CHEE :

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

882211Lyw112288 : Because therefore.

71013325 : I believe it will end the year between $22-25 because it's definitely on a positive path for the company but just as it didn't lose it's value all in 1 day, it won't gain back all it's value in one day either...It will slowly go back up and considering there's only about 3 months left in this year, I feel my choice is about where it will be if I'm being realistic and not blinded by my desire to get rich quick and think I can wish its value up quickly by simplying trying to wish it true, lol