Intel Sees Millions of Dollars in Inflows, Bullish Option Positions as Chip Stocks Rise

$Intel (INTC.US)$ bulls are pouring millions into the lagging chipmaker even as technical indicators flash warning signs that the rally could be losing steam.

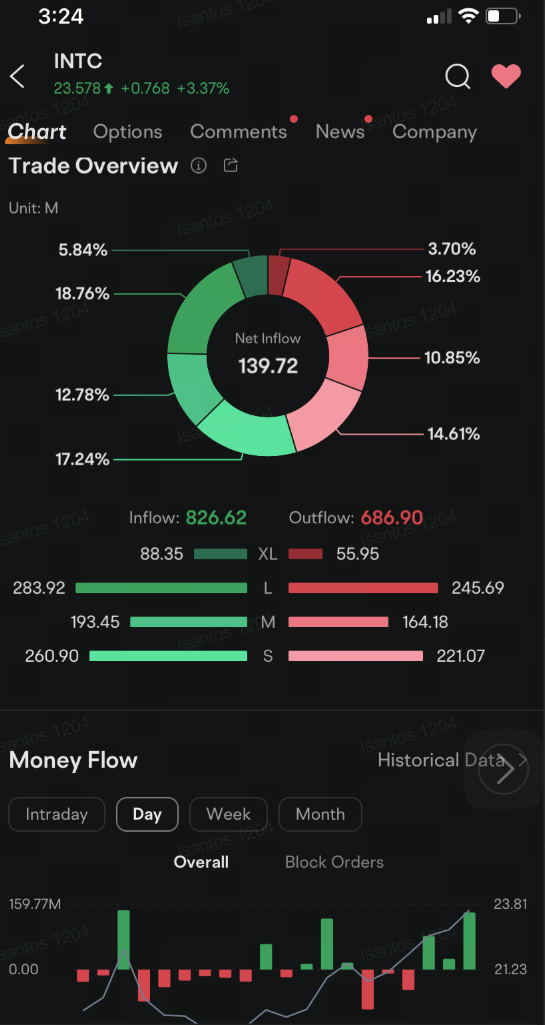

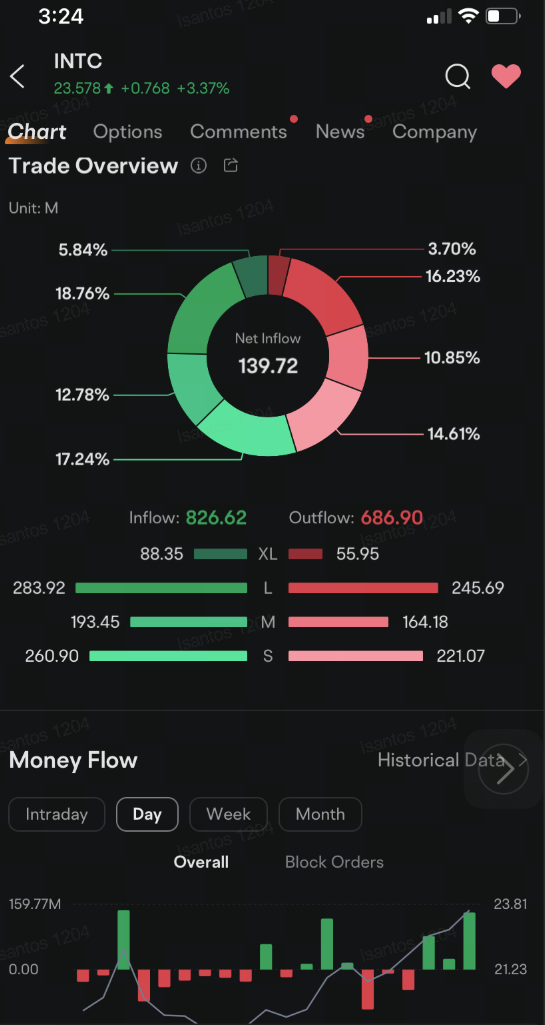

Inflows outpaced outflows by $139.7 million as of 3:24 p.m. on Tuesday. That would be the straight net inflow into Intel. The bulls are also taking positions in put options that could become profitable if the stock price climbs above $30 over the next two years.

Intel shares advanced for a fifth straight session, rising 3.4% to $23.57 as of 3:25 p.m. Tuesday, on pace to become the day's best performer on the $Dow Jones Industrial Average (.DJI.US)$. The chipmaker's gains outpaced the 2.1% rise in $NVIDIA (NVDA.US)$, and 2.7% advance for $Advanced Micro Devices (AMD.US)$.

Intel, which has lost 53% of its value over the past year is playing catch up with its peers. Over the weekend, Bloomberg reported that $Apollo Global Management (APO.US)$ has offered as much as $5 billion in equity-like investment in Intel. That came just days after the Wall Street Journal reported that San Diego-based chipmaker $Qualcomm (QCOM.US)$ approached Intel about a potential takeover.

At 1:18:02 p.m., a bullish multi-leg trade was posted. One of the legs involved an active seller collecting a $1.16 million premium for offering put options that give the holder the right to sell 125,000 Intel shares at $30 by Dec. 18, 2026. At that exact time, another bullish transaction was posted with the active seller collecting an $839,500 premium for selling put options with the same strike price but with a different expiration date, March 21. A third leg of the trade was a bearish transaction for $18 put options expiring Sept. 19, 2025.

With just over an hour left into the trading, Intel has already seen 565,210 options changing hands, landing the chipmaker in the top 4 most active stock options, behind $NVIDIA (NVDA.US)$, $Tesla (TSLA.US)$ and $Apple (AAPL.US)$. The heaviest Intel options volume is on call options that give the holders the right to buy the stock at $24 in two days.

Tuesday's rally took the share price less than 50 cents below that $24 strike price. Amid the gains, 10 of 15 technical indicators tracked by moomoo are showing the stock may now be overbought and the trend could soon turn bearish.

Reports of a potential takeover offer by Qualcomm and capital infusion from Apollo are helping fuel optimism on the outlook of the chipmaker that recently saw its credit rating downgraded to one notch closer to junk. Intel's debt load has risen above $50 billion amid weakening financial results. That debt is bigger than $Meta Platforms (META.US)$'s $38 billion, $Alphabet-A (GOOGL.US)$'s $28 billion, $Dell Technologies (DELL.US)$'s $26 billion and Nvidia's $11 billion, according to Bloomberg Intelligence.

Share your thoughts on Intel's future in the comments section. If you have a price forecast for the stock, please vote below.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Angelica Torres :

RDK79 : Guess it’s the quarterly ‘pump’ season.

RDK79 RDK79 : - buy out rumor…

- ‘millions’ incoming revenue…

- next… let’s try AI rumors again…

Goal: get this puppy back up again so shorters can do their quarterly swoop, after quarterly report show continued performance

Laine Ford : like that stock too

Andrew Figueroa : on word, "chips."

103677010 : noted

Hanboy73 : Am a big fan of this stock at current levels. The risk reward is compelling, seldom does one get a chance of making 20 pct or more on this large cap stock.

youreatowel : It’s going to 40 tomorrow

Laine Ford : all good stock

BLACKLIST00 : Thank you guys

View more comments...