Interest rate cut decision announced: how should investors act?

The much-anticipated rate cut decision has finally arrived, with the Federal Reserve announcing a 50 basis point rate cut! At this pivotal moment, investors need to have a deeper understanding of the background and impact of rate cuts.

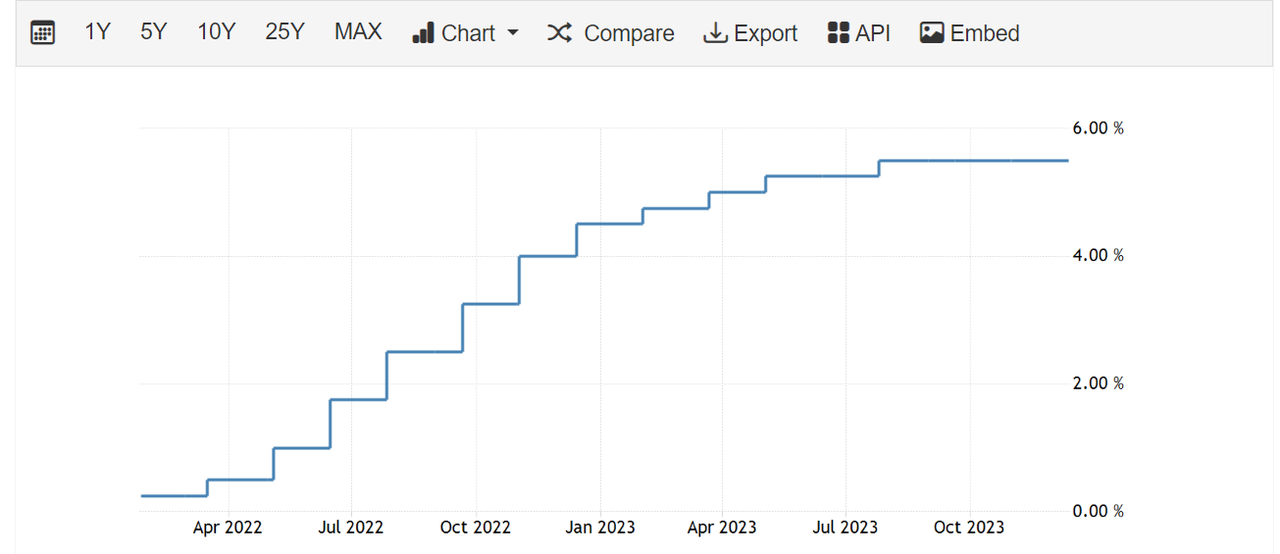

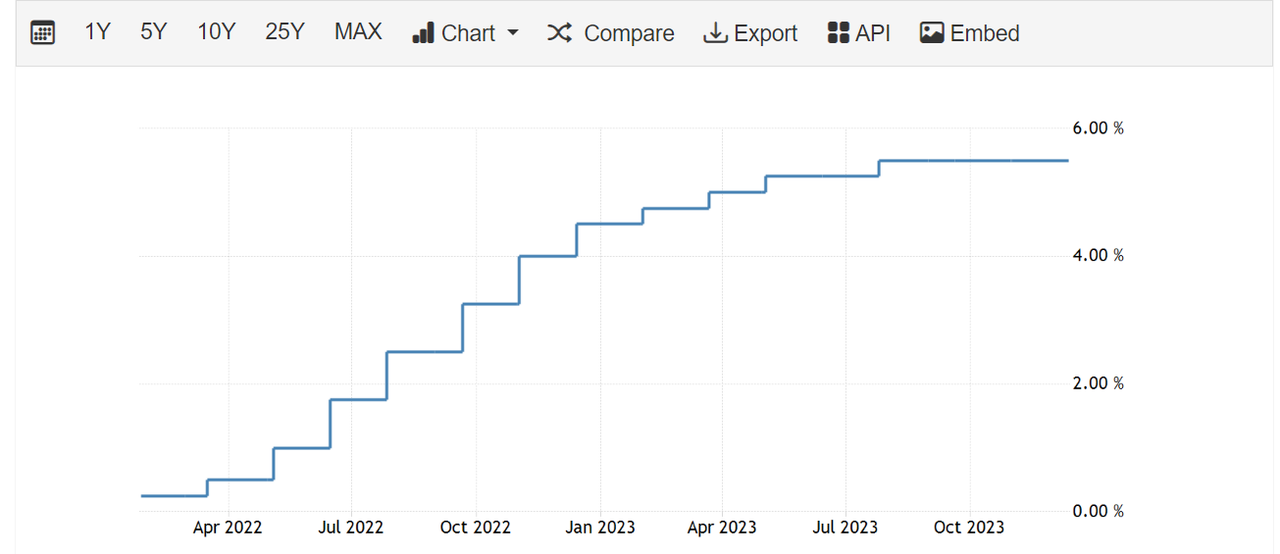

Since March 2022, in a bid to curb inflation, the Fed has hiked rates 11 times, bringing it to the current range of 5.25%-5.50%. Now that inflation is under control, the calls for a rate cut are growing louder.

Based on market expectations, previous articles introduced several sectors affected by rate cuts. Let's briefly review them.

1. Small-cap stocks:

Typically, small-cap stocks tend to benefit more than large-cap stocks in a rate-cut environment. Small companies tend to rely more heavily on debt than larger enterprises. In a rate-cut environment, small companies benefit from reduced borrowing costs and improve profit margins.

On moomoo, users can review the components of the $Russell 2000 Index (.RUT.US)$ and identify promising stocks.

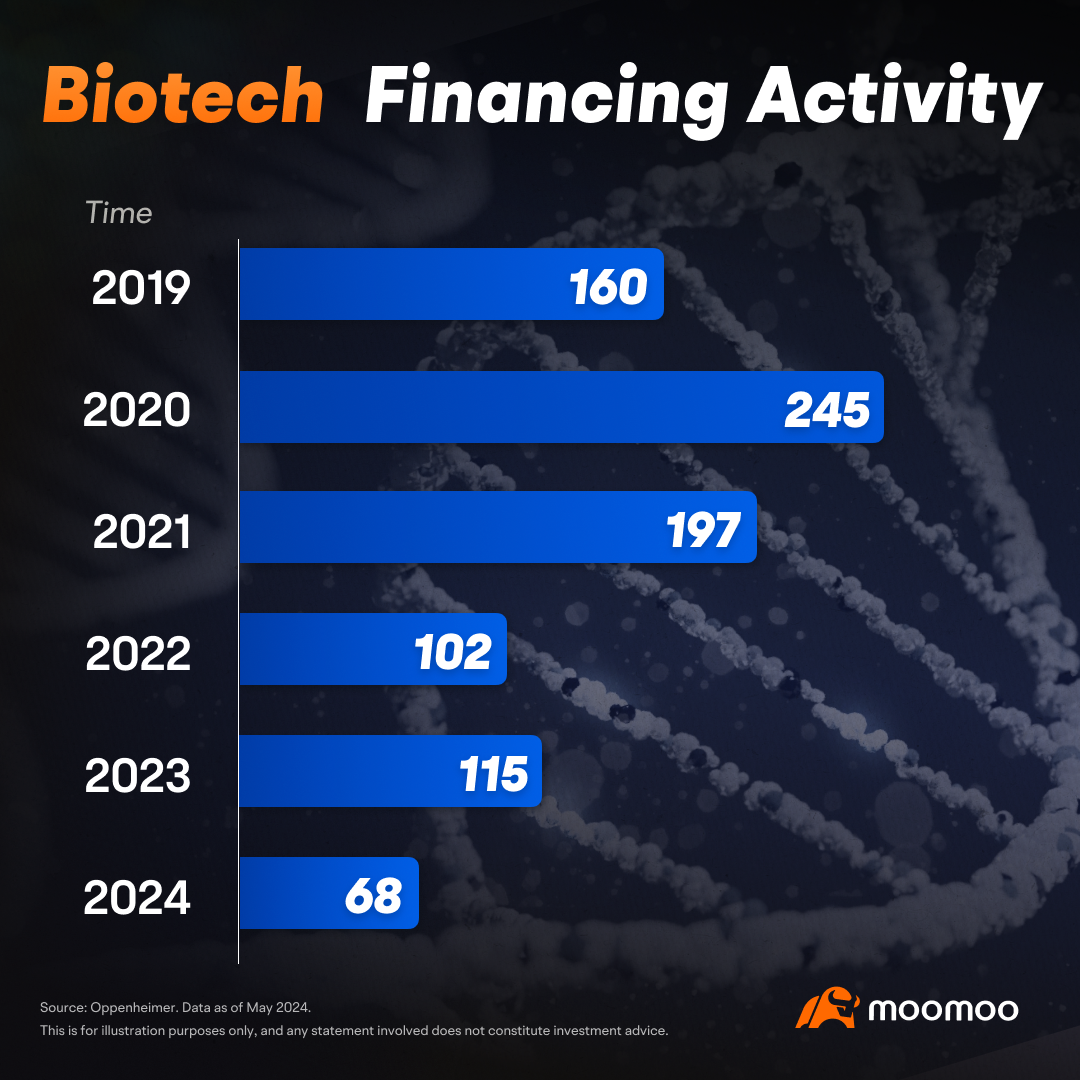

2. Biotech stocks:

Unlike pharmaceutical companies with stable cash flow, biotech companies often small to mid-sized enterprises that rely heavily on external financing.

Funding is the lifeblood of biotech companies and interest rates are crucial because they directly impact the cost of capital. Biotech companies often perform well around the onset of a rate-cutting cycle.

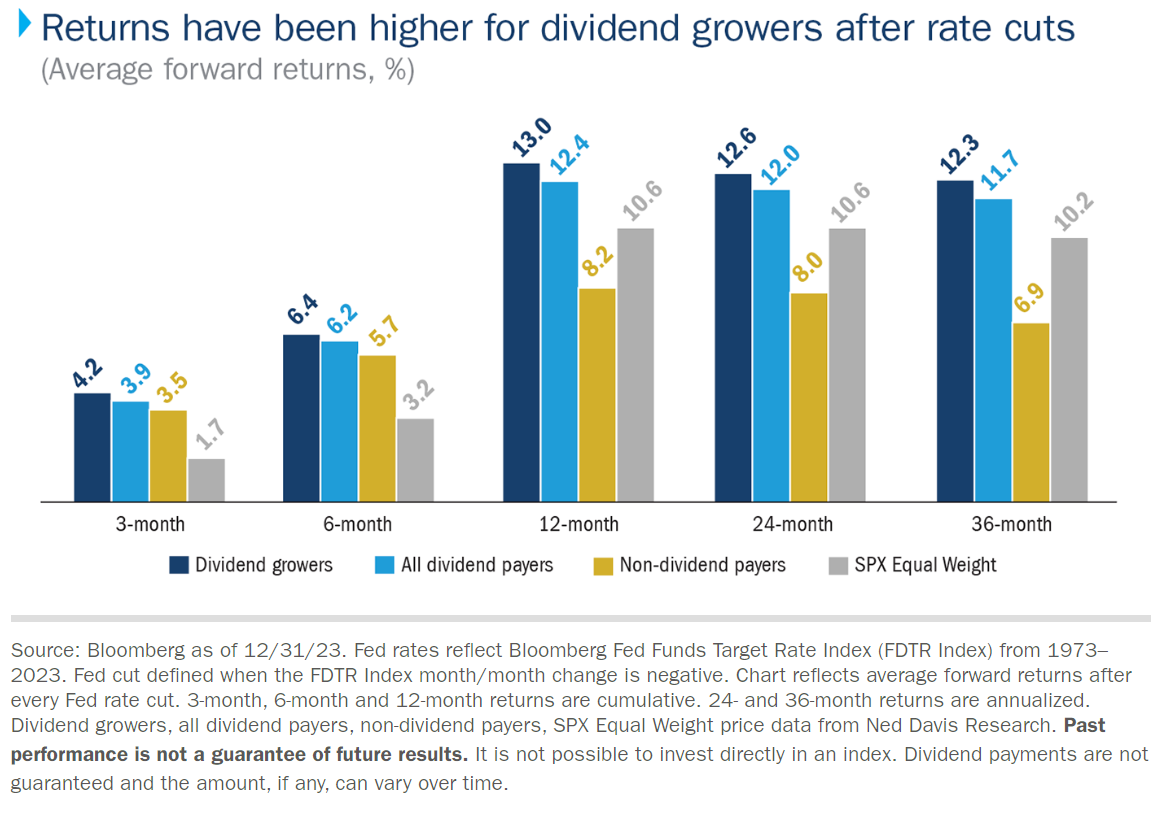

3. Dividend stocks:

Previous article: Rate cuts navigation: Thriving with Dividend Kings.

Historically, during rate cut periods, dividend-paying stocks generally outperform non-dividend-paying stocks. The potential reason for this is that lower interest rates may enhance the appeal of dividend stocks.

4. U.S. bonds:

The impact of interest rate changes on bonds is the most direct.

Because the price of bonds is inversely proportional to the market interest rate. Simply put, when the bond interest rate falls, the bond price rises.

5. Gold:

Previous article: Under the expect of rate cut: how to invest in gold?

Gold is another asset influenced by interest rates.

The interest rate cut may cause capital outflows and a declining dollar index. Since gold is priced in dollars, a weaker dollar could drive up gold prices.

6. Bitcoin:

Previous article: Rate cuts are here – Is Bitcoin set to surge?

The benefits of interest rate cuts for Bitcoin mainly come from two aspects: boosting liquidity and rising inflation.

– The Fed's interest rate cut usually stimulates investment, pushing investors toward high-risk, high-reward assets like Bitcoin.

– If unexpected inflation spikes during a rate cut cycle, Bitcoin, known as "digital gold," could benefit significantly.

To help you make smart investment choices during rate cut cycle, moomoo Learn has created a series of courses - How to Invest During Rate Cuts. This course covers which sectors typically benefit from rate cuts, how to pick promising investments, and provides tools to help you better analyze. You can choose investment types that match your investment preferences. Tap to learn more here>>

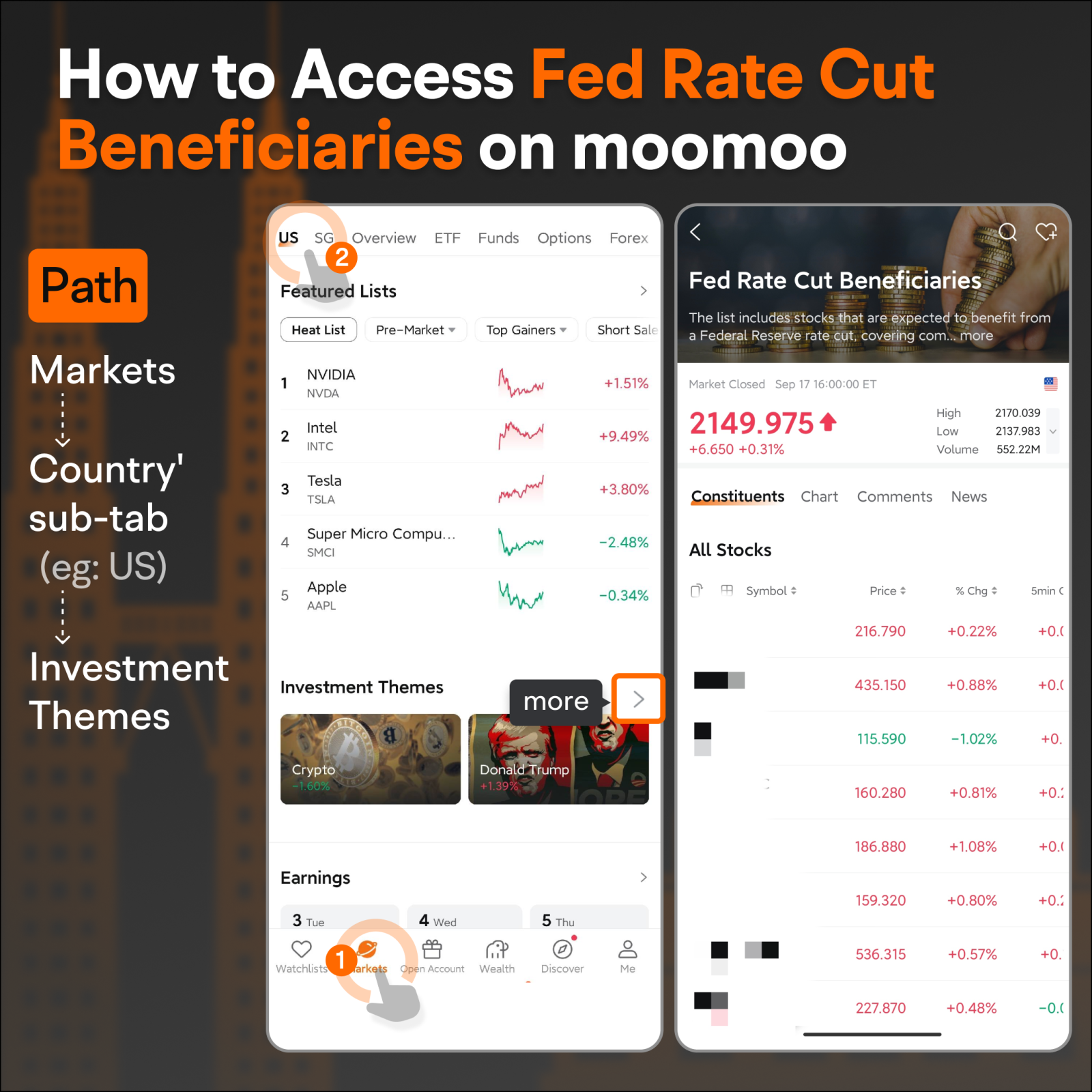

Direct investments in U.S. stocks, bonds, and gold might not be very convenient for ordinary investors. In the current context of interest rate cuts, moomoo offers thematic investment approaches.

Taking the US market as an example, moomoo has compiled a list of stocks for users to consider, which might benefit from Fed rate cut: go to Moomoo> Markets> US> Investment Themes> Fed Rate cut Beneficiaries.

Image provided is not current and any security is shown for illustrative purposes only and is not a recommendation.

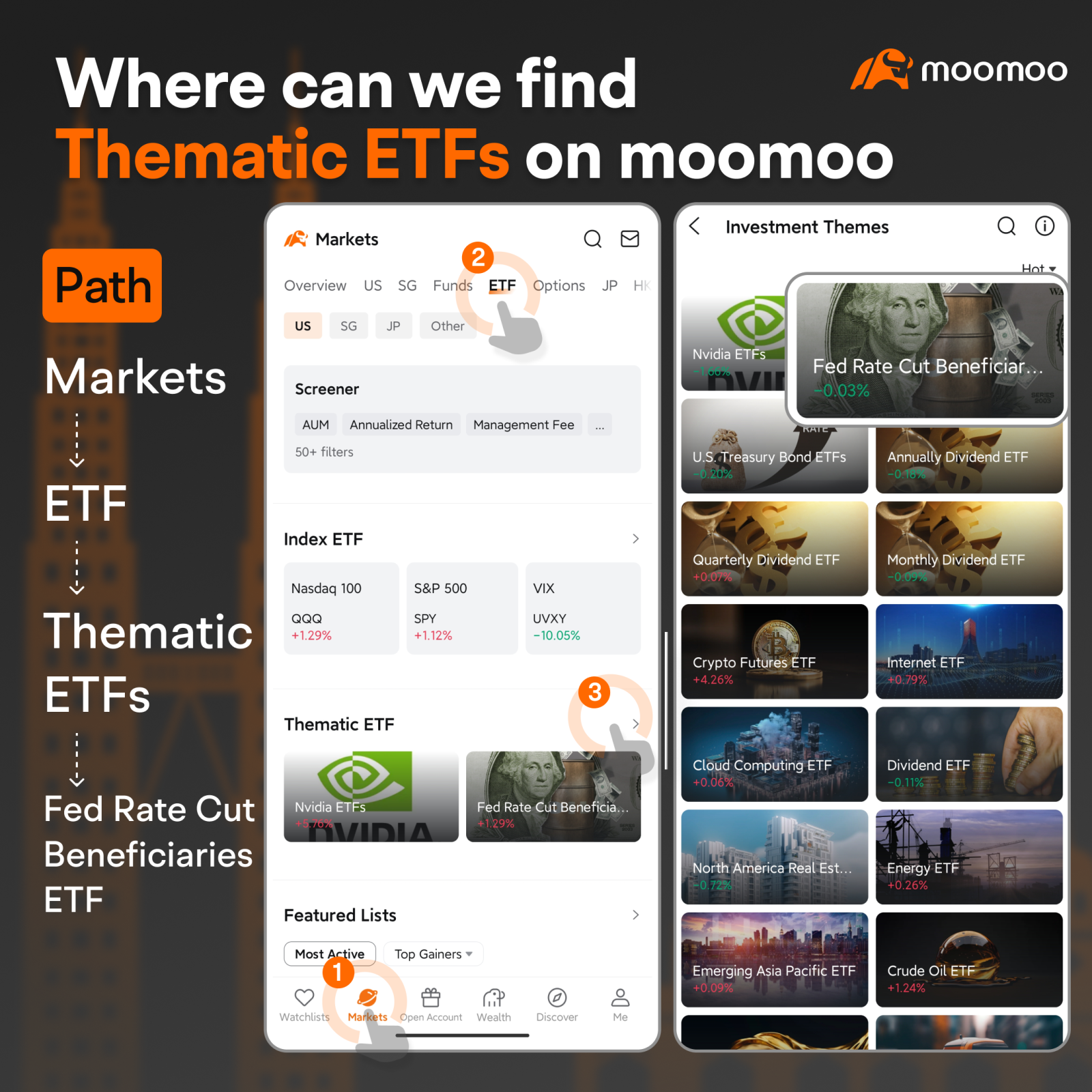

In addition, moomoo provides ETFs with interest rate cut themes, which can help reduce investment risks by indirectly investing in sectors that benefit from interest rate cuts: go to Moomoo> Markets> ETF> Thematic ETFs> Fed Rate cut Beneficiaries ETF.

Image provided is not current and any security is shown for illustrative purposes only and is not a recommendation.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

万利荣102528968 : Good

102181510 : Good

Lets Gamble :

JackyHeng :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

105716517 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

104532357 : Thanks moomoo for sharing, it will be helpful for newbies like me

Malik ritduan : ok

树下老人 : Good

Faithful Fox : Thanks for sharing

Tom Murphy : plenty

View more comments...