Interest rates down, Wealth up: Guidance for asset allocation

In the context of the current market widely expected interest rate cuts, savvy investors are seeking to seize the opportunity to deploy potential assets to achieve wealth appreciation. Here we look at three big lucrative investment strategies: long-term bonds and ETFs such as TLT, which show remarkable potential for appreciation when interest rates are low; S&p 500 index funds, such as low-cost SPY and IVV, have a history of outperforming monetary easing cycles; As well as the new rising star of digital currency investment, it is easy to get involved through Bitcoin ETF to capture the capital appreciation opportunities under the interest rate reduction cycle.

1. Bonds and bond ETFs (longer-dated bonds are more sensitive)

What is the logic of bond pricing?

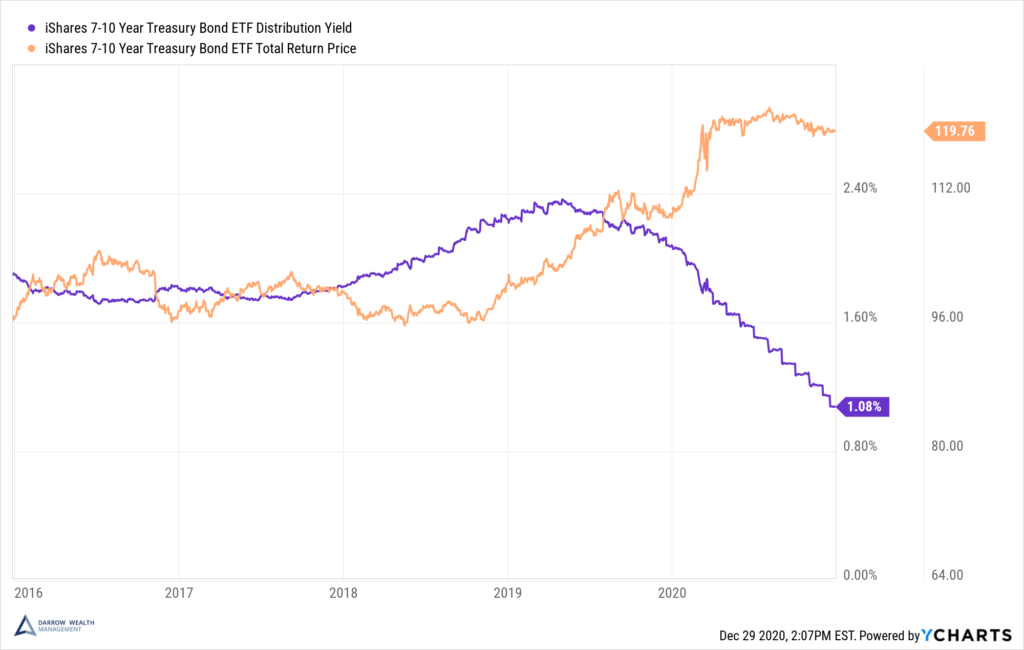

Bonds are priced based on the present value of future cash flows, with interest rates acting as discount rates. Understanding it in a simple way: Bonds pay interest regularly, return to maturity, and their value is discounted based on these cash flows at market interest rates. When interest rates rise, the present value of future cash flows decreases and bond prices fall; Conversely, prices go up. The discount process adds up each cash flow after the interest rate is adjusted to its current value to determine the bond price. Interest rate changes affect the attractiveness of bonds, and the extent of this effect is determined by the "duration" of bonds: the longer the duration, the more sensitive it is to interest rate changes and the greater the price volatility. In short, lower interest rates usually cause bond prices to rise, with longer-dated bonds responding particularly strongly.

What products are available?

For the average investor, investing in bond ETFs is easier and more convenient (of course, there are tax issues in different regions). The biggest advantage of bond ETFs is that investors can avoid the hassle of selecting specific bonds and directly hold different types of bonds at low cost, achieving the purpose of diversification.

Bonds and ETFs are essentially two completely different types of trading, buying a bond can hold until maturity, but ETF is essentially a fund, there is no "maturity".

TLT is an ETF that tracks the performance of long-term US Treasuries and invests primarily in US government bonds with a maturity of more than 20 years. As a long-term Treasury ETF, the yield on TLT is closely tied to the movement of long-term interest rates and usually performs better when risk aversion in the market increases or when future interest rates are expected to fall. If the Fed cuts rates, it can enjoy a rise in the face price. If the Fed doesn't cut rates, it will continue to pay interest, and it will be more convenient to trade than bonds.

2. S&P 500 index fund

What makes up the S&P 500 Index? What are the rules?

The S&P 500 index includes 500 of the largest U.S. companies, weighted by market capitalization to reflect economic strength, with selected stocks taking into account capital, liquidity, financial and operational performance, and timely inclusion of emerging industries. The index adjusts dynamically to keep pace with the market and reduce volatility. As a top-tier fund, the S&P 500 often shows superior returns during periods of monetary easing due to increased liquidity, lower borrowing costs, rising corporate earnings and low discount rates driven by valuation increases, and it his beneficial for companies to borrow and buy back shares to support the index.

What products are available?

ETF equity funds linked to the S&P 500 offer a one-stop, low-cost solution. In the case of SPY, the expense ratio is only 0.09%, far lower than the 1-2% of stock fees or mutual funds, which is very cost-effective.

With the belief that US funds are good in the long term, and there are future interest rate cut expectations, IVV is a good product.

3. Digital Currency

What is the logic of digital currency speculation?

Digital currency is not an interest-bearing asset and does not generate cash flow itself, and the income earned by investing in digital currency mainly comes from capital appreciation. If the price is low at the time of purchase, the price rises as the market demand for the digital currency increases, and the investor can sell to get the difference. If the Federal Reserve cuts interest rates, liquidity and risk appetite will drive market demand for digital currencies, and interest rate cuts will also benefit digital currencies.

What products are available?

Don't want to miss out on crypto opportunities, check out the Bitcoin ETF. A Bitcoin ETF is an exchange-traded fund that allows investors to participate in the Bitcoin market through a traditional stock exchange without having to buy and hold bitcoin directly, that is, buying a Bitcoin ETF can be equivalent to owning a portion of the digital currency.

1. Hong Kong Stock Market: $Crypto Spot ETF (LIST22873.HK)$

To sum up, in the economic environment where interest rate cuts are expected, through a deep understanding of the pricing logic and market dynamics of various assets, investors can cleverly layout and ride the trend.

Long-term bonds and bond ETFs, such as TLT, are preferred for steady appreciation due to their high sensitivity to interest rates;

S&p 500 index funds such as SPY and IVV have historically performed well under easy monetary policy, providing easy access for investors seeking above-average market returns;

Digital currencies and their related ETFs open the door to an emerging world of high-risk, high-return investments.

Each investment vehicle has its own strengths and is designed to suit investors with different risk appetites. The key is to rationally evaluate their own conditions, timely adjust the investment portfolio, and respond to market changes with flexible strategies, so as to not only protect wealth in the interest rate reduction cycle, but also seize opportunities and achieve steady growth of assets.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment