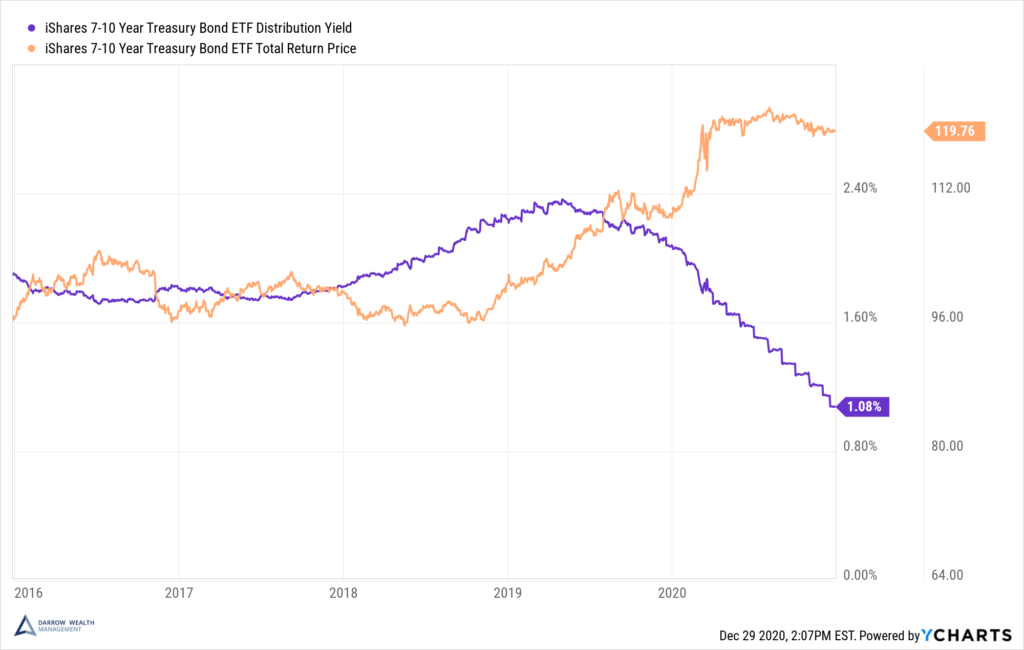

Bonds are priced based on the present value of future cash flows, with interest rates acting as discount rates. Understanding it in a simple way: Bonds pay interest regularly, return to maturity, and their value is discounted based on these cash flows at market interest rates. When interest rates rise, the present value of future cash flows decreases and bond prices fall; Conversely, prices go up. The discount process adds up each cash flow after the interest rate is adjusted to its current value to determine the bond price. Interest rate changes affect the attractiveness of bonds, and the extent of this effect is determined by the "duration" of bonds: the longer the duration, the more sensitive it is to interest rate changes and the greater the price volatility. In short, lower interest rates usually cause bond prices to rise, with longer-dated bonds responding particularly strongly.