Interest rates peaking? Is it time to look at US Treasuries?

Hi, mooers!

![]()

On March 20, the Federal Reserve stuck to its current interest rates, triggering a surge that sent US stocks and gold to new heights. Their dot plot still shows three rate cuts this year, and Powell hinted that a reduction in the Fed's balance sheet could be coming soon.

Find out more>>What's more, the chance of a rate cut in June, according to federal funds rate futures, has jumped to about 70% from 50% earlier in the week.

![]()

![]()

Where can we turn for safe investment options when the economy feels unpredictable? Many of you have discussed putting spare cash into

Cash Plus for its high liquidity and stability.

What other smart investment moves should we consider to spread out risks? ![]()

![]()

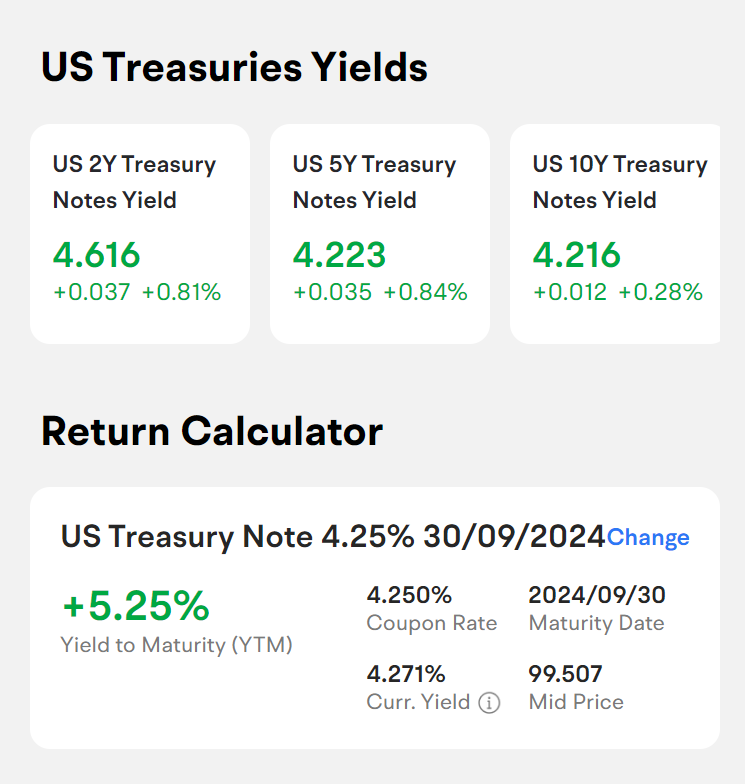

With the end of rising interest rates possibly in view, could

US Treasury bonds become a smart choice?

US Treasury bonds are known for being safe and offer regular income through twice-yearly interest payments. Plus, bond prices and interest rates usually move in opposite directions; typically, the longer a bond's term, the better it could do when yields are up.

Find out more>>Moreover, with the Fed leaning towards rate cuts and the market's rate cut expectations not being met, Treasury yields have made a strong comeback. This has resulted in a slight fall in bond prices, which could be a great chance to invest!

![]()

![]()

How can you get relatively stable returns with US Treasury on moomoo?

Begin securing relatively stable returns by investing in US Treasury Bonds with moomoo, starting from as little as $1,000. Our guide is here to help you every step of the way.

What's more, we've got a special offer for you:

"Lock in 5%+ stable yields with US Treasury". Get in by

June 30 to enjoy

zero commission fees. If you're new to moomoo, a welcome reward worth up to

S$880 is up for grabs. Seize this opportunity for consistent returns.

With just $1,000 and no commission, unlock passive income. Tap to explore your financial possibilities now!![]()

![]()

Want to share your perspective on US Treasury Bonds in the current market?

![]()

Cast your vote and share your insights in the comment section below!

We'd love to hear more about your take on US Treasury Bonds and your investment strategy in light of today's market trends. The five mooers providing the most

relevant and

engaging comments will receive

500 points as a reward!

![]() *Notes:

*Notes:Posts that are not original or relevant shall be excluded.

All rewards will be distributed to your universal account within 15–30 working days after the winner's announcement.

Happy investing, and see you next time!

All contents such as comments and links posted or shared by users of the community are the opinion of the respective authors only and do not reflect the opinions, views, or positions of Moomoo Financial Inc., Moomoo Technologies, any affiliates, or any employees of MFI, MTI or its affiliates. Please consult with a qualified financial professional for your personal financial planning and tax situations. Moomoo may share or provide links to third-party content. Doing so is intended to provide additional perspective and should not be construed as an endorsement or recommendation of any chat room, channel, services, products, guidance, individuals, or points of view. Any testimonials provided herein may not represent other customers' experience, and there is no guarantee of future performance or success. Your experience may be different than the ones represented here. This presentation is for information and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. See this link for more in

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

mr_cashcow : On one hand the the market seems to be rallying in AI sectors but on the other hand it might be safer to lock in the 5% stable yields with US Treasury bonds before the 3 interest rate cuts that is forecasted to come soonish?![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

aMaT_tHe_TrAdEr : safe bets with US treasury bonds

Wonder : sounds attractive to lock in long term rates now n with potential to have capital gains if bond price rise as rates fall. but bearing in mind too tat too long term (>5years) may hv currency risks if USD lose its appeal. Tinkin too much![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Thy GoD : I think they're worth locking in as I do expect interest rate cuts as well, but for more aggressive investors I guess they'd be more willing to go into stocks instead to benefit off the cuts.

also I believe we could just use bond funds instead of just buying a bond.

小trader : Currently, in the US, government bond yields are 2% higher than equity yields, which is attractive compared to a 10-year historical average where both yields are at par. Personally, in this currently high yield environment, I am considering allocating a small portion of my portfolio to US government bonds for diversification, hedging against inflation, and enjoying up to a 5% yield from a relatively risk-free asset!

However, it is important to note one's investing goals, risk tolerance, and investment horizon. If you are aiming for high risk and high returns, this is definitely not what you should be looking at. Also, you should consider how long you can afford to not "touch" this sum before deciding on the commitment period.

WackyWong :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

THEWIZARD : 1) Over the last 50 years, the USD has only depreciated against the SGD.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

2) HIgh US withholding, capital gain taxes, custody fees etc. even for non US residents.

3) HUGE DEBT ridden economy.

4) Frequent cash flow problems.

5) Unimpressive, inconsistent and hypocritical Key Executives.

6) DOWN GRADED Credit Ratings.

7) Face strong rising competitors.

8) If you conduct indepth Financial Analysis due diligence on them, as you should with any other companies that you want to invest in, would the eventual FA results show a "Buy" or "Strong Buy" ?

9) Personally, I'll rather park my spare cash elsewhere.

10) My good cash is globally mobile, it's never been a loyal lap dog type to any Gov debt, no matter how well it's sugar coated by the seller.

Think About It. CAREFULLY and THROUGHLY!

All things considered, there will still be suckers being born every minute.

夏恋 : US Treasury bonds are the safest investment. The benefits are impressive. It can be said that this interest rate hike has been rare for many years, and it is an excellent time. Freedom to buy and sell, and interest rates are fixed after purchase. Commission-free in combination, perfect![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

doctorpot1 : So, right now, the Fed funds rate is at 5.5%, but it's expected to drop. When interest rates fall, it usually means existing bond prices will go up, and yields will go down.

That's because existing bonds with higher rates become more valuable compared to new bonds issued at lower rates. So, if we already own Treasury Bonds, we might see their prices rise, which is good news for us. But there are a few things to consider.

As interest rates fall, the income we get from new bonds also goes down, especially when we're buying new bonds with lower coupon rates. If we rely on that income, we might need to think about other sources or adjust our portfolio.

We could consider reinvesting in longer-term Treasury bonds or notes. In a falling rate environment, longer-term Treasury bonds or notes could be considered better investments compared to short-term bills for a few reasons.

Firstly, longer-term bonds usually offer higher yields than short-term bills. So, when interest rates drop, the higher yields of longer-term securities become more attractive, potentially giving you better returns over time.

Also, as rates go down, the prices of longer-term bonds tend to rise more than those of short-term bills. This is because longer-term bonds are more sensitive to rate changes, offering more potential for capital gains.

By investing in longer-term bonds, you're essentially locking in those higher yields for a longer period. This can give you a steady income stream and a level of stability, especially in a low-rate environment.

Overall, while falling interest rates can bring some benefits for bond investors, it's essential to stay on top of our portfolio and being ready to make changes as needed. With rates changing, it's a good idea to regularly review our investments, consider rebalancing, and stay informed about what's happening in the economy.

amusing Wolverine : Look at the rate inversion and u know where

View more comments...