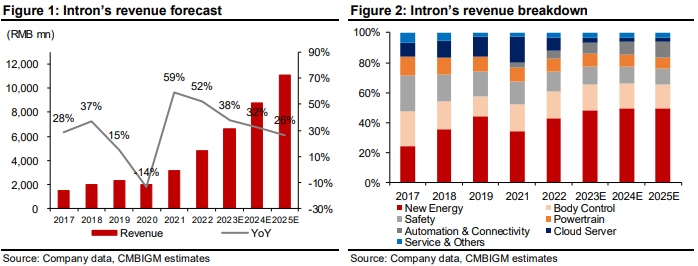

Intron Tech will announce its 1H23 results next week. We estimate 1H23E revenue of RMB 2.66bn (+28% YoY) and net income of RMB 191mn (+25% YoY). The solid growth was mainly due to strong NEV shipment and rising penetration of auto electrification/intelligence, partly offset by OEM price pressure, weaker cloud server and higher R&D expenses. Looking ahead, we expect a back-loaded 2H23E driven by seasonality, new product ramps and better operating leverage. We slightly trimmed FY23-25E EPS by 4-7% to factor in slower traditional business and higher R&D expenses. Trading at 8.2x/6.0x FY23/24E P/E, we think the risk-reward is very attractive compared with A/H share peers. Maintain BUY with new TP of HK$ 7.01. Upcoming catalysts include rising ADAS penetration and NEV client share gain.