Investment Opportunities in US Stocks Ahead of Trump's Inauguration

Three weeks after the election, investors are zeroing in on the Trump administration’s policy trajectory. The Trump 2.0 cabinet is nearly set, with nominees for key economic roles like Treasury and Commerce Secretary mostly decided.

In this environment, U.S. equities have been volatile. The 'Trump trade' initially surged, pulled back on concerns about reflation, and then began to rebound. Since election day, the $S&P 500 Index (.SPX.US)$ has risen 4.6%.

Historically, U.S. stocks tend to climb leading up to the inauguration. After Trump’s first election in 2016, the S&P 500 rose 6.6% between the election and inauguration day. In 2020, it jumped 15.5% between Biden's election and inauguration.

U.S. Stocks Set for More Gains with Multiple Catalysts in Play

Goldman Sachs technical strategist Scott Rubner predicts a rally starting this week and lasting into early 2025. He forecasts the S&P 500 will hit 6,200 by year-end, a 3.5% increase from its current 5,987.

Market Rotation

Rubner expects a December rise in the S&P, driven by a shift from large tech companies, like the "Mag 7", to smaller-cap and value sectors such as financials, industrials, and energy.

Capital concentration is decreasing, moving from tech giants to small and cyclical stocks. The S&P 500 equal-weight index is up 5.9%, and the $Russell 2000 Index (.RUT.US)$ has gained 10.2%, outpacing the broader S&P 500.

Goldman Sachs’ prime brokerage data shows the "Mag 7" tech giants' share of net U.S. equity exposure has dropped to a one-year low. Hedge funds are shifting to other AI stocks and broader beneficiaries of Trump’s policies.

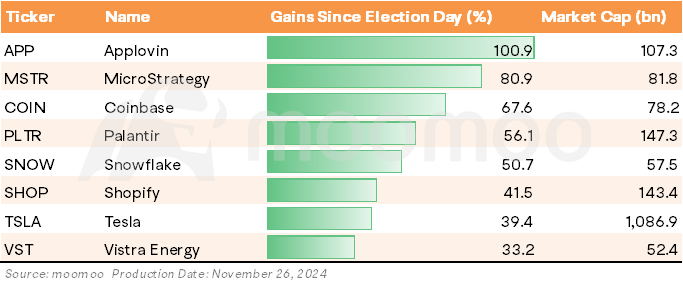

Since election day, eight companies with market caps over $50 billion have gained over 30%, including AI stocks $Applovin (APP.US)$, $Palantir (PLTR.US)$, $Snowflake (SNOW.US)$, AI-linked utility $Vistra Energy (VST.US)$, Bitcoin-related $Strategy (MSTR.US)$ and $Coinbase (COIN.US)$, as well as $Tesla (TSLA.US)$ and e-commerce stock $Shopify (SHOP.US)$.

Fundstrat’s Thomas Lee suggests that with the president-elect’s deregulatory agenda and prevailing "animal spirits," small-cap and cyclical stocks have more upside potential. Confidence remains that the government and Donald Trump will support the economy and keep it from faltering, providing a tailwind for equities.

Seasonal Factors

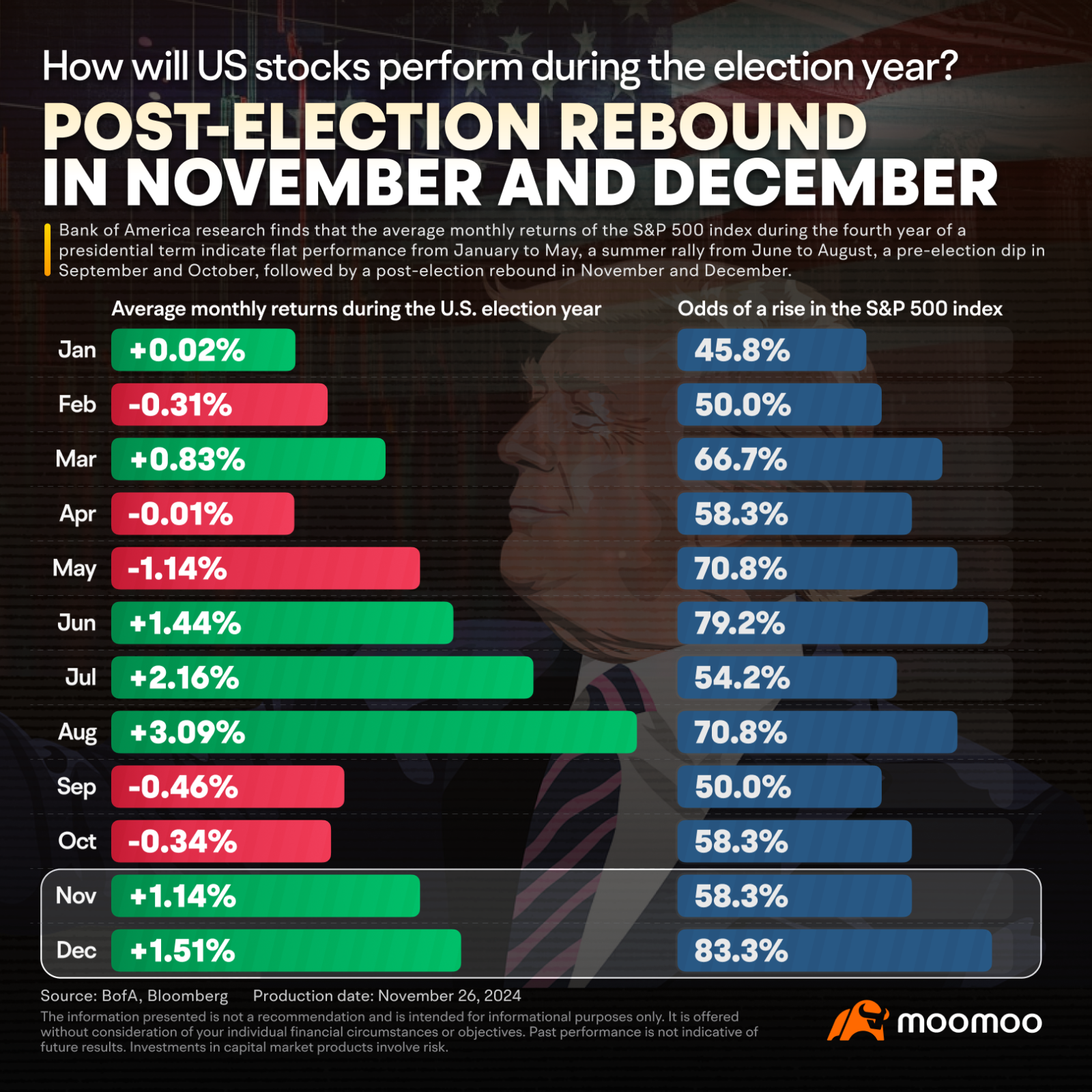

Bank of America data shows indicates an 83% chance of U.S. stocks rising in December of an election year, with an average gain of 1.51%.

Rubner notes, "We are entering the best seasonal period for US equities." Many investors return to work post-Thanksgiving, with just 20 trading days left in the 2024 calendar year.

Corporate buybacks are another catalyst. November and December are peak months for buybacks, with Goldman estimating a total of $960 billion for 2024. This activity could bolster the market, especially during lower-liquidity holiday trading.

Looking ahead to January, Rubner expects the "January effect" to provide a boost to stocks. "Historically, good years tend to follow more good years for US equities, and January is when capital gets deployed from the largest asset base," Rubner concluded.

Source: Yahoo Finance, Investing

by moomoo News Olivia

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

103492837 : Thank you for sharing

103811630 : “Q

103681739 : good to know that year end is a good time to deploy capital

1016551418 : wow

103677010 : noted

Adrianlim90 : 1

Alice Lim choo :

Alice Lim choo : good

151809788 : do yourself a favor and buy xrp

151809788 : xrp will go to 100 dollars is structured better than Bitcoin

View more comments...