Trading Strategy

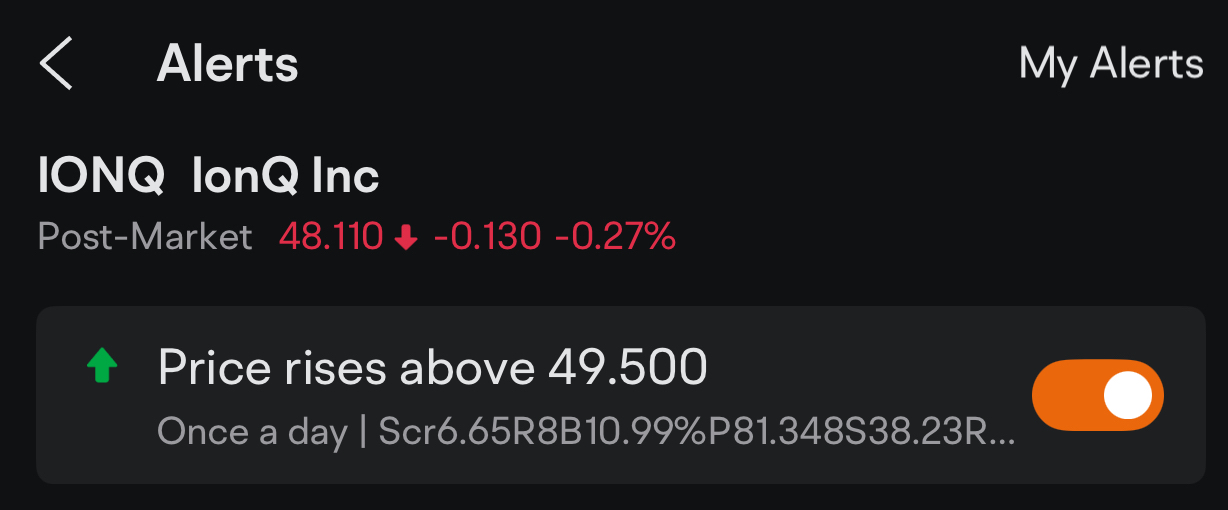

Given a score adequate for trading consideration, with an available trading capital of $10,000, I've developed the following strategy for IonQ. Entry is selected near $49.00 due to proximity to recent breakout highs, while the profitable exit is targeted at $81.348, capitalizing on forward momentum signals from news sentiment and deep technical analysis. I've designated a stop at $38.23, aligning with risk tolerance and market fluctuations, offering a conservative risk-reward ratio of 1:3.0. With a strategic allocation of 10.99% of equity, the position involves acquiring 22 shares, proportionate to stock volatility and the capital constraint. The focus is on maximizing upside potential amid current market dynamics.

Trading Details:

Equity to Commit: $10,000

Position Bias: Long

Percentage Allocation: 10.99%

Position Size: 22 shares

Entry Price: $49.00

Exit Price: $81.348

Stop Loss: $38.23

Risk-Reward Ratio: 1:3.0