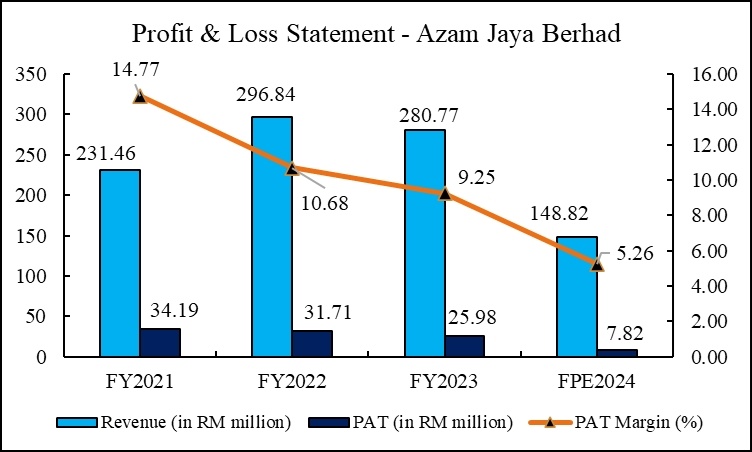

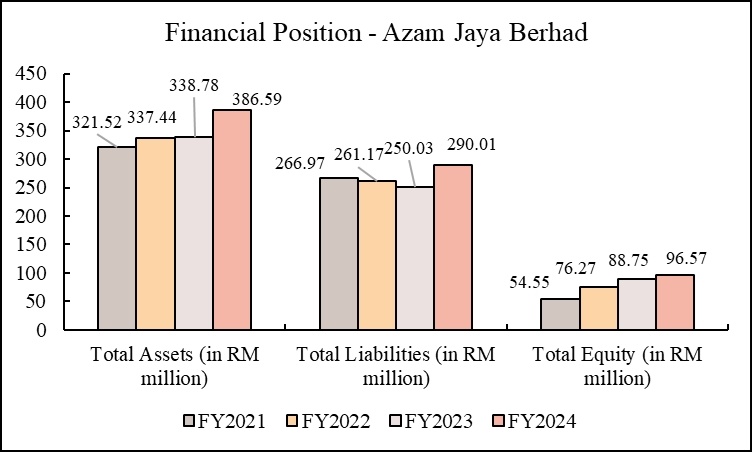

Figure 8: Financial position of AZAM JAYA BERHAD

Financial overview, industry market, and personal opinion

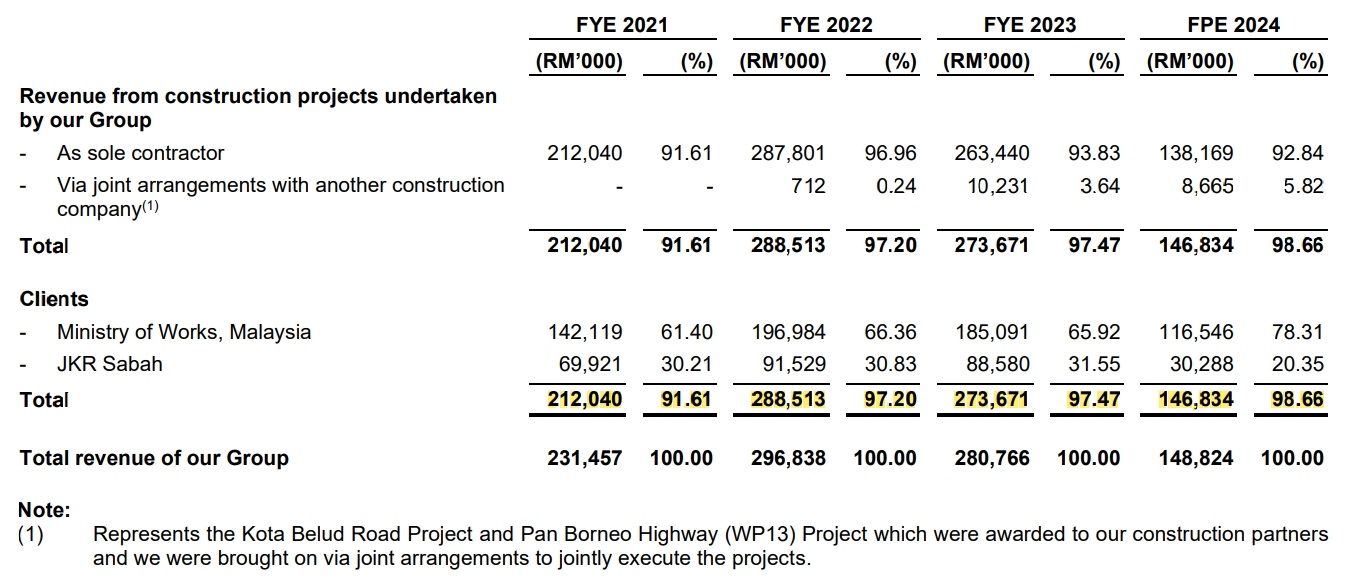

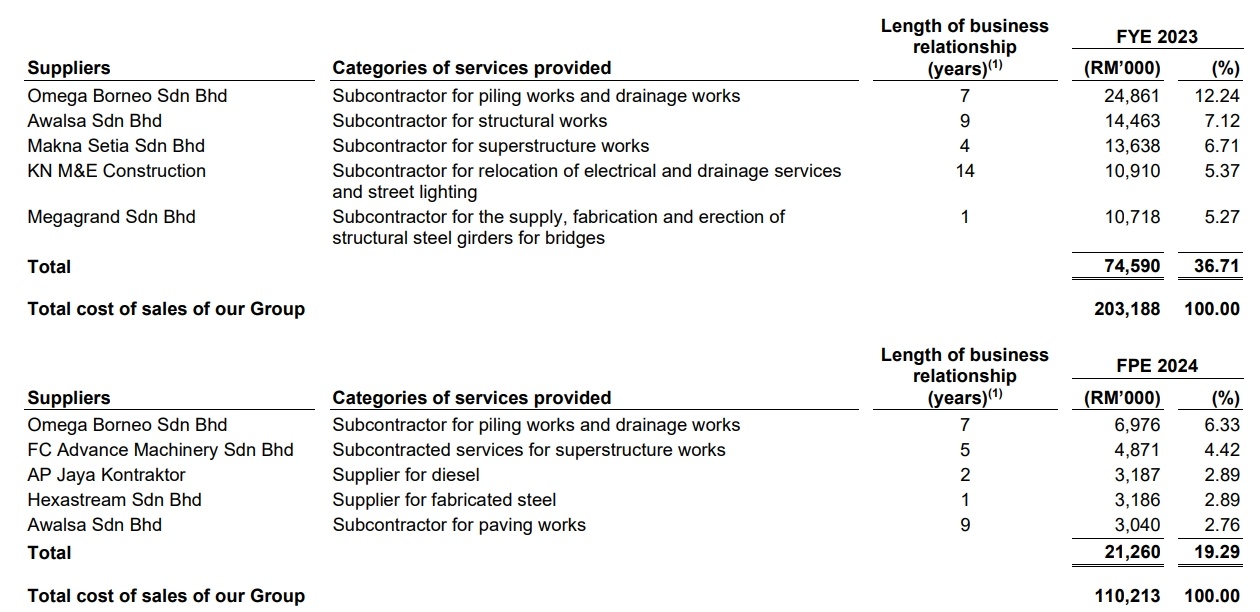

-The group’s revenue maintains at the range of RM230 million to RM300 million, however, the PAT margin seems to decrease from FY2021 to FPE2024, recorded from 14.77% to 5.26%, respectively. The total borrowings of the group increased from RM130.348 million to RM178.967 million within the period, thus causing the total assets to rise from RM321.516 million to RM386.585 million.

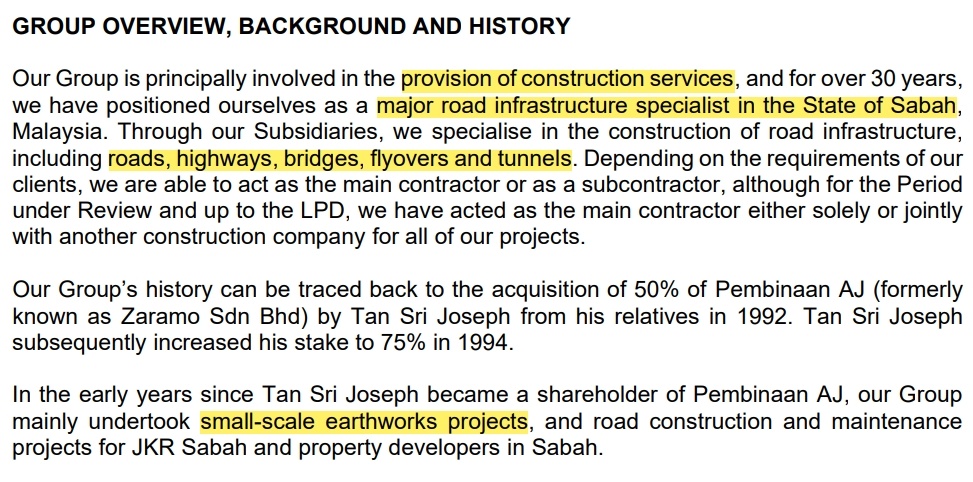

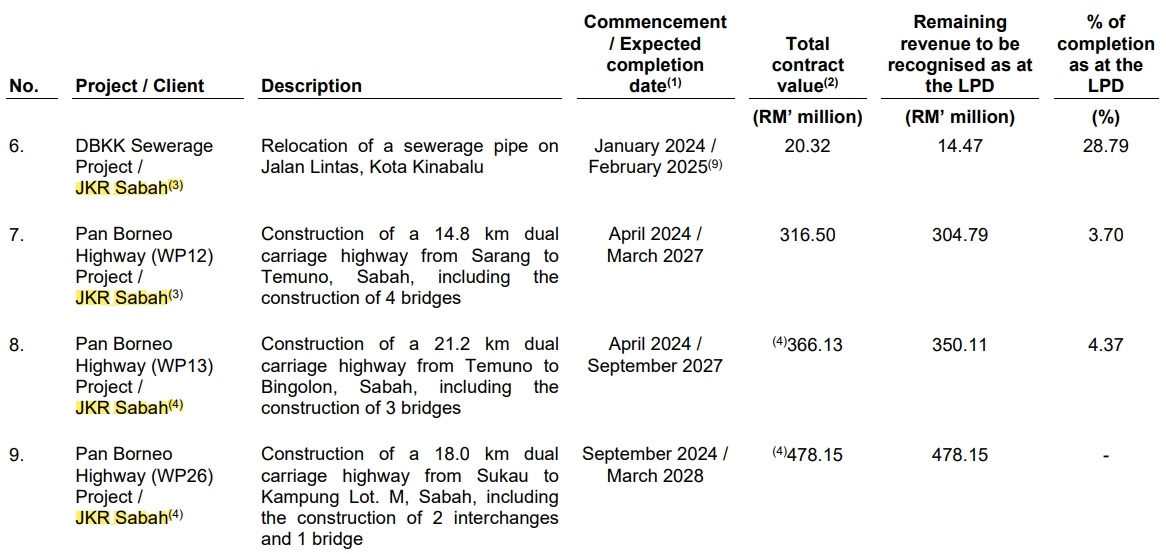

-Sabah is drawing the attention of investors for the mega infrastructure development, particularly the Pan Borneo Highway, stretching up to 1,236km. However, the Mid-Term Review of the 12th Malaysia Plan has revised the target annual growth rate of Sabah from 4.4% to 3.1%.

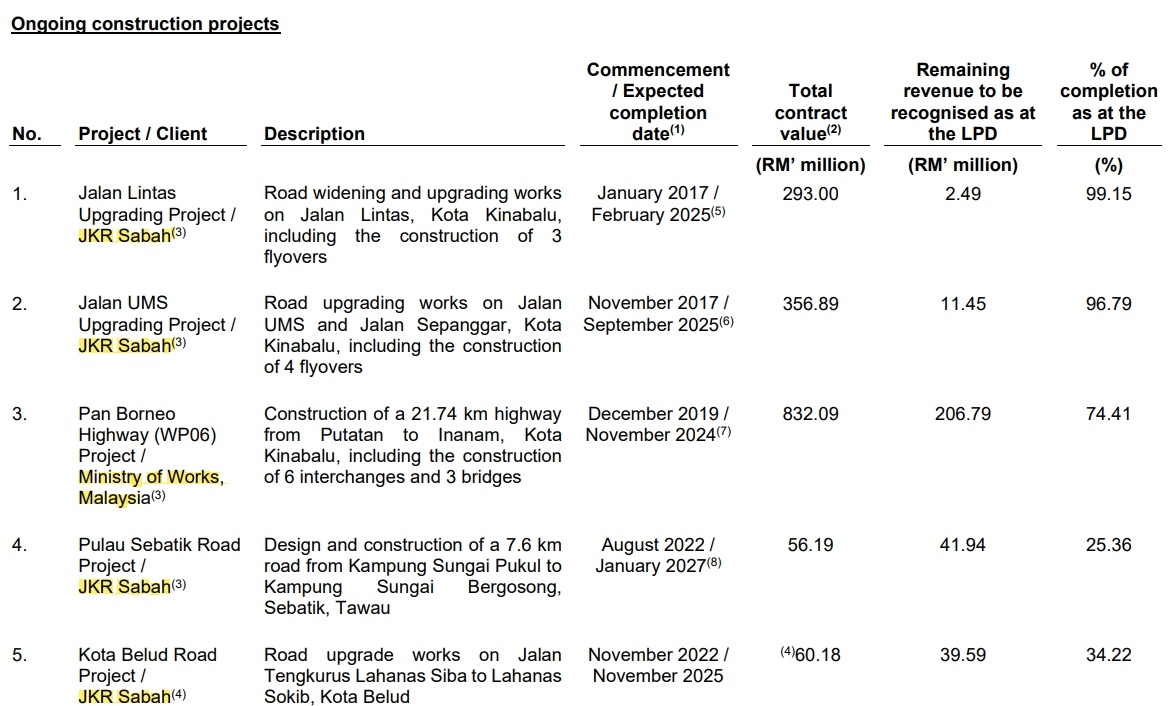

-Azam Jaya has a close relationship with / major customers of JKR Sabah and Kementrian Kerja Raya. This might be a risk/advantage for securing constant projects from these respective parties.