IPO Series - TMK Chemical Berhad - Chemical Management & Storage Company

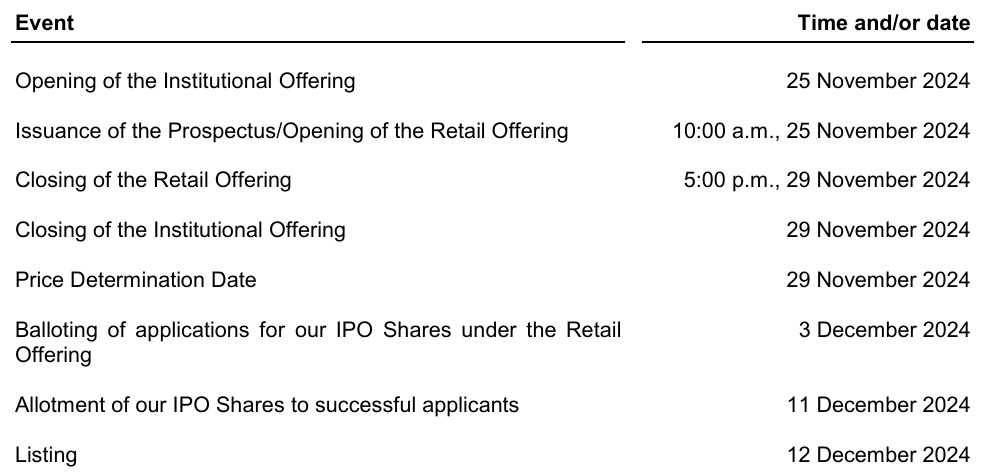

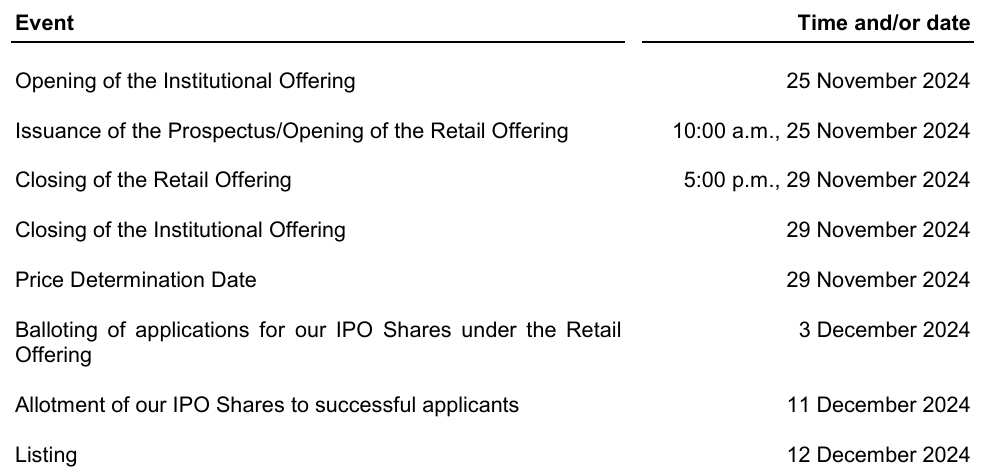

Figure 1: IPO timetable of TMK Chemical Berhad

-Will be listed on the MAIN Board

-Will be listed on the MAIN Board

Info of IPO

Enlarged no. of shares upon listing: 1000 million

IPO price: RM1.75

Market capitalization: RM1750 million

Estimated funds to raise from Public Issue: RM385 million

PE ratio = 19.10x (based on FY2023)

Enlarged no. of shares upon listing: 1000 million

IPO price: RM1.75

Market capitalization: RM1750 million

Estimated funds to raise from Public Issue: RM385 million

PE ratio = 19.10x (based on FY2023)

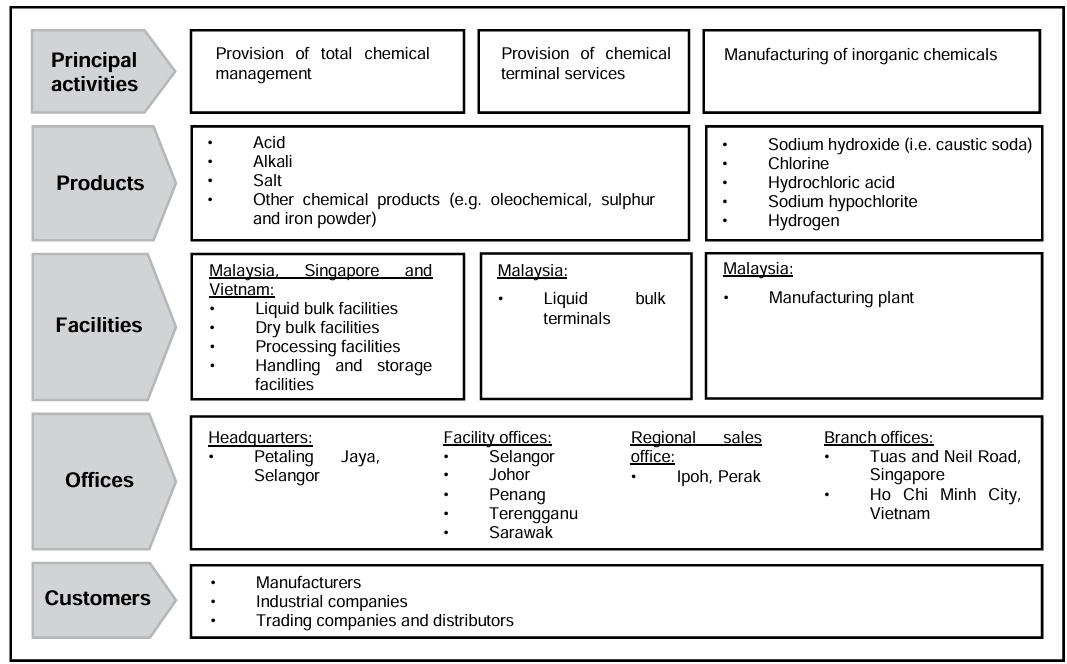

Figure 2: Business model of TMK Chemical Berhad

Source: TMK Chemical Berhad IPO prospectus

Source: TMK Chemical Berhad IPO prospectus

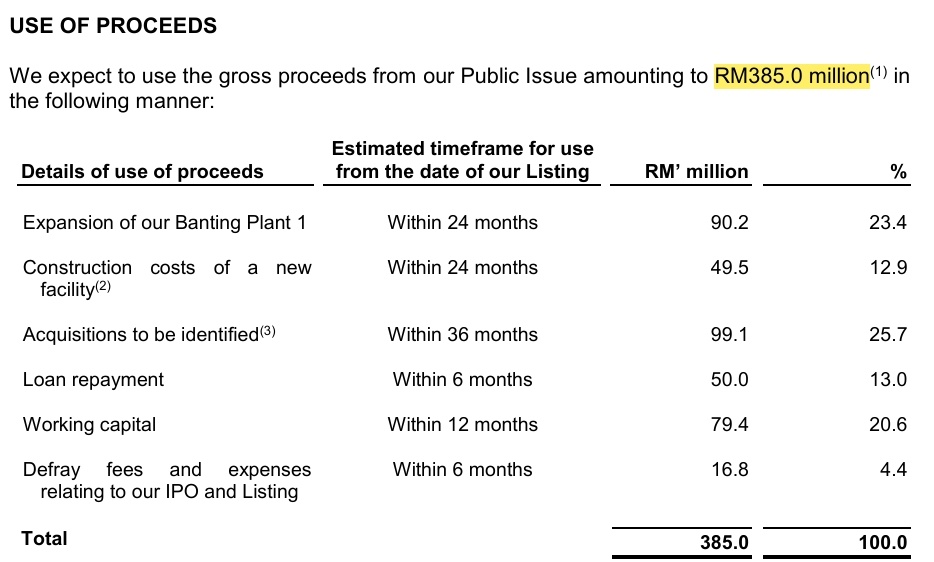

Figure 3: Utilization of proceeds of TMK Chemical Berhad

Source: TMK Chemical Berhad IPO prospectus

Source: TMK Chemical Berhad IPO prospectus

Dividend Policy

-The group targets a payout ratio of 30% to 50% of PAT

-The group targets a payout ratio of 30% to 50% of PAT

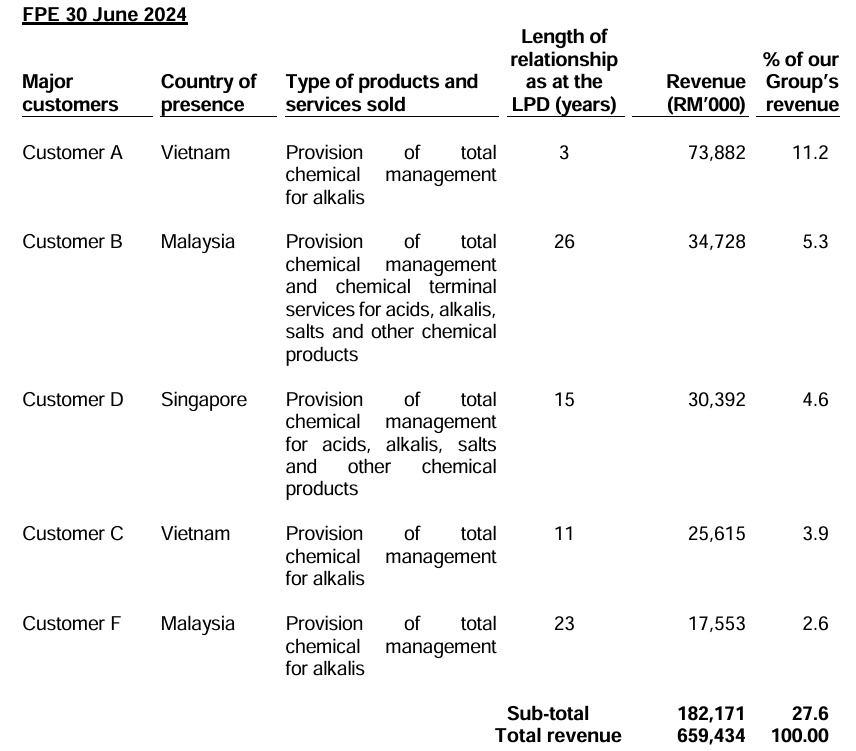

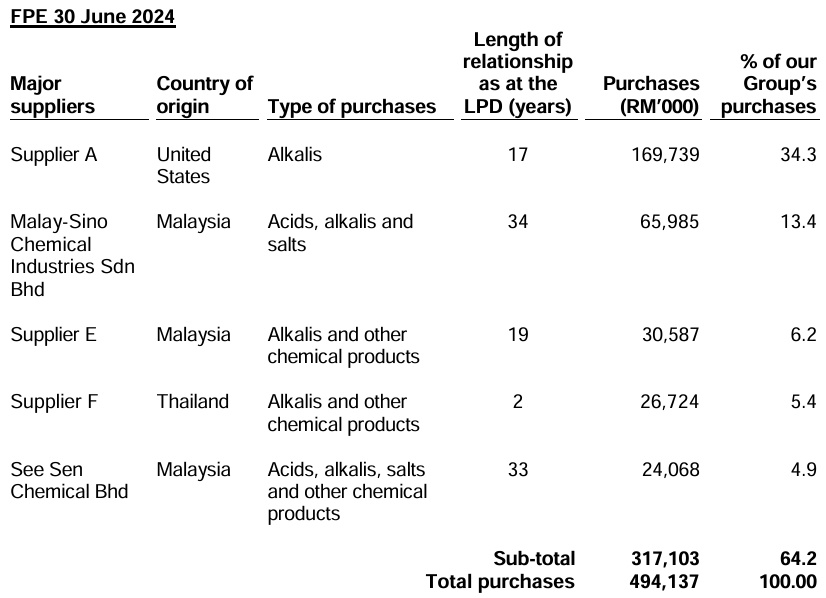

Figure 5: Major customers and suppliers of TMK Chemical Berhad in FPE2024

Source: TMK Chemical Berhad IPO prospectus

Source: TMK Chemical Berhad IPO prospectus

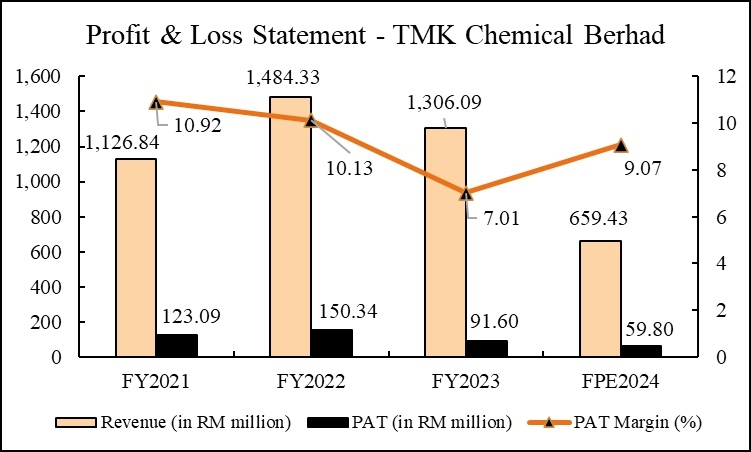

Figure 6: Profit & Loss statement of TMK Chemical Berhad

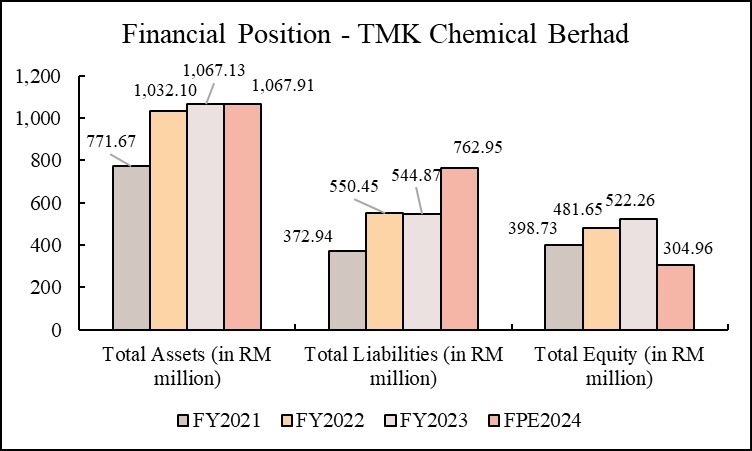

Figure 7: Financial position of TMK Chemical Berhad

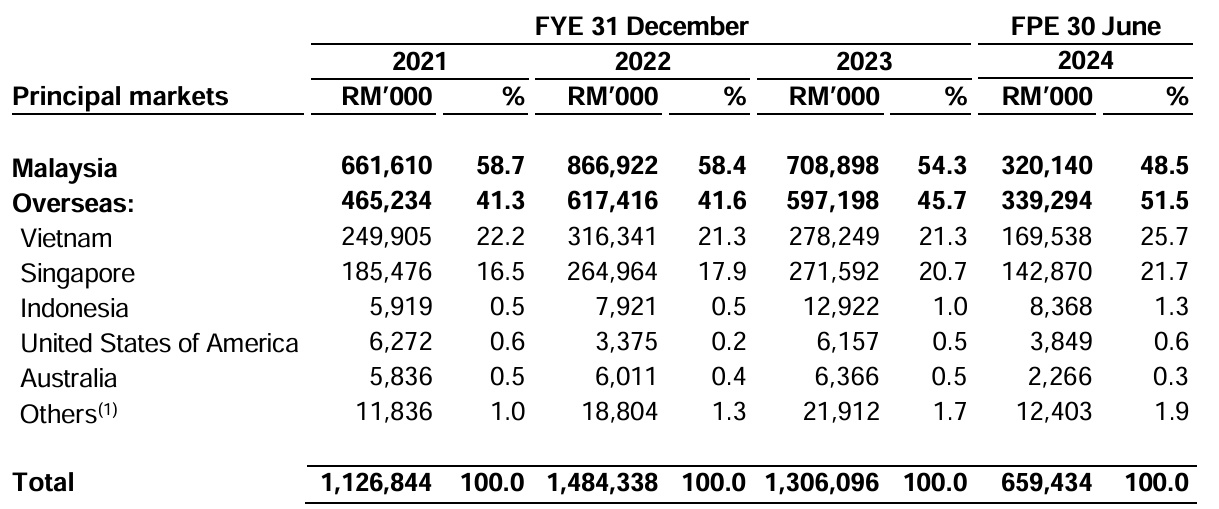

Figure 8: Principal markers of TMK Chemical Berhad

Source: TMK Chemical Berhad IPO prospectus

Figure 9: Market share of TMK Chemical Berhad in Malaysia, Vietnam, and Singapore

Source: TMK Chemical Berhad IPO prospectus

Financial overview, industry market, and personal opinion

-Based on the existing data, the group’s PAT has maintained more than RM100 million from FY2021 to FY2023, and RM91.60 million for FY2023. However, it is expected the group’s PAT in FPE2024 will exceed RM100 million as well.

-The principal market of TMK Chemical is focusing in Malaysia, with more than 50% of sales from FY2021 to FY2023, where FPE2024 dropped slightly to 48.5%.

-Referring to the group’s fundamentals, its PE for FY2023 is slightly higher than the given average PE, which is 13.4x. However, the highest PE is from Luxchem Corporation Berhad, which has 17.9x of PE based on the given industry players.

-Based on the existing data, the group’s PAT has maintained more than RM100 million from FY2021 to FY2023, and RM91.60 million for FY2023. However, it is expected the group’s PAT in FPE2024 will exceed RM100 million as well.

-The principal market of TMK Chemical is focusing in Malaysia, with more than 50% of sales from FY2021 to FY2023, where FPE2024 dropped slightly to 48.5%.

-Referring to the group’s fundamentals, its PE for FY2023 is slightly higher than the given average PE, which is 13.4x. However, the highest PE is from Luxchem Corporation Berhad, which has 17.9x of PE based on the given industry players.

Disclaimer: The above content is not an investment advisory service and does not purport to tell or suggest which securities or stocks customers should buy or sell for themselves. It should not be assumed that the methods, techniques, or indicators presented above will be profitable or will not result in losses. You should not rely solely on information when making any investment. Rather, you should use the information only as a starting point for doing additional independent research to allow you to form your own opinion regarding investments.

The details of the IPO prospectus can be accessed through

TMK - INITIAL PUBLIC OFFERING ("IPO") OF 220,000,000 ORDINARY SHARES IN TMK CHEMICAL BHD (FORMERLY KNOWN AS TAIKO MARKETING SDN BHD) ("TMK" OR "COMPANY") ("IPO SHARES") IN CONJUNCTION WITH THE LISTING OF AND QUOTATION FOR THE ENTIRE ENLARGED ISSUED ORDINARY SHARES IN TMK ("TMK SHARES" OR "SHARES") O...

TMK - INITIAL PUBLIC OFFERING ("IPO") OF 220,000,000 ORDINARY SHARES IN TMK CHEMICAL BHD (FORMERLY KNOWN AS TAIKO MARKETING SDN BHD) ("TMK" OR "COMPANY") ("IPO SHARES") IN CONJUNCTION WITH THE LISTING OF AND QUOTATION FOR THE ENTIRE ENLARGED ISSUED ORDINARY SHARES IN TMK ("TMK SHARES" OR "SHARES") O...

By: Jshen Ng

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

HeYa HeYo HeYe : any clue why liabilities ratio increased in 2024?

Jshen Ng OP HeYa HeYo HeYe : You can refer to the IPO Prospectus Chapter 12 or page 289 for the borrowings part